Key Takeaways

- Rapid operational ramp-up and underutilized acquisitions position the company for margin and earnings growth surpassing market expectations as facilities mature.

- Aggressive expansion, digital services, and rising health insurance access will fuel sustainable revenue growth and transform Max into a diversified healthcare platform.

- Heavy geographic concentration, regulatory challenges, rising costs, and reliance on vulnerable revenue streams threaten profitability and stability amid competitive and expansion-related pressures.

Catalysts

About Max Healthcare Institute- Provides medical and healthcare services in India.

- Analysts broadly agree that brownfield expansion will drive higher occupancy and margins, but this is likely to be understated; Max's uniquely rapid ramp-up, demonstrated by multiple hospitals reaching high occupancy and breakeven far ahead of schedule, suggests that EBITDA growth could structurally outpace even the most optimistic forecasts as operational leverage kicks in, materially lifting net margins.

- While analyst consensus anticipates value creation from integrating new acquisitions, the magnitude is likely underestimated since the newly acquired hospitals are already delivering margin improvements of over 100 percent in EBITDA in their first year, and most units are operating at well below optimal utilization, implying a potentially explosive uplift in earnings as these facilities move toward mature margin and ARPOB profiles.

- The growth in the insured Indian middle class and rising health insurance penetration will dramatically expand the pool of patients who can afford high-value advanced procedures, directly fueling sustainable double-digit revenue and ARPOB growth as Max deepens its focus on tertiary and super-specialty care.

- Max's aggressive asset-light expansion and greenfield plus brownfield strategy puts its bed addition pipeline several years ahead of most peers; with significant unutilized debt capacity and robust free cash flow generation, the company is uniquely positioned to double (or more) its network ahead of industry timelines, compounding both topline and EBITDA faster than consensus models.

- Investment in digital transformation, home healthcare, and diagnostics (Max@Home and Max Lab) creates a flywheel of recurring, high-margin, capital-light revenues that will increasingly hedge cyclicality in inpatient volumes, reinforce upward pressure on consolidated net margins, and position Max as a healthcare platform rather than just a hospital operator.

