Key Takeaways

- Rising regulatory, environmental, and community pressures are set to increase operating costs, complicate mine expansions, and threaten profit margins.

- Demand headwinds and competitive threats from alternative technologies and metal recycling risk undermining long-term growth and cash flow stability.

- Sustained cost reductions, operational improvements, exploration success, and favorable market trends position the company for long-term growth, stability, and enhanced shareholder value.

Catalysts

About Fresnillo- Fresnillo plc mines, develops, and produces non-ferrous minerals in Mexico.

- The accelerating rollout of green technologies and decarbonization initiatives could increasingly shift investment toward metals other than silver and gold, while substitution in industrial applications and the rise of digital alternatives like cryptocurrencies threaten the long-term demand outlook for Fresnillo, undermining sustained revenue growth.

- Ongoing pressure from heightened ESG activism, coupled with tightening global environmental regulations, is expected to require expensive upgrades in water management, tailings storage, and decarbonization, driving materially higher production costs and compressing future net margins for Fresnillo's operations.

- Persistent declines in ore grades at core mines such as Fresnillo and Saucito, combined with continued dilution and mine maturity issues, will necessitate greater capital intensity and undermine operating leverage, risking long-term erosion of profitability and weakening earnings quality.

- Structural volatility from community relations challenges in Mexico, coupled with slow or unpredictable permitting even under a friendlier administration, is likely to delay production ramp-ups and the realization of growth projects, putting multi-year pressure on group production volumes and mid-term revenue trajectory.

- The global mining sector faces increasing competition from lower-cost producers and threats of technological disruption in metal recycling, which-along with potential future trade barriers-could intensify price pressure and reduce Fresnillo's ability to maintain its current earnings power and cash flow generation.

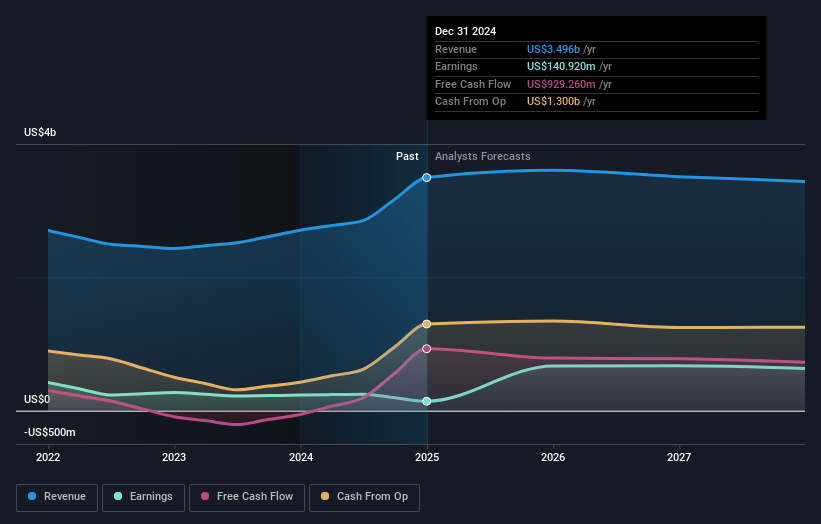

Fresnillo Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Fresnillo compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Fresnillo's revenue will decrease by 2.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 4.0% today to 21.6% in 3 years time.

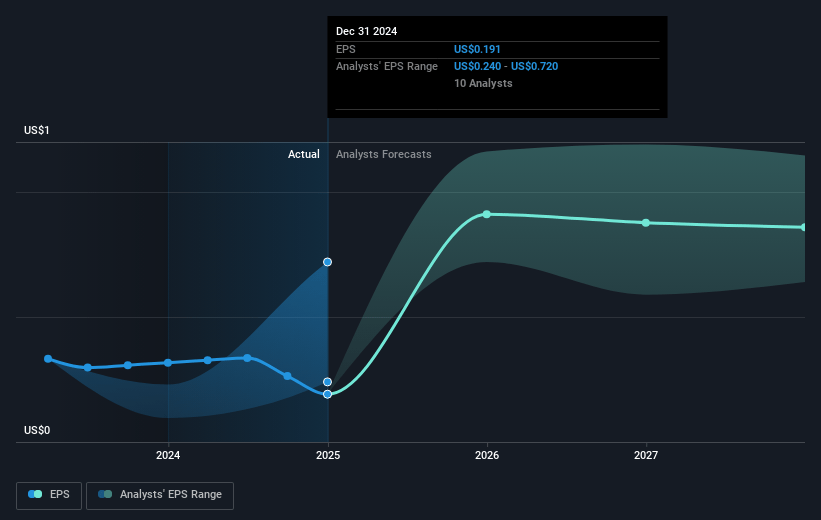

- The bearish analysts expect earnings to reach $708.3 million (and earnings per share of $0.94) by about July 2028, up from $140.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 16.0x on those 2028 earnings, down from 103.2x today. This future PE is greater than the current PE for the GB Metals and Mining industry at 8.2x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.15%, as per the Simply Wall St company report.

Fresnillo Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing cost optimization, operational efficiency programs, and infrastructure investments-such as the San Carlos shaft at Fresnillo, the deepening of Jarillas shaft at Saucito, and turnaround strategies at Herradura and Ciénega-have delivered tangible cost reductions and productivity improvements, supporting higher operating margins and ultimately driving stronger earnings.

- Persistent and even increasing focus on exploration success, particularly in brownfield and greenfield opportunities at core assets like Guanajuato, Orisyvo, Rodeo, Tajitos, and ongoing reserve replenishment at flagship mines, secures a long-term growth pipeline and underpins resource base stability, which supports sustained future revenue streams and valuations.

- Structural demand tailwinds for silver and gold-including safe haven demand due to geopolitical and inflationary pressures, as well as growing industrial usage of silver in electronics and the green energy transition (PV solar, EVs)-support a favorable price environment, which directly benefits Fresnillo's sales and cash flows.

- Enhanced community relations, a more constructive regulatory environment in Mexico, and the gradual improvement of permitting processes reduce operational risk and enable mine life extensions, project development, and expansion, contributing to longer-term production stability and resource conversion, which supports ongoing revenue growth.

- Strong balance sheet, robust cash flow generation, and disciplined capital allocation-including special dividends and a conservative dividend policy-provide flexibility to invest in growth and efficiency initiatives or pursue accretive M&A, all of which can bolster long-term earnings and shareholder returns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Fresnillo is £8.83, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Fresnillo's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £18.59, and the most bearish reporting a price target of just £8.83.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $3.3 billion, earnings will come to $708.3 million, and it would be trading on a PE ratio of 16.0x, assuming you use a discount rate of 9.2%.

- Given the current share price of £14.72, the bearish analyst price target of £8.83 is 66.7% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.