Last Update 29 Oct 25

Fair value Increased 0.73%Analyst Price Target for Softcat Marginally Raised

Analysts have slightly increased their price target for Softcat from £18.14 to £18.27. This reflects a nuanced adjustment based on updated forecasts for revenue growth and profitability.

What's in the News

- Softcat's Board proposed a final ordinary dividend of 20.4 pence per share for the year ended July 31, 2025, up from 18.1 pence. The total dividend of 29.3 pence per share is pending shareholder approval (Key Developments).

- A special dividend of 16.1 pence per share has also been recommended. If approved, it will be paid alongside the final dividend and will increase total shareholder returns since listing to £661.9 million (Key Developments).

- Softcat is actively seeking acquisition opportunities following its first acquisition of Oakland and continues to evaluate potential bolt-on acquisitions and U.S. expansion (Key Developments).

- The company reaffirmed earnings guidance for 2025 and 2026 and indicated strong gross profit growth expectations along with steady operating profit increases, particularly weighted toward the first half of the year (Key Developments).

Valuation Changes

- Consensus Analyst Price Target has risen slightly from £18.14 to £18.27.

- Discount Rate increased modestly from 8.97% to 9.13%.

- Revenue Growth forecast has fallen significantly from 11.97% to 4.47%.

- Net Profit Margin forecast declined from 11.09% to 10.26%.

- Future P/E ratio estimate decreased from 29.0x to 27.8x.

Key Takeaways

- Expansion in cybersecurity and data center services is expected to drive revenue growth, with emphasis on internally delivered services and technological advancements.

- Global expansion and strategic customer relationship initiatives aim to increase international market share and customer lifetime value.

- Declining software margins and rising costs could hinder profitability, while strategic and market challenges may impact revenue growth and scalability.

Catalysts

About Softcat- Operates as a value-added IT reseller and IT infrastructure solutions provider in the United Kingdom.

- Softcat's expansion in cybersecurity services, driven by customer prioritization of cyber investments and the enhancement of internally delivered services, positions the company for continued revenue growth in this segment.

- Growth in data center and networking demand, supported by a robust pipeline and ongoing technological advancement, is expected to drive revenue upward, reflecting in higher gross profits.

- Investment in AI and data capabilities, alongside the adoption of platforms like Microsoft CoPilot, aims to improve productivity and offer enhanced services, potentially improving net margins through increased operational efficiencies.

- Continued global expansion supported by multinational customer demand could bolster earnings, as Softcat leverages its diverse technology portfolio to increase its international market share.

- Strategic initiatives, including maturing their approach with large and complex customers, are expected to deepen existing customer relationships, increasing customer lifetime value and driving gross profit per customer upward over time.

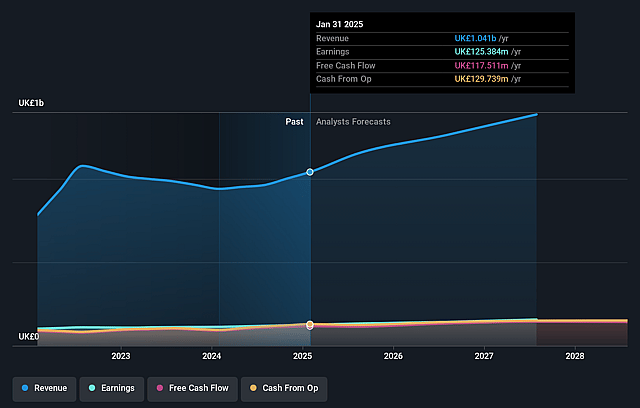

Softcat Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Softcat's revenue will grow by 12.0% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 12.0% today to 11.1% in 3 years time.

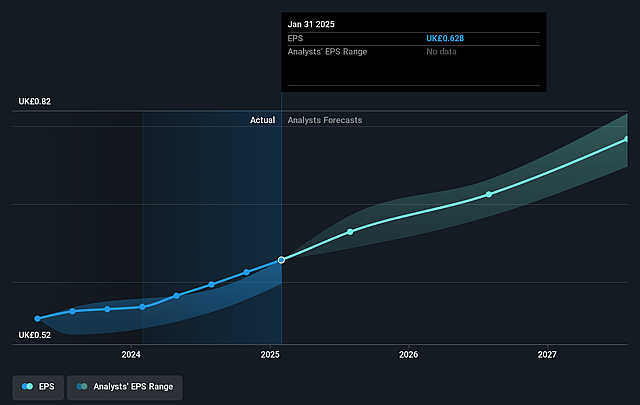

- Analysts expect earnings to reach £162.1 million (and earnings per share of £0.78) by about September 2028, up from £125.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 29.0x on those 2028 earnings, up from 24.8x today. This future PE is greater than the current PE for the GB IT industry at 24.8x.

- Analysts expect the number of shares outstanding to grow by 0.21% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.97%, as per the Simply Wall St company report.

Softcat Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The decline in software gross margins, attributed to product mix and a shift toward high-volume, low-margin transactions, could negatively impact net margins and profitability if this trend continues.

- Operating costs grew by 12.9% year-on-year, driven by increased commissions, rising wages, and costs associated with office space expansion, which could exert pressure on net margins if revenue growth does not outpace these expenses.

- The company's strategy of measured head count growth, following significant past expansions, could result in lower immediate scalability of revenue growth if not complemented by productivity improvements and technology investments.

- The macroeconomic uncertainty and a potentially challenging public sector environment, influenced by government pressure on efficient spending, might affect revenue growth if public sector demand weakens or if budgets are constrained.

- The competitive landscape, particularly within the partnership model and vendor management strategy, could pose risks if the framework does not evolve adequately to capture new technological innovations and maintain revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £18.141 for Softcat based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £21.35, and the most bearish reporting a price target of just £14.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £1.5 billion, earnings will come to £162.1 million, and it would be trading on a PE ratio of 29.0x, assuming you use a discount rate of 9.0%.

- Given the current share price of £15.58, the analyst price target of £18.14 is 14.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.