Key Takeaways

- Rapid international expansion and unique AI-driven merchant services are driving exceptional revenue growth and increased profitability beyond market expectations.

- Emphasis on high-margin value-added services and innovative fintech products enables recurring revenue and long-term earnings leverage unrecognized by analysts.

- Reliance on low-margin payments, regulatory pressures, tough domestic competition, and costly overseas growth threaten Yeahka's ability to sustainably expand margins and revenues.

Catalysts

About Yeahka- An investment holding company, provides payment and business services to merchants and consumers in the People’s Republic of China.

- Analyst consensus sees overseas expansion as a driver for revenue, but this likely understates the extraordinary magnitude since Yeahka's global payment volumes have increased sixfold in a single year and management is rapidly rolling out AI and value-added merchant services in regions where digital payments adoption is still nascent, allowing for exceptional revenue growth and substantial margin expansion through higher take rates.

- While analysts broadly expect AI adoption to bring efficiency gains and margin improvement, Yeahka's unique approach of deploying client-facing generative AI-such as proactive AI agents and automated value-added marketing-directly targets revenue creation and premium up-sell opportunities, suggesting a step-change in both revenue per merchant and structural net profit margins beyond what consensus incorporates.

- The accelerating shift to cashless transactions and mobile commerce in Asia, especially in early-stage markets like Southeast Asia, positions Yeahka to capture outsized gains in total payment volume and market share at higher profitability, as entrenched incumbency and local partnerships enable a winner-take-most dynamic leading to higher earnings power relative to traditional payment platforms.

- Yeahka has engineered a structural shift in its business mix by rapidly expanding its suite of high-margin value-added services-now comprising a growing share of overall revenue-including proprietary SaaS, in-store e-commerce, and precision marketing, with each new product stacking recurring revenue sources and driving operating leverage that converts to higher long-term EBITDA growth.

- By leveraging its vast trove of proprietary transaction and behavioral data, Yeahka can accelerate the launch of innovative financial products like merchant credit, supply-chain finance, and cross-border fintech services-initiatives largely unaccounted for by the market-which can unlock high-margin incremental earnings through data-driven underwriting and broadened customer monetization.

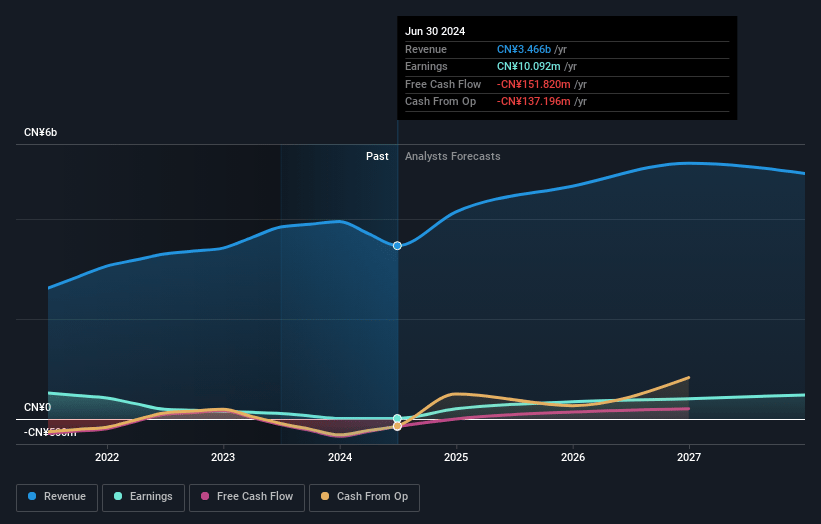

Yeahka Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Yeahka compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Yeahka's revenue will grow by 17.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 2.7% today to 7.7% in 3 years time.

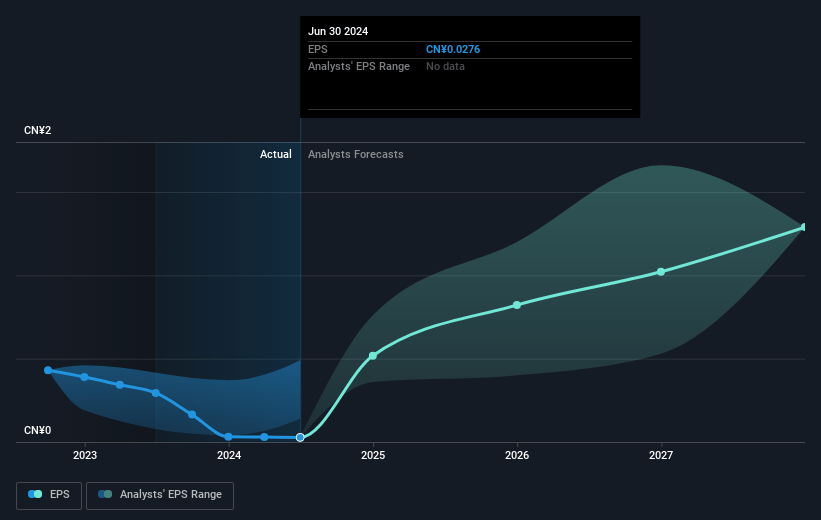

- The bullish analysts expect earnings to reach CN¥379.5 million (and earnings per share of CN¥0.98) by about July 2028, up from CN¥82.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 26.6x on those 2028 earnings, down from 72.3x today. This future PE is greater than the current PE for the HK Diversified Financial industry at 9.6x.

- Analysts expect the number of shares outstanding to grow by 5.47% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.96%, as per the Simply Wall St company report.

Yeahka Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Despite significant advancements in AI-driven products and operational efficiencies, Yeahka reported a sharp decline in total revenue of 21 percent year over year, attributed to phasing out less profitable projects and macroeconomic volatility, signaling ongoing top-line pressure that could constrain future revenue growth.

- The company's payment processing business, while high in volume, remains a low-margin segment and heavily reliant on QR code payments in China, exposing Yeahka to industry-wide pricing pressure, further margin compression, and limiting its ability to drive meaningful expansion of net margins over the long term.

- Market saturation in China's digital payments landscape and increasing regulatory oversight around fintech and data privacy are likely to raise compliance costs and restrict business model flexibility, directly impacting Yeahka's ability to scale revenues and protect profit margins.

- Intensifying competition from dominant incumbents such as Alipay and WeChat Pay, as well as emerging fintech challengers, increases the risk of market share erosion and fee-rate declines, which could dampen gross profit growth and threaten long-term earnings sustainability.

- Although overseas expansion is positioned as a growth lever, the company faces increased macroeconomic and geopolitical uncertainties as well as the substantial investment requirement needed to build scale in international markets, raising the prospect that increased operating expenses and capital allocation may outweigh incremental revenue and EBITDA generation in the medium term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Yeahka is HK$16.74, which represents two standard deviations above the consensus price target of HK$11.83. This valuation is based on what can be assumed as the expectations of Yeahka's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of HK$16.99, and the most bearish reporting a price target of just HK$9.71.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be CN¥4.9 billion, earnings will come to CN¥379.5 million, and it would be trading on a PE ratio of 26.6x, assuming you use a discount rate of 8.0%.

- Given the current share price of HK$14.58, the bullish analyst price target of HK$16.74 is 12.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.