Key Takeaways

- Structural shifts toward renewables, new materials, and stricter ESG norms threaten demand, raise costs, and compress margins for JTL Industries' core products.

- Geopolitical volatility and declining ore quality heighten supply chain risks, input cost swings, and may erode operating margins despite capacity expansions.

- Expansion into value-added products, operational scale-up, vertical integration, and financial strength position JTL Industries for sustainable margin growth and resilience amid evolving market trends.

Catalysts

About JTL Industries- Manufactures and sells steel pipes and tubes, and allied products in India and internationally.

- The ongoing global shift toward renewable energy and electrification may lead to structural declines in demand for certain steel products and base metals, especially if JTL Industries' product mix remains heavily reliant on segments that become less essential in a decarbonizing world. This could suppress revenue growth over the long term as end-markets shrink.

- Stricter environmental and ESG regulations globally are expected to drive up compliance costs and limit expansion opportunities for resource extraction and metallurgical processing companies such as JTL Industries, leading to persistent margin compression and increased capital expenditure requirements.

- Heightened geopolitical risks, rising protectionism, and volatility in global trade flows could disrupt JTL Industries' raw material access, expose the company to input price swings, and result in unpredictable earnings volatility and supply chain disruption, particularly as export markets become a larger share of its business.

- The industry-wide decline in high-grade ore reserves, combined with JTL's push for aggressive capacity expansion, poses a risk that operational costs will escalate while achievable selling prices remain flat or decline, leading to lower operating margins and reduced returns on capital invested in new lines and facilities.

- Rapid advancements in material science, recycling technologies, and the increasing adoption of substitutes like composites threaten to cap or reduce long-term demand growth for core metals processed by JTL Industries, putting at risk both top-line growth and future market share in its traditional markets.

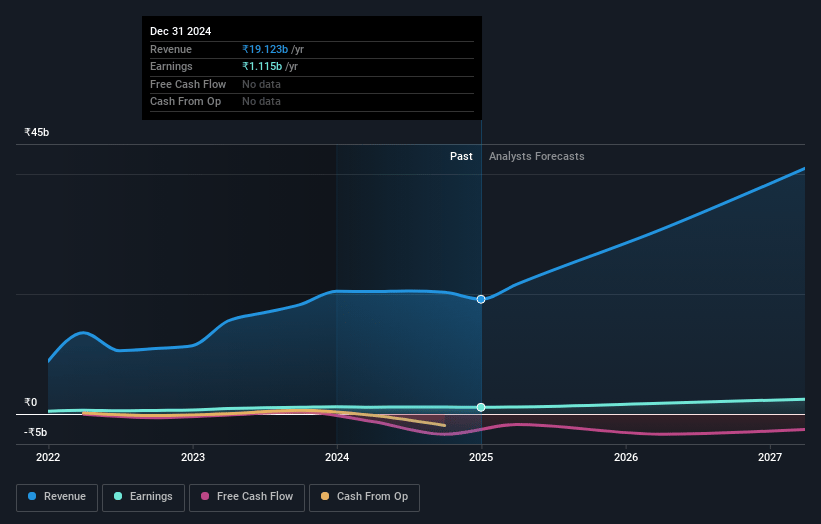

JTL Industries Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on JTL Industries compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming JTL Industries's revenue will grow by 37.9% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 5.2% today to 5.8% in 3 years time.

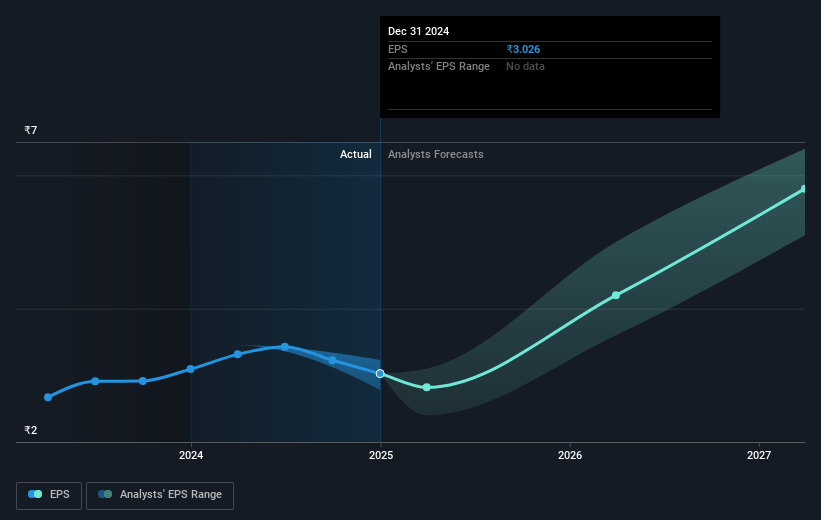

- The bearish analysts expect earnings to reach ₹2.9 billion (and earnings per share of ₹6.71) by about July 2028, up from ₹988.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 21.7x on those 2028 earnings, down from 34.1x today. This future PE is lower than the current PE for the IN Metals and Mining industry at 23.0x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.1%, as per the Simply Wall St company report.

JTL Industries Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- JTL Industries is actively expanding its value-added product portfolio, including new segments like copper and brass foils, and targeting a significant increase in value-added offerings from 34 percent to 50 percent of its sales mix, which is likely to drive higher margins and support long-term earnings and profitability.

- The company has completed major capacity enhancements, such as commissioning the DFT (Direct Forming Technology) line in Maharashtra, which has increased plant capacity from 200,000 to 450,000 metric tons annually and is expected to enable further volume growth and operational efficiency, strengthening revenue and margin potential over the long run.

- JTL Industries has achieved debt-free status and maintains a strong cash balance, which allows it to fund ongoing and future capital expenditure from internal accruals rather than through leverage, enabling resilience across business cycles and supporting consistent investment in strategic growth initiatives that could bolster shareholder value and return on equity.

- The company is pursuing vertical integration through the incorporation of Nabha Steels and Metals as JTL Engineering, enabling backward integration of HR coil production and consumption within JTL's operations, which should lower input costs, improve control over raw materials, and support stable or improved net margins as it scales.

- JTL is strategically positioned to capitalize on long-term secular trends such as government infrastructure spending, increased demand for steel tubes in renewable energy (solar structures), and demand growth in both domestic and export markets, which-together with a broadening SKU range and a focus on high-margin niche sectors-can result in long-term revenue stability and margin expansion.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for JTL Industries is ₹89.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of JTL Industries's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹141.0, and the most bearish reporting a price target of just ₹89.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ₹50.2 billion, earnings will come to ₹2.9 billion, and it would be trading on a PE ratio of 21.7x, assuming you use a discount rate of 14.1%.

- Given the current share price of ₹85.76, the bearish analyst price target of ₹89.0 is 3.6% higher. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.