Key Takeaways

- Near-term growth may disappoint as international monetization develops slowly and rising competition challenges Meitu's ability to maintain premium pricing and differentiation.

- Significant ongoing investments and regulatory risks could limit profitability and user growth despite optimism about digital beauty and self-expression trends.

- Meitu's global expansion, AI-driven monetization, scalable operations, and diversified user base support sustainable revenue and earnings growth while reducing segment reliance.

Catalysts

About Meitu- An investment holding company, engages in the development and provision of products that streamline the production of photo, video, and design with other AI-powered products in Mainland China and internationally.

- The market appears to be pricing in uninterrupted rapid user base and revenue growth fueled by expanding international adoption and AI-driven product launches, even though management flagged that meaningful monetization in overseas markets could be gradual, with the real revenue explosive period not expected until late 2026; as a result, near

- to mid-term top-line growth may lag heightened expectations.

- Investors may be underestimating the threat posed by accelerating competition, as generative AI and open-source advancements lower barriers to entry in photo and video editing; Meitu acknowledged a surge in new startups and noted that differentiation and premium pricing could become increasingly difficult, potentially putting pressure on both market share and ARPU.

- Expectations for rising net margins might be overly optimistic, as substantial R&D and promotional investments-especially in international expansion and AI model development-could continue or even escalate, while the anticipated efficiencies and cost reductions from their model container strategy may take time to significantly impact the bottom line.

- Despite enthusiasm for long-term trends in digital self-expression and beauty spending, growing regulatory scrutiny over data privacy/facial recognition and evolving consumer attitudes towards digital authenticity could materially constrain product innovation, user growth, and ultimately revenue streams.

- The assumption that rapidly rising subscription penetration rates will sustain growth neglects Meitu's own guidance that increasing payment rates must be carefully balanced to avoid alienating users and stalling active user growth, suggesting that revenue per user and gross profit could be slower to scale than current valuations imply.

