Key Takeaways

- Diversification into high-value products and new export markets is expected to structurally boost margins and earnings quality beyond current consensus.

- Debt-free growth strategy and reinvestment into capacity expansions enhance financial strength, supporting ambitious long-term revenue and profit growth plans.

- Shifting market demand, rising compliance costs, resource constraints, and regulatory hurdles threaten JTL Industries' growth prospects and long-term earnings stability.

Catalysts

About JTL Industries- Manufactures and sells steel pipes and tubes, and allied products in India and internationally.

- While analysts broadly agree that DFT capacity expansion and higher value-add product mix will boost volumes and margins, management guidance indicates the full impact is yet to be reflected, as targets for 5 lakh tonnes and value-added product share moving from 34% to 50% could lead to a step-function increase in both revenue and EBITDA margins, far surpassing current consensus expectations.

- Analyst consensus acknowledges export growth and market penetration, but this may understate the impact of imminent access to higher-margin U.S., Canadian, and Mexican markets enabled by new product approvals and DFT lines, positioning exports as a powerful earnings and margin growth engine, not just a diversification buffer.

- JTL's foray into copper and brass foils-products that sell at over 200 times the price per kg of steel-unlocks an entry into niche, high-growth, high-margin industrial and defense segments, underpinning a long-term mix shift that may structurally raise group-level EBITDA margins and earnings quality.

- Management's unwavering focus on debt-free expansion and aggressive reinvestment of promoter dividends into capacity and working capital ensures the company has both the financial muscle and flexibility to execute on ambitious growth plans without the drag of interest costs, providing a significant long-term boost to net profit margins and cash flow.

- The broadening of SKU count (targeting 2,500 SKUs and expanding to downstream, higher-value applications like roofing sheets and color-coated products) positions JTL to capitalize on multi-decade global infrastructure and supply chain localization trends, capturing share in new, resilient demand pools and underpinning both sustained revenue growth and superior pricing power.

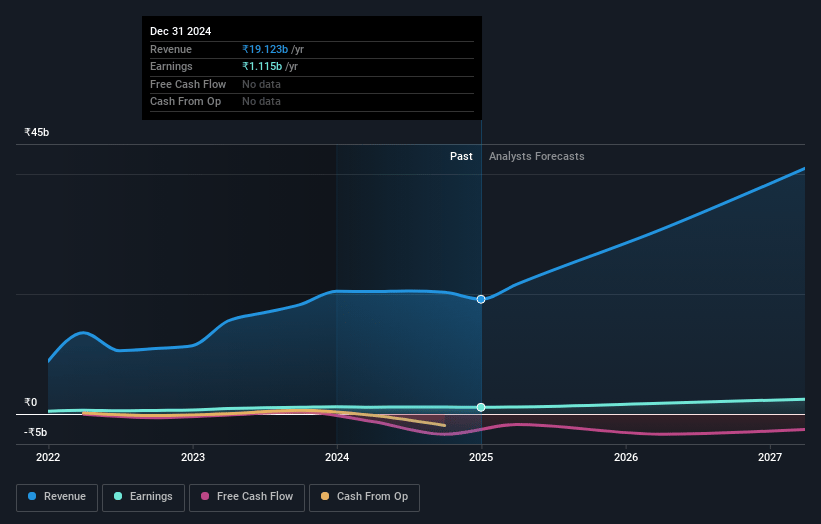

JTL Industries Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on JTL Industries compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming JTL Industries's revenue will grow by 37.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 5.2% today to 5.8% in 3 years time.

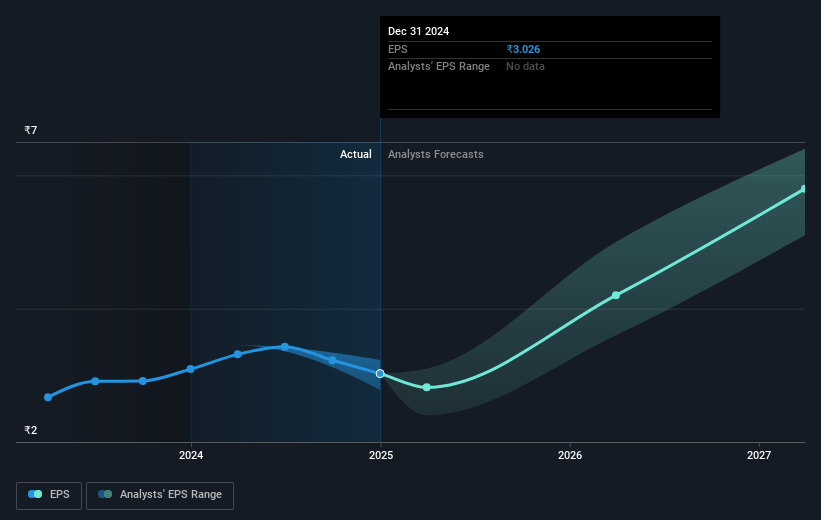

- The bullish analysts expect earnings to reach ₹2.9 billion (and earnings per share of ₹6.71) by about July 2028, up from ₹988.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 34.4x on those 2028 earnings, up from 34.1x today. This future PE is greater than the current PE for the IN Metals and Mining industry at 23.3x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.1%, as per the Simply Wall St company report.

JTL Industries Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The global transition to renewable energy and decarbonization may structurally reduce long-term demand for steel and certain metals, threatening JTL Industries' revenue growth as traditional markets shrink and product prices face downward pressure.

- Stricter ESG regulations and mounting investor expectations could drive significant increases in compliance and operating costs for JTL Industries, potentially compressing net margins as the company contends with new environmental standards and reporting requirements.

- JTL Industries' high dependence on a limited set of resource deposits heightens its vulnerability to resource depletion, which, if not mitigated, could result in increased extraction costs and lower future earnings as accessible, high-quality raw materials dwindle.

- Technological advances such as metal recycling and the development of alternative materials may accelerate price deflation across the broader steel and metals market, leading to reduced top-line growth and making it more difficult for JTL to maintain or expand revenue.

- Increasing difficulties in obtaining new mining and expansion permits, heightened by environmental and social opposition, may slow JTL's capacity growth and could render certain capital investments stranded, negatively affecting return on invested capital and long-term earnings predictability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for JTL Industries is ₹141.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of JTL Industries's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹141.0, and the most bearish reporting a price target of just ₹89.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₹50.2 billion, earnings will come to ₹2.9 billion, and it would be trading on a PE ratio of 34.4x, assuming you use a discount rate of 14.1%.

- Given the current share price of ₹85.76, the bullish analyst price target of ₹141.0 is 39.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.