Key Takeaways

- Regulatory tightening and heightened competition from major tech firms threaten Yeahka's data-driven growth, market share, and top-line expansion in payments and value-added services.

- Heavy investment needs, margin pressure, and overseas expansion risks may undermine scalability and sustainable long-term earnings despite efficiency efforts.

- Rapid digital payments and AI adoption, diverse value-added services, and international expansion position Yeahka for sustained profit growth and robust margins amid favorable market dynamics.

Catalysts

About Yeahka- An investment holding company, provides payment and business services to merchants and consumers in the People’s Republic of China.

- Yeahka's long-term revenue prospects are threatened by intensifying regulatory scrutiny and the tightening of data privacy laws both in China and globally, which could severely limit access to merchant and customer data that underpins its AI-driven value-added services and ecosystem expansion, thereby jeopardizing the company's ability to monetize new use cases and expand its product suite.

- The risk of disruption from large technology platforms, including aggressive moves by big tech fintech arms with superior technology and resources, may accelerate as digital payment adoption matures, eroding Yeahka's market share and compressing pricing power across core payment processing and ancillary SaaS offerings, ultimately resulting in stagnating or declining revenues.

- Heavy reliance on merchant acquiring in a highly commoditized payments landscape, with slow-growing or volatile transaction volumes-as evidenced by the reported 21 percent year-on-year revenue decline in 2024 and reduced transaction amounts from macro weakness-raises the likelihood of persistent top-line pressure, despite cost cuts, threatening sustainable long-term earnings growth.

- While Yeahka touts cost reductions and AI-driven operational efficiencies, continued significant investments in research and development to keep pace with rapidly-evolving technologies and client demand for more advanced value-added services risk outstripping the incremental profits generated, leading to margin compression and a possible deterioration in future return on investment as competitors escalate spending.

- The rapid global expansion strategy, especially in immature overseas payments markets with less entrenched QR-code adoption, exposes Yeahka to heightened geopolitical risks, cross-border regulatory uncertainty, and variable competitive dynamics that may derail projected overseas revenue growth, causing profit volatility and undermining the scalability of its model.

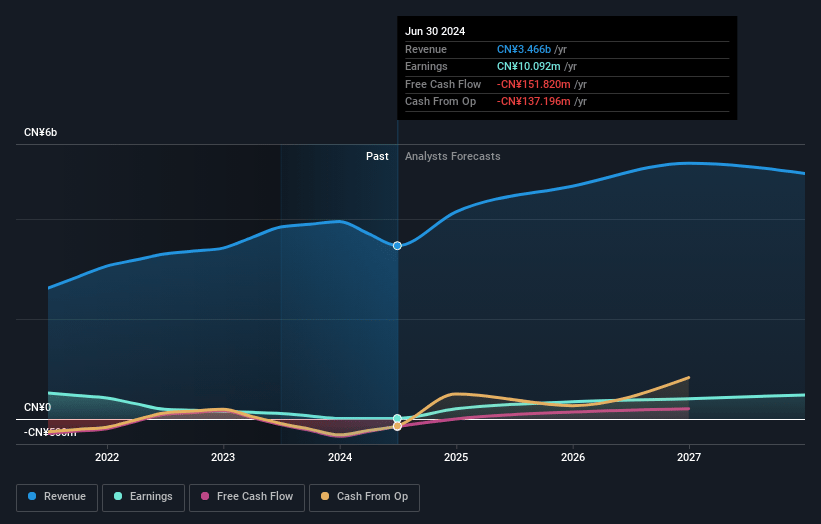

Yeahka Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Yeahka compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Yeahka's revenue will grow by 9.1% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 2.7% today to 3.5% in 3 years time.

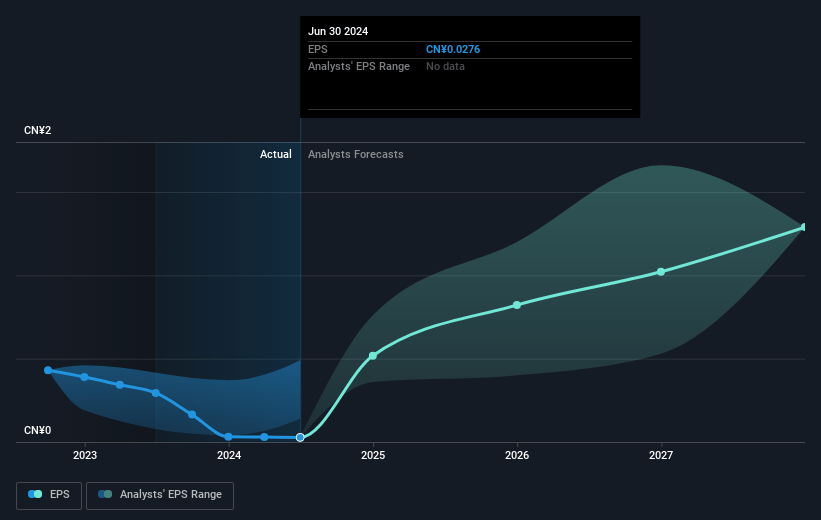

- The bearish analysts expect earnings to reach CN¥138.9 million (and earnings per share of CN¥0.3) by about July 2028, up from CN¥82.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 42.2x on those 2028 earnings, down from 72.6x today. This future PE is greater than the current PE for the HK Diversified Financial industry at 9.1x.

- Analysts expect the number of shares outstanding to grow by 5.47% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.97%, as per the Simply Wall St company report.

Yeahka Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerated adoption of AI and digital payments in China and across Asia is fueling growth in Yeahka's addressable market, which drove a six-fold increase in net profit for 2024 and could continue to support higher earnings and net margins over time.

- Expansion into value-added services, including merchant solutions, in-store e-commerce, and precision marketing, has led to a higher proportion of nonpayment revenue (up to 13 percent in 2024), increased cross-selling, and doubled revenue and profit per merchant in some segments, supporting future revenue and gross profit growth.

- Overseas business is scaling rapidly, with payment volume increasing sixfold year-over-year in 2024 and new products, cross-border partnerships, and limited local competition providing substantial headroom for revenue and earnings expansion outside of China.

- Substantial improvements in gross profit margin, from 18.7 percent in 2023 to 23.6 percent in 2024 (and 28.4 percent in the second half), stem from optimized cost structures, increased automation through AI, and a shift toward higher-margin business lines, which together reduce costs and improve net margins.

- The company's strong industry positioning, focus on premium service rather than price competition, and winner-take-most market dynamics, supported by government policy tailwinds and early-mover advantages in Asia's developing payments markets, increase customer stickiness and reduce risks of margin compression, sustaining long-term earnings power.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Yeahka is HK$9.71, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Yeahka's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of HK$16.99, and the most bearish reporting a price target of just HK$9.71.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be CN¥4.0 billion, earnings will come to CN¥138.9 million, and it would be trading on a PE ratio of 42.2x, assuming you use a discount rate of 8.0%.

- Given the current share price of HK$14.64, the bearish analyst price target of HK$9.71 is 50.7% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.