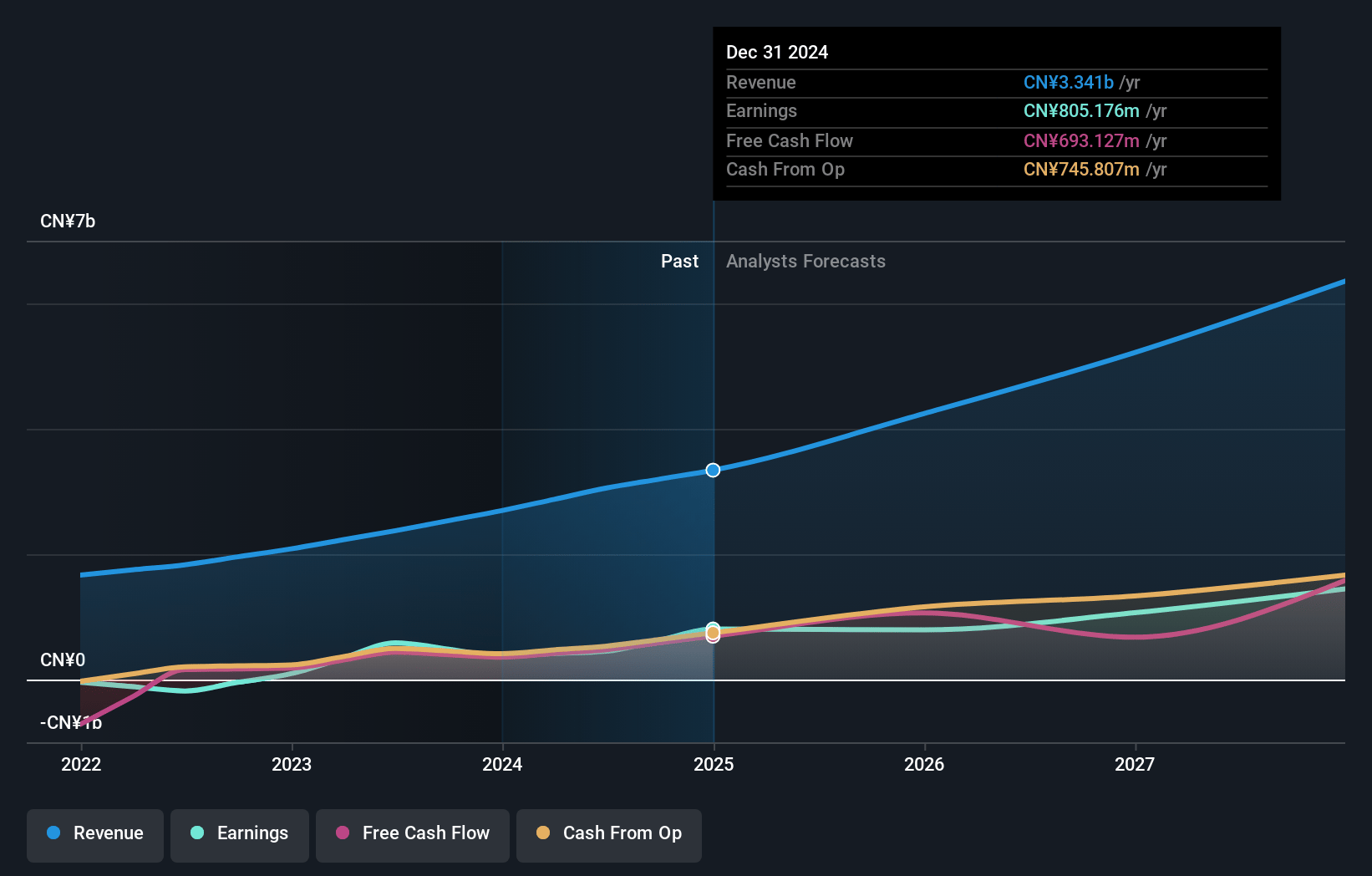

Meitu Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Meitu's revenue will grow by 23.0% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 24.1% today to 22.5% in 3 years time.

