Last Update 05 Sep 25

With no change in either the discount rate (13.06%) or future P/E (36.04x), there is no revision to the consensus analyst price target, which remains at ₹4556.

What's in the News

- LTTS announced a strategic partnership with SiMa.ai to jointly deliver AI-driven solutions in Mobility, Healthcare, Industrial Automation, and Robotics, leveraging SiMa.ai’s MLSoC platform and LTTS’ engineering expertise.

- Launched PLxAI, a proprietary GenAI-based framework to accelerate product development across Mobility, Sustainability, and Tech, with more than 36 use cases deployed and 35 more in design, optimizing engineering processes and costs.

- Signed a $60 million multi-year agreement with a major U.S. wireless telecommunications provider for advanced network software development and application engineering, including a new U.S.-based delivery center.

- Selected by TRATON GROUP as a strategic engineering partner to support global R&D, EV adoption, and unified product-platform development, spanning multiple countries and advanced mobility technologies.

- Announced a strategic agreement to establish a software development center in Pune with thyssenkrupp Steering, focused on automotive software for advanced steering technologies and safety-critical applications.

Valuation Changes

Summary of Valuation Changes for L&T Technology Services

- The Consensus Analyst Price Target remained effectively unchanged, at ₹4556.

- The Discount Rate for L&T Technology Services remained effectively unchanged, at 13.06%.

- The Future P/E for L&T Technology Services remained effectively unchanged, at 36.04x.

Key Takeaways

- Strong demand for digital engineering, sustainability, and AI-driven solutions is driving revenue growth, margin expansion, and improving quality of earnings.

- Geographic and vertical diversification, supported by acquisitions and operational efficiencies, are broadening the addressable market and strengthening resilience.

- Rising competition, client concentration, integration challenges, and margin pressures threaten revenue growth stability and profitability, while diversification and recovery efforts remain unproven.

Catalysts

About L&T Technology Services- Operates as an engineering research and development services company in India, North America, Europe, and internationally.

- The ongoing wave of digital transformation and increased complexity in engineering across industries is driving robust demand for end-to-end ER&D outsourcing and solutions, as evidenced by LTTS' consistent large-deal wins, expanding pipeline, and strong order backlog; this dynamic supports forward revenue growth and long-term client stickiness.

- The accelerating global and cross-industry focus on sustainability, renewables, plant modernization, and energy efficiency is boosting high-margin segments for LTTS (e.g., a 16.4% YoY growth in sustainability), leading to margin expansion and improved visibility on higher-quality revenue as client spend increasingly favors sustainability-focused engineering partners.

- LTTS' strategic investments in proprietary AI and digital engineering platforms (such as PLxAI, iDriVe, and computer vision offerings) are shifting its business mix toward higher-margin, scalable digital solutions, which is expected to enhance blended net margins and support sustainable earnings growth over time.

- Expansion efforts into newer geographies (Middle East, North America, Japan) and industry verticals, supported by acquisitions like Intelliswift and the opening of new design centers, are broadening the company's addressable market and reducing client concentration risk, driving diversified revenue streams and improving earnings resilience.

- Increasing utilization of offshore delivery, operational efficiencies from AI-led automation, and targeted SG&A optimization provide a clear path for ongoing EBIT margin expansion (targeting mid-16% by FY27/FY28) and higher overall profitability as revenue mix shifts towards value-added, digital-led services.

L&T Technology Services Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming L&T Technology Services's revenue will grow by 11.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 11.5% today to 12.7% in 3 years time.

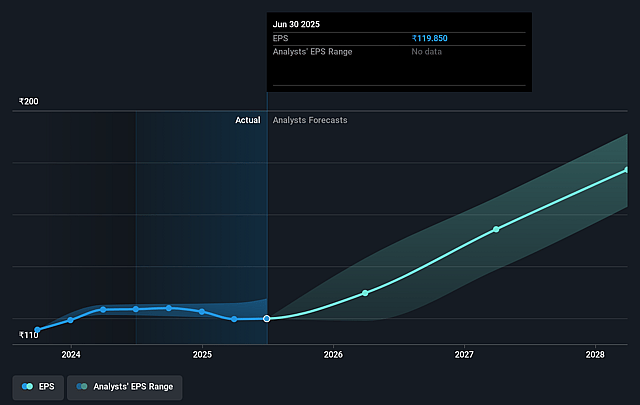

- Analysts expect earnings to reach ₹19.4 billion (and earnings per share of ₹182.49) by about September 2028, up from ₹12.7 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as ₹17.0 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 36.0x on those 2028 earnings, up from 35.0x today. This future PE is greater than the current PE for the IN Professional Services industry at 29.1x.

- Analysts expect the number of shares outstanding to grow by 0.07% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.06%, as per the Simply Wall St company report.

L&T Technology Services Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heightened competitive price pressures in the automotive segment, especially from Chinese EV manufacturers, are causing program delays, pauses, and contract cancellations among major global OEM clients, which could suppress LTTS' medium-term revenue growth and increase top-client volatility.

- Persistent seasonality and customer concentration in the Smart World business introduces recurring quarterly revenue swings and negative cash flows; management efforts to diversify remain unproven, posing sustained risk to earnings stability.

- Prolonged periods of "strategic support" for certain clients (notably in the tech segment) and margin pressure in Mobility, including customer discounts and delayed project starts, signal a risk of longer-than-expected recovery in EBIT margins, jeopardizing net profit growth targets.

- Increased SG&A costs following recent acquisitions (e.g., Intelliswift), coupled with elevated attrition rates and rising wage pressures, threaten effective integration and efficiency targets, potentially limiting operational leverage and squeezing net margins over time.

- The slow pace of deal conversion and ongoing client caution amid macroeconomic uncertainty may result in continued sluggishness in top-20 accounts and uneven topline expansion, undermining the resilience of LTTS' long-term revenue growth projections.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹4555.844 for L&T Technology Services based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹5770.0, and the most bearish reporting a price target of just ₹3460.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹152.4 billion, earnings will come to ₹19.4 billion, and it would be trading on a PE ratio of 36.0x, assuming you use a discount rate of 13.1%.

- Given the current share price of ₹4195.4, the analyst price target of ₹4555.84 is 7.9% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on L&T Technology Services?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.