Last Update 17 Oct 25

Fair value Increased 1.01%Analysts have modestly raised their price target for Sartorius Stedim Biotech from €229.62 to €231.92. They cited improved revenue growth and higher profit margin projections as key drivers for the adjustment.

What's in the News

- Sartorius Stedim Biotech and Bio Usawa Biotechnology Ltd. have formed a partnership to advance Africa's biopharmaceutical industry, with a focus on affordable monoclonal antibody manufacturing and workforce training (Key Developments).

- The new collaboration includes initiatives in research and development, technology enablement, process optimization, and analytical quality assurance for the African market (Key Developments).

- Sartorius Stedim Biotech has confirmed its earnings guidance for fiscal 2025, projecting organic sales revenue growth of around 7%, with a forecast range of plus or minus two percentage points due to market volatility (Key Developments).

Valuation Changes

- Consensus Analyst Price Target has risen slightly from €229.62 to €231.92.

- Discount Rate has decreased marginally from 6.85% to 6.79%.

- Revenue Growth estimate has increased from 10.53% to 11.04%.

- Net Profit Margin forecast has edged up from 15.94% to 16.32%.

- Future P/E (Price to Earnings) ratio has fallen from 45.81x to 40.32x.

Key Takeaways

- Strong demand for single-use consumables and compliance expertise drive high-margin growth, supporting both revenue expansion and pricing power for sustained profitability.

- Leadership in innovative bioprocess technologies and rising customer equipment utilization position the company for future sales acceleration and reduced business risk.

- Ongoing weak equipment demand, geopolitical risks, inventory challenges, and slow China recovery threaten revenue growth and margins, especially in the underperforming lab products segment.

Catalysts

About Sartorius Stedim Biotech- Engages in the production and sale of instruments and consumables for the biopharmaceutical industry worldwide.

- Strong, sustained double-digit growth in recurring single-use consumables is being driven by higher bioprocess utilization and robust end-market demand, reflecting increasing adoption of biologics, cell/gene therapies, and the need for flexible production platforms-which supports both revenue growth and margin expansion due to the high-margin nature of these products.

- Continued global momentum in regulation-driven requirements for manufacturing quality and safety benefits Sartorius Stedim Biotech as a trusted partner with strong compliance track records, increasing its competitive moat and supporting premium pricing-leading to sustained improvements in net margins over time.

- Recent product launches-such as automated/intensified bioprocess modules and next-gen lab instruments-position the company ahead of the ongoing industry shift toward more innovative manufacturing technologies and personalized medicine, setting up for future revenue acceleration as new drug modalities scale.

- The growing installed base and high utilization of Sartorius' equipment platform signal a likely inflection point in new equipment investment cycles as customers' capacity becomes fully utilized, which is expected to translate into a recovery in equipment sales and incremental top line growth.

- Consistent improvement in order intake and a book-to-bill ratio above 1 on a rolling 12-month basis indicate strengthening forward demand visibility across regions, reducing revenue and earnings uncertainty, and supporting management's confidence in meeting or exceeding current financial guidance.

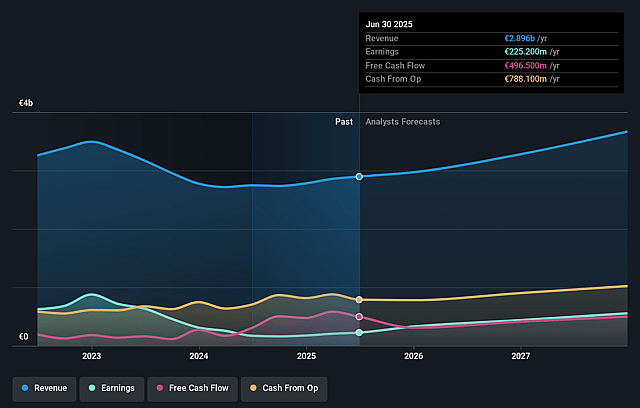

Sartorius Stedim Biotech Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Sartorius Stedim Biotech's revenue will grow by 10.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.8% today to 15.9% in 3 years time.

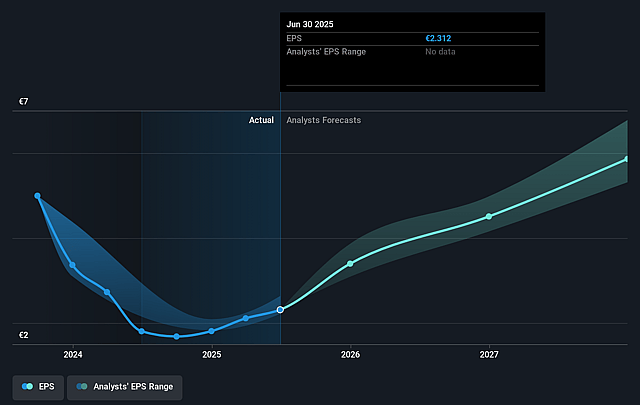

- Analysts expect earnings to reach €623.7 million (and earnings per share of €6.53) by about September 2028, up from €225.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 45.5x on those 2028 earnings, down from 75.3x today. This future PE is greater than the current PE for the GB Life Sciences industry at 29.3x.

- Analysts expect the number of shares outstanding to grow by 1.22% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.74%, as per the Simply Wall St company report.

Sartorius Stedim Biotech Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Lingering weakness and uncertainty in equipment sales, with capital spending by customers remaining soft and continued reluctance to invest in large CapEx projects, could cap topline revenue growth and increase dependence on consumables for margin expansion.

- Tariff increases and ongoing geopolitical risks (notably for US business) are anticipated to intensify in the second half of the year; these could inflate the top line but potentially dilute margins (by 30–40 bps), and in a prolonged scenario, raise costs and disrupt operations, negatively impacting net margins and earnings.

- Persistent inventory write-downs-still above pre-pandemic levels-are continuing to dampen profitability, with only a gradual normalization projected into 2026, presenting an ongoing drag on net margin and earnings quality.

- Slow recovery and heightened local competition in key markets such as China, where government procurement policies increasingly favor locally produced lab instruments, may limit regional revenue growth and profitability, particularly in the LPS division.

- The LPS (Lab Products & Services) segment remains underperforming with CapEx-driven business in structural decline and ambitious guidance for a second–half acceleration reliant on new product launches and market stabilization, raising the risk of missed revenue targets and ongoing margin pressure if the recovery does not materialize as expected.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €233.308 for Sartorius Stedim Biotech based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €3.9 billion, earnings will come to €623.7 million, and it would be trading on a PE ratio of 45.5x, assuming you use a discount rate of 6.7%.

- Given the current share price of €174.25, the analyst price target of €233.31 is 25.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.