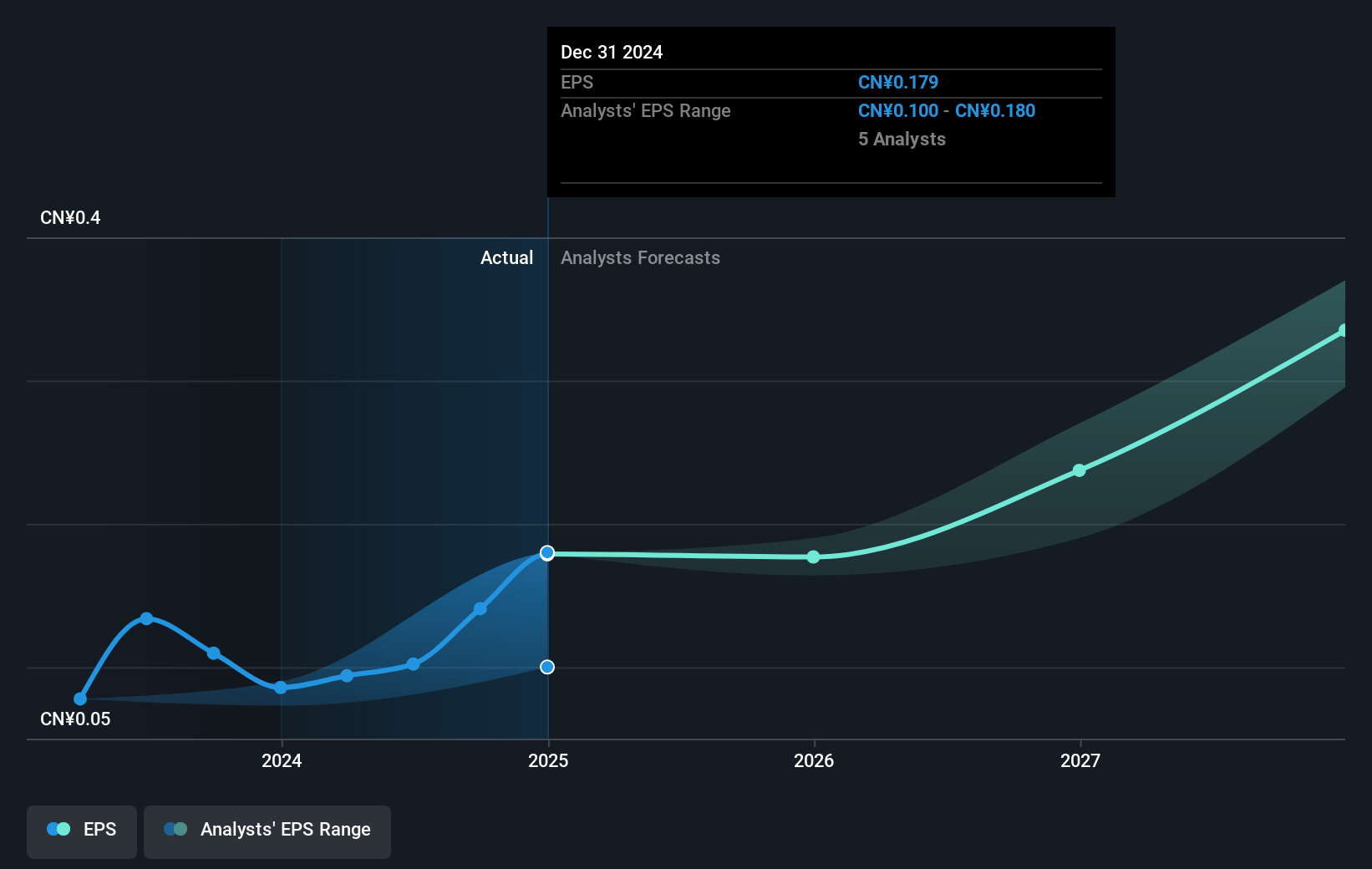

- Analysts expect earnings to reach CN¥1.4 billion (and earnings per share of CN¥0.32) by about July 2028, up from CN¥805.2 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting CN¥1.6 billion in earnings, and the most bearish expecting CN¥1.1 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 28.7x on those 2028 earnings, down from 53.3x today. This future PE is greater than the current PE for the HK Interactive Media and Services industry at 17.7x.

- Analysts expect the number of shares outstanding to grow by 0.6% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.22%, as per the Simply Wall St company report.

Meitu Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Strong international revenue growth-42% YoY growth and increasing overseas user penetration-suggests that Meitu is successfully globalizing, tapping into markets with higher payment willingness, which could drive sustained revenue expansion and improve earnings over the long term.

- Rapid adoption of AI-powered productivity tools (notably Meitu Studio and Kai Pai), with high subscription penetration rates and continued gross margin improvement, indicates resilient demand, supporting rising ARPU and potential for ongoing net margin expansion.

- Operational leverage is visible as revenue and gross profit are outpacing operating cost growth, leading to substantial improvements in profitability and suggesting scalable future earnings growth even as R&D expenses stabilize.

- Large, growing active user base (266 million MAU) across diverse products provides a foundation for further product monetization and up-selling, reducing dependency on any single segment and stabilizing overall revenue streams.

- Emphasis on leveraging AI, open-source ecosystem, and vertical integration into high-value domains (e.g., e-commerce, video, image tools) positions Meitu to benefit from long-term secular trends in digital content creation and monetization, providing competitive differentiation and supporting long-term revenue and net profit growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of HK$7.429 for Meitu based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of HK$13.6, and the most bearish reporting a price target of just HK$3.81.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CN¥6.2 billion, earnings will come to CN¥1.4 billion, and it would be trading on a PE ratio of 28.7x, assuming you use a discount rate of 8.2%.

- Given the current share price of HK$10.28, the analyst price target of HK$7.43 is 38.4% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.