Last Update 07 Nov 25

Fair value Increased 1.32%500440: Fair Value To Be Maintained As Margins And Outlook Improve

Analysts have raised their price target for Hindalco Industries by approximately ₹10, citing improved outlooks for revenue growth and profit margins.

What's in the News

- Hindalco Industries has scheduled a board meeting on November 7, 2025. The meeting will consider and approve the unaudited standalone and consolidated financial results for the quarter and half-year ending September 30, 2025 (Key Developments).

Valuation Changes

- Fair Value has risen slightly from ₹781.88 to ₹792.19.

- Discount Rate has increased from 15.08% to 15.74%.

- Revenue Growth expectation has edged up from 3.83% to 3.99%.

- Net Profit Margin has improved from 5.93% to 6.09%.

- Future P/E ratio has decreased marginally from 16.19x to 16.16x.

Key Takeaways

- Heightened regulatory, energy, and trade pressures threaten profitability and create volatility, while heavy spending on expansion risks overextension amid uncertain global demand.

- Shifts toward recycling, changing material preferences, and technological advances may limit long-term primary metal demand, potentially constraining growth and earnings.

- Diversification into value-added products, cost efficiency measures, and sustainability initiatives are expected to enhance earnings resilience, margin stability, and long-term growth.

Catalysts

About Hindalco Industries- Manufactures and distributes aluminum and copper products in India, the United States, Brazil, South Korea, the United Kingdom, Germany, China, and internationally.

- Investors may be factoring in elevated regulatory and input costs for Hindalco, as the global push for decarbonization and stricter climate controls puts pressure on carbon-intensive industries. While Hindalco is investing in renewables, delays in ramping up green energy capacity and continued reliance on thermal power could lead to higher future compliance and operating costs, impacting net margins and earnings.

- There are concerns that rising adoption of metal recycling and circular economy initiatives globally might dampen long-term demand for primary aluminum and copper, historically core to Hindalco's revenue streams. This could constrain topline growth, especially as the company invests heavily in new primary production assets.

- The ongoing wave of trade protectionism, including higher tariffs in major export markets like the U.S., creates significant near

- and long-term risk to Hindalco's global business lines. Tariff-related EBITDA headwinds, muted demand in certain sectors (e.g., EVs in North America/Europe), and persistent policy uncertainty could result in more volatile revenues and compress earnings.

- Hindalco's aggressive capital expenditure cycle-expanding both domestic and international operations, including the costly integration of Novelis and new specialty acquisitions-raises the risk of overextension. Elevated leverage and interest expense, particularly if new capacities face slower demand ramp-up due to global economic moderation, could pressure future earnings and return metrics.

- Competition from alternative materials and the risk of technological substitution (e.g., lightweight composites replacing aluminum in key end markets) threaten long-term volumes and pricing power, ultimately putting pressure on Hindalco's revenue and EBITDA growth outlook despite the current optimism in sector transformation.

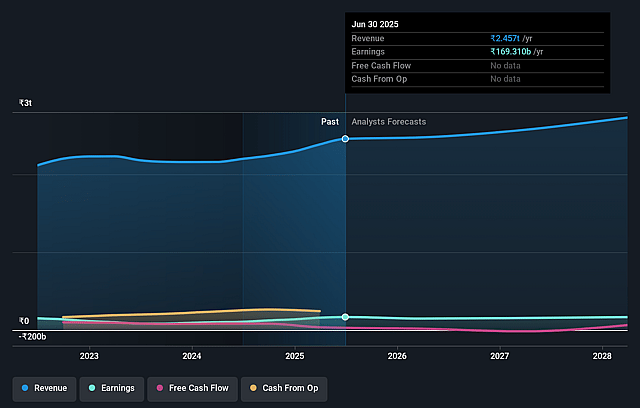

Hindalco Industries Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Hindalco Industries's revenue will grow by 3.3% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 6.9% today to 5.8% in 3 years time.

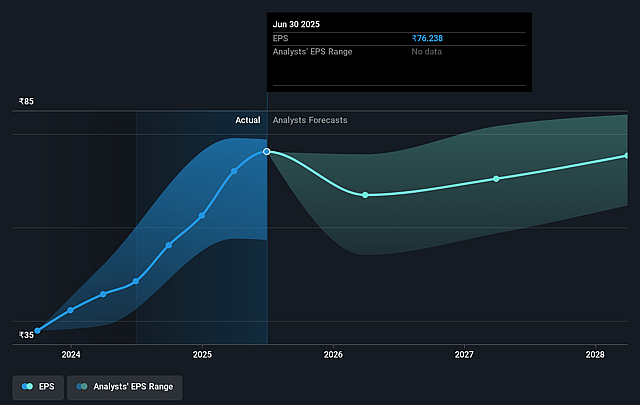

- Analysts expect earnings to reach ₹157.7 billion (and earnings per share of ₹74.05) by about September 2028, down from ₹169.3 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as ₹189.1 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.9x on those 2028 earnings, up from 9.7x today. This future PE is lower than the current PE for the IN Metals and Mining industry at 23.6x.

- Analysts expect the number of shares outstanding to decline by 0.1% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.73%, as per the Simply Wall St company report.

Hindalco Industries Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Global long-term demand for aluminum and copper remains robust, fueled by secular trends like electrification, sustainable packaging, urbanization, and infrastructure growth in both emerging markets and developed economies-supporting steady or rising revenue and mitigating cyclicality.

- Hindalco's aggressive expansion into higher-margin, value-added downstream products (e.g., battery enclosures, specialty alumina, and copper recycling) is expected to drive increases in EBITDA per tonne, improve product mix, and lift overall earnings resilience.

- Ongoing investments in captive coal mines, renewable power capacity, and operational excellence are systematically lowering the company's cost of production, supporting industry-leading EBITDA margins and thus protecting net margins even in volatile pricing environments.

- The company maintains a strong balance sheet with consolidated net debt-to-EBITDA at 1.02x, continued net cash positions in India operations, and disciplined, cash flow-aligned capital allocation, supporting financial stability and the ability to sustain long-term investments and withstand downturns.

- Strategic global diversification and focused renewable/recycling initiatives (including greenfield capacity additions, technology-driven specialty acquisitions, and quadrupling downstream EBITDA targets by FY 2030) position Hindalco to capture secular sustainability and circular economy trends, potentially driving higher long-term earnings and revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹749.667 for Hindalco Industries based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹875.0, and the most bearish reporting a price target of just ₹615.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹2710.2 billion, earnings will come to ₹157.7 billion, and it would be trading on a PE ratio of 15.9x, assuming you use a discount rate of 14.7%.

- Given the current share price of ₹743.05, the analyst price target of ₹749.67 is 0.9% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.