Key Takeaways

- Operational upgrades, infrastructure projects, and market factors could enable rapid earnings recovery and significant, underestimated improvements in margins and production volume.

- Rising global silver demand and strong resource development position Fresnillo for robust, long-term growth, enhanced cash flow, and strategic partnership opportunities.

- Reliance on high metal prices, operational and environmental challenges, and capital intensity threaten profitability, production growth, and long-term returns amidst stricter industry regulations.

Catalysts

About Fresnillo- Fresnillo plc mines, develops, and produces non-ferrous minerals in Mexico.

- Analyst consensus expects incremental improvements in production efficiency and cost control to modestly benefit net margins, but this view likely underestimates the compounding benefits as multiple operational upgrades, infrastructure projects, and ongoing FX tailwinds could deliver a structural step change in cost base and margin expansion, rapidly accelerating Fresnillo's earnings recovery.

- Analysts broadly agree that mine plan reassessment and advanced sulphide processing at Herradura can boost future efficiency, but this outlook is conservative relative to the emerging evidence of a multi-deposit integrated mining complex; upcoming disclosures could reveal a far more material uplift in production volume and mine life, significantly enhancing top-line revenue growth trajectory.

- Accelerating global silver demand driven by surging adoption in solar panels, EVs, and electronics is intensifying tightness in the physical market, and with Fresnillo controlling a vast, low-cost silver reserve, sustained upward price pressure has the potential to transform Fresnillo's revenue and cash generation for years, well beyond what is contemplated in current valuations.

- Fresnillo's ability to rapidly monetize large-scale brownfield and greenfield discoveries, such as Guanajuato and Orisyvo, alongside a healthy permitting environment and strong local stakeholder relations, positions the company for rapid resource-to-production conversion, securing long-term production visibility and derisking multi-year earnings.

- Industry-wide consolidation and heightened demand for high-ESG, domestic supply of critical minerals make Fresnillo an attractive counterparty for value-accretive M&A and strategic partnerships, opening the door to even greater scale, asset quality, and capital access, with the potential to accelerate both growth and margin resilience.

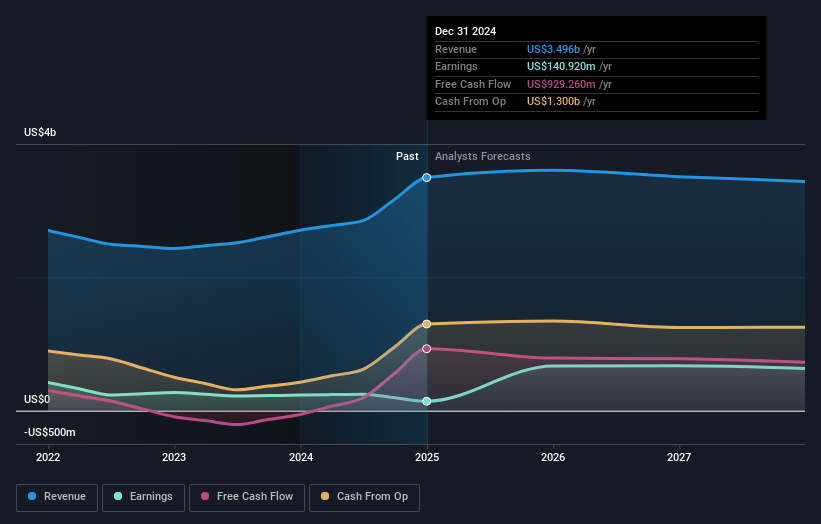

Fresnillo Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Fresnillo compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Fresnillo's revenue will grow by 5.1% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 4.0% today to 32.3% in 3 years time.

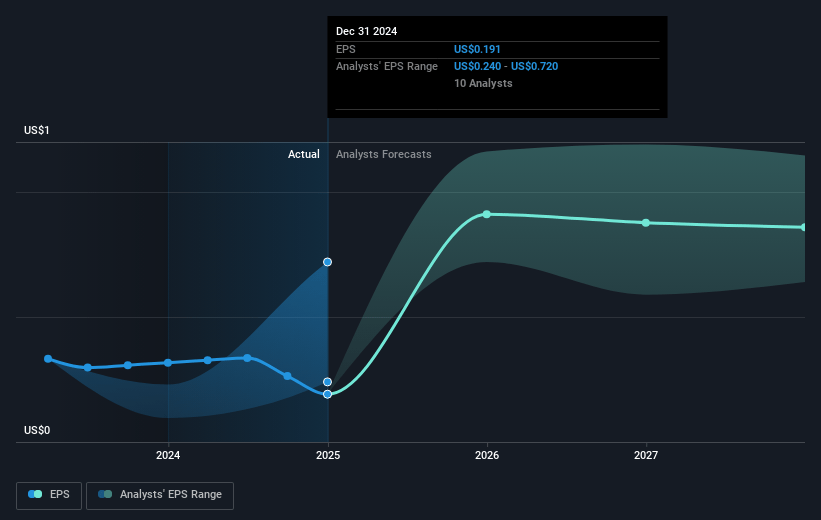

- The bullish analysts expect earnings to reach $1.3 billion (and earnings per share of $1.77) by about July 2028, up from $140.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 16.7x on those 2028 earnings, down from 107.0x today. This future PE is greater than the current PE for the GB Metals and Mining industry at 8.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.14%, as per the Simply Wall St company report.

Fresnillo Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's proven reserves declined by 7% due to a more conservative approach to resource and reserve calculation, and persistent challenges with declining grades and narrowing veins at key mines like Fresnillo and Saucito threaten to sustain higher long-term production costs, putting pressure on EBITDA margins in future years.

- Almost all of the recent profit growth was driven by high silver and gold prices, with 81% of revenue gains attributed to price rather than volume, making Fresnillo's revenues and net profits highly sensitive to a potential structural decline in precious metal prices as central banks raise rates or investor sentiment shifts away from gold and silver.

- Lengthy permitting processes and community consultation requirements-especially for new projects such as Orisyvo and brownfield expansions-are already causing project delays of a year or more on average, indicating that heightened environmental regulations and anti-mining sentiment may increase compliance costs and disrupt project timelines, constraining future production growth and free cash flow.

- The text highlights repeated operational challenges, including ongoing transitions to lower-grade ore bodies (such as at Herradura and Ciénega), a shift to higher-cost sulphide zones, and the reliance on incremental efficiency savings that are becoming harder to achieve, all of which risk producing flat or declining output, putting sustained pressure on margins and earnings.

- Fresnillo's business model remains highly capital intensive, with management guiding to a rebound in annual CapEx towards $485 million to $500 million, while also facing persistent industry-wide trends of declining discovery rates of new high-grade deposits and increased ESG scrutiny, both of which threaten to erode long-term return on capital and shareholder distributions through cost inflation and environmental compliance expenses.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Fresnillo is £16.98, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Fresnillo's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £16.98, and the most bearish reporting a price target of just £8.17.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $4.1 billion, earnings will come to $1.3 billion, and it would be trading on a PE ratio of 16.7x, assuming you use a discount rate of 9.1%.

- Given the current share price of £15.16, the bullish analyst price target of £16.98 is 10.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.