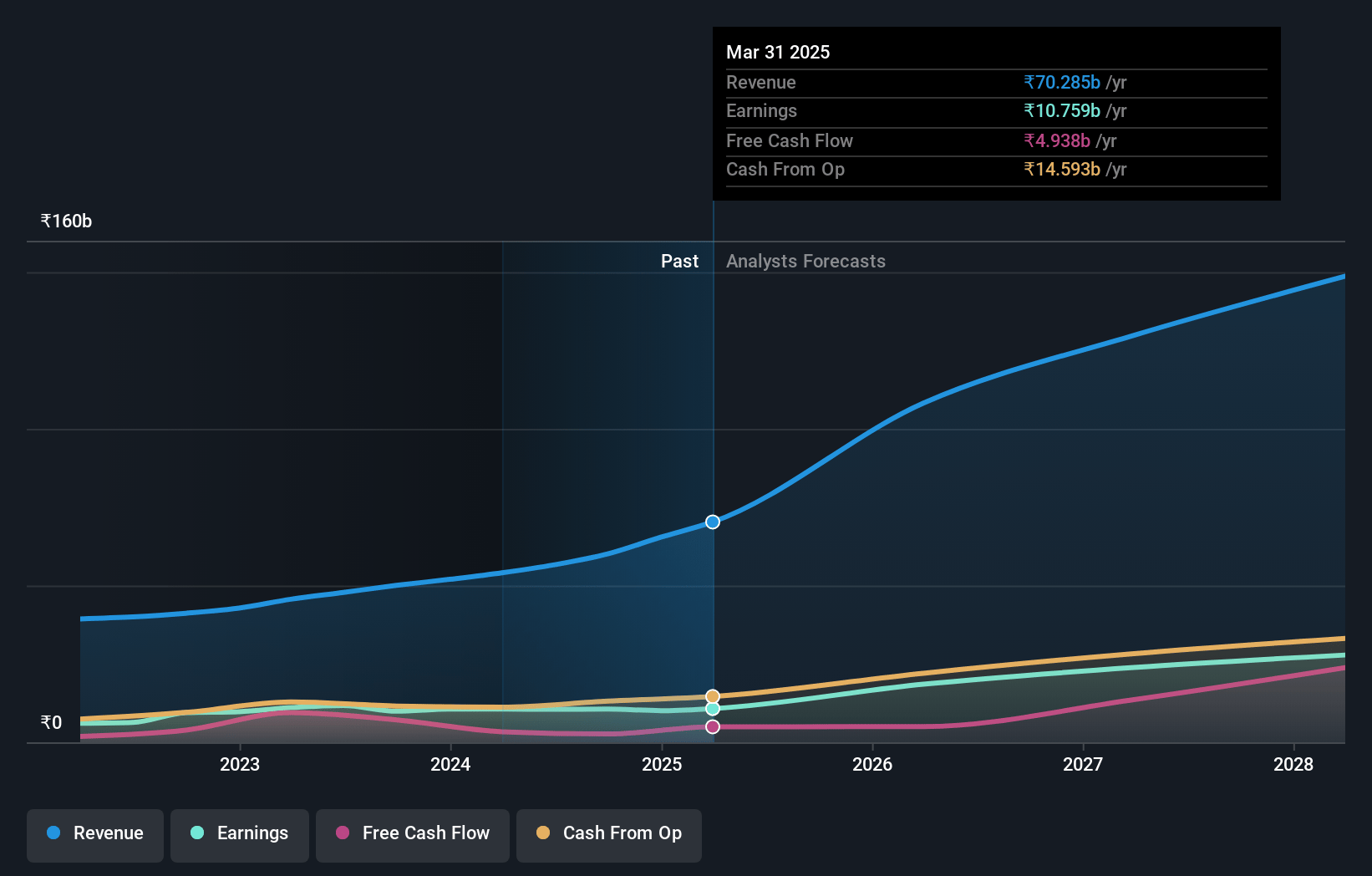

Max Healthcare Institute Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Max Healthcare Institute compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Max Healthcare Institute's revenue will grow by 35.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 15.3% today to 18.2% in 3 years time.

