Last Update01 May 25Fair value Increased 6.36%

Key Takeaways

- Strategic partnerships and advanced technology investments position HKBN for international expansion and increased margins through higher-speed packages and value-added services.

- Bundling telecom and ICT solutions increases customer retention and upsell opportunities, boosting average revenue and profitability through innovative multi-service offerings.

- Reduced focus on reselling and heavy reliance on China partnerships pose risks to revenue growth, cash flow, and expose HKBN to geopolitical vulnerabilities.

Catalysts

About HKBN- An investment holding company, provides fixed telecommunications network, international telecommunications, and mobile services to residential and enterprise customers in Hong Kong, Mainland China, and Macao.

- The implementation of the GigaFast campaign and investment in advanced broadband technology, such as the Nokia 25 gig, positions HKBN to increase its enterprise customer base and revenue by transitioning existing clients to higher-speed packages, thereby potentially increasing margins.

- The bundling of telecom services with the ICT/System Integration business allows HKBN to increase customer loyalty and upsell, thereby increasing average revenue per user (ARPU) and enhancing profitability.

- The InnoTech Ecosystem Alliance partnership with Mainland Chinese vendors sets HKBN up for increased international reach and revenue growth, leveraging Hong Kong as a hub for expansion into ASEAN, Middle East, and Belt and Road countries.

- The rollout of CyberZafe solutions aligns HKBN with the regulatory focus on cybersecurity, potentially boosting revenue from extended connectivity solutions and increasing margins through value-added services.

- The Infinite-play solutions strategy, which increases customer stickiness through bundling broadband with additional services like OTT and health solutions, is expected to raise average revenue per household (ARPH) and improve net income through higher customer lifetime value.

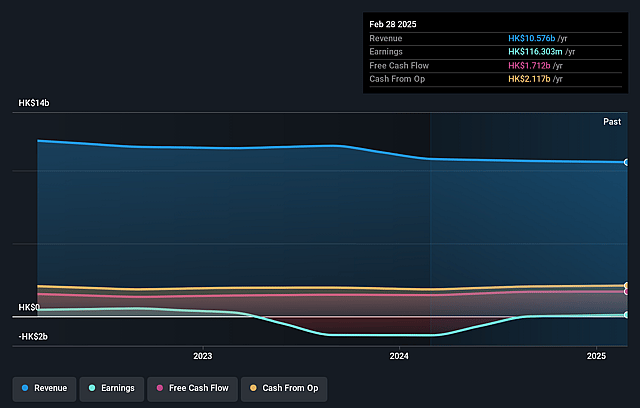

HKBN Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming HKBN's revenue will grow by 3.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 1.1% today to 6.0% in 3 years time.

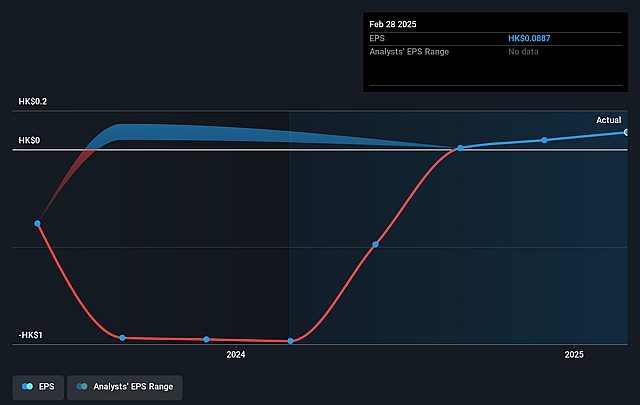

- Analysts expect earnings to reach HK$707.5 million (and earnings per share of HK$0.36) by about May 2028, up from HK$116.3 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.8x on those 2028 earnings, down from 64.5x today. This future PE is lower than the current PE for the HK Telecom industry at 13.9x.

- Analysts expect the number of shares outstanding to decline by 0.06% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.68%, as per the Simply Wall St company report.

HKBN Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's reduced focus on less profitable reselling businesses implies a flat or slightly declining aggregate revenue, which could negatively affect overall revenue growth and future cash flow.

- The heavy reliance on partnerships with Mainland China vendors exposes HKBN to geopolitical risks, which may lead to fluctuations in revenue due to regulatory changes or trade tensions.

- The statement regarding the minimal impact of the geopolitical environments and macroeconomic downturns may be overly optimistic, as any adverse effects on their enterprise customers might indirectly affect HKBN’s revenue.

- There is significant competition within the broadband sector, as indicated by the management's aggressive strategies to counteract competitors, which could put pressure on margins if customer retention efforts become more costly.

- The increase in cash through financing activities and the priority on deleveraging suggests a significant existing debt burden, which might affect net margins and profitability if interest rates fluctuate unfavorably.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of HK$5.05 for HKBN based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be HK$11.7 billion, earnings will come to HK$707.5 million, and it would be trading on a PE ratio of 12.8x, assuming you use a discount rate of 6.7%.

- Given the current share price of HK$5.07, the analyst price target of HK$5.05 is 0.4% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.