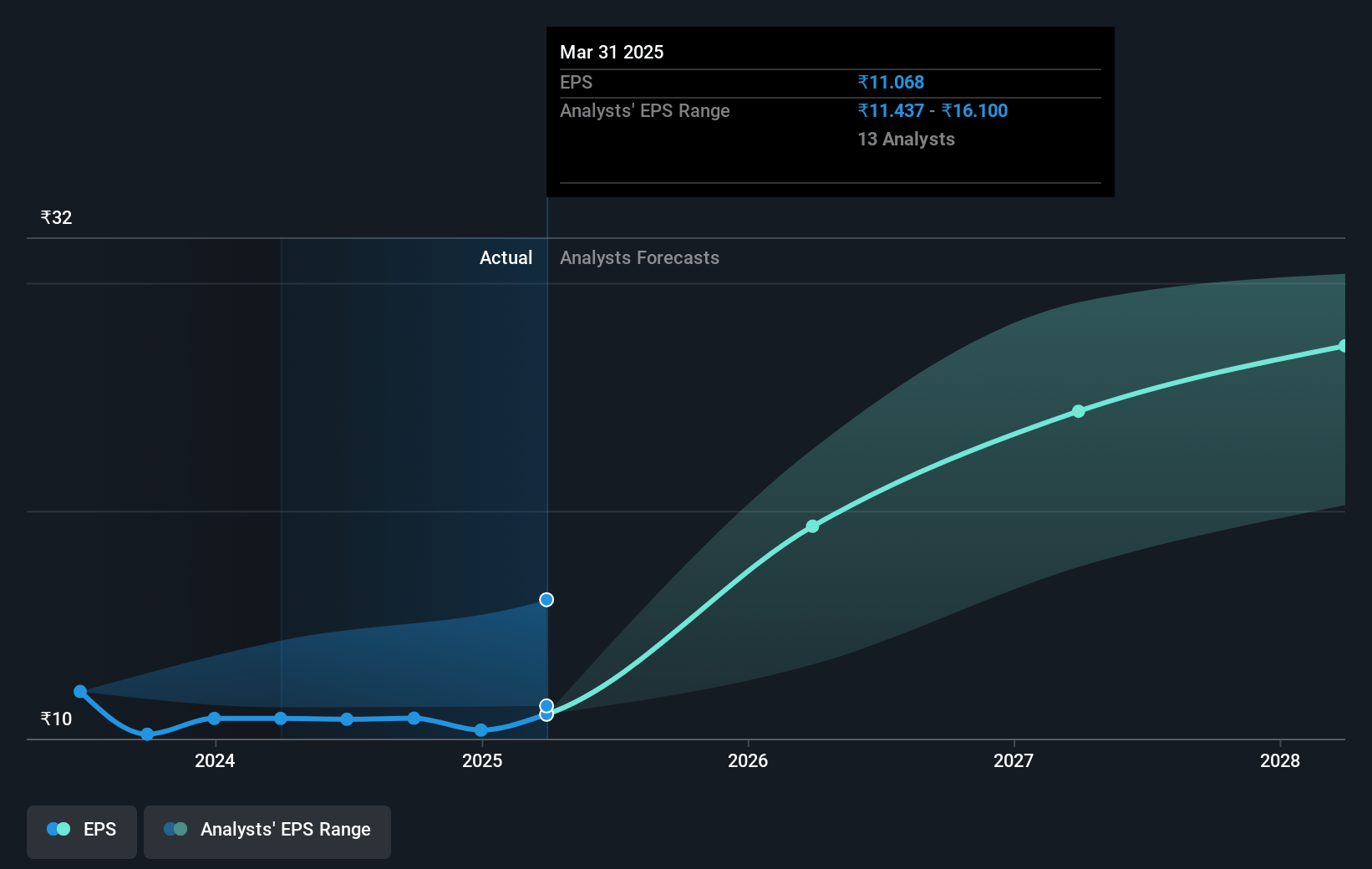

- The bullish analysts expect earnings to reach ₹31.4 billion (and earnings per share of ₹32.32) by about July 2028, up from ₹10.8 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 61.6x on those 2028 earnings, down from 110.2x today. This future PE is greater than the current PE for the IN Healthcare industry at 50.0x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.55%, as per the Simply Wall St company report.

Max Healthcare Institute Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Increasing regulatory scrutiny and tightening of healthcare data privacy laws could result in higher compliance costs and stricter controls on patient data usage, risking lower digital efficiencies and negatively affecting profit margins over the long run.

- The company's international patient revenues are vulnerable to geopolitical instability and rising public or policy resistance to medical tourism, which could depress high-margin international inflows and consequently reduce overall revenue growth.

- Max Healthcare Institute's heavy reliance on the National Capital Region (NCR) for most of its revenue, coupled with limited geographic diversification, exposes it to concentrated local competition and regulatory policy risks, threatening revenue stability and long-term growth rates.

- Continuous high capital expenditure and aggressive expansion, especially into new or less established markets, could strain return on invested capital and squeeze net margins, particularly if newly added capacities or acquired facilities underperform against expectations.

- Industry-wide shortage of skilled clinicians and rising wage costs, alongside the accelerated growth of low-cost digital health and telemedicine platforms, could increase operating expenses, intensify price competition, and put sustained downward pressure on future earnings and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Max Healthcare Institute is ₹1400.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Max Healthcare Institute's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹1400.0, and the most bearish reporting a price target of just ₹615.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₹173.1 billion, earnings will come to ₹31.4 billion, and it would be trading on a PE ratio of 61.6x, assuming you use a discount rate of 12.5%.

- Given the current share price of ₹1219.4, the bullish analyst price target of ₹1400.0 is 12.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.