Last Update 03 Dec 25

CS: Modestly Higher Future Multiple Will Support Attractive Upside Potential

Analysts have modestly raised their price target on AXA to €45.04, citing a slightly higher assumed future price to earnings multiple, which more than offsets marginal adjustments to the discount rate and profit margin forecasts.

Valuation Changes

- Fair Value Estimate unchanged at approximately €45.04 per share, indicating no revision to the intrinsic value assessment.

- Discount Rate risen very slightly from about 6.85 percent to 6.85 percent, reflecting a marginally higher required rate of return.

- Revenue Growth effectively unchanged at around 9.83 percent, suggesting a stable outlook for top line expansion.

- Net Profit Margin fallen slightly from roughly 7.21 percent to 7.19 percent, indicating a modestly lower profitability assumption.

- Future P/E risen slightly from about 12.41x to 12.44x, implying a marginally higher valuation multiple applied to forward earnings.

Key Takeaways

- Digitalization, AI, and operational efficiencies are set to drive improved customer acquisition, cost savings, and revenue growth, especially among underserved and price-sensitive segments.

- Expansion in health solutions, product innovation in Life & Savings, and growth into emerging markets will underpin sustained earnings growth and greater geographic diversification.

- Currency weakness, softening insurance markets, limited European growth, execution risks in digital transformation, and climate-related claims all threaten future profitability and earnings stability.

Catalysts

About AXA- Through its subsidiaries, insurance, asset management, and banking services worldwide.

- Strong momentum in digitalization, AI adoption, and streamlined direct distribution (bolstered by the Prima acquisition) is expected to drive future cost efficiencies, improved customer acquisition, and expanded market share among digitally savvy, price-sensitive, and underserved customer segments, supporting higher future revenue growth and net margins.

- Ongoing investment and innovation in Health (including care delivery, prevention, and integrated digital health solutions) positions AXA to capture increasing demand triggered by rising health awareness, regulatory focus, and global demographic shifts, which will underpin sustained top-line growth and expand net margins via better claims management and reduced fraud/waste.

- The rejuvenation and positive net flows in Life & Savings-driven by product innovations and better persistency-are expected to convert into higher Contractual Service Margin (CSM) release and sustained earnings growth as the aging global population increases demand for retirement and protection products.

- Expansion into emerging markets and strengthening of diversified distribution (e.g., partnerships with Correos in Spain and Lloyds Bank in the UK) is anticipated to open new customer bases where insurance penetration is lower, providing a long-term runway for revenue growth and geographic diversification of earnings.

- Operational efficiency initiatives-including simplification, modernization of tech platforms, and disciplined cost management-are expected to further reduce the expense ratio and support higher underlying ROE and earnings, reinforcing AXA's ability to deliver attractive returns despite a complex macro and regulatory environment.

AXA Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming AXA's revenue will grow by 10.0% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 7.7% today to 7.2% in 3 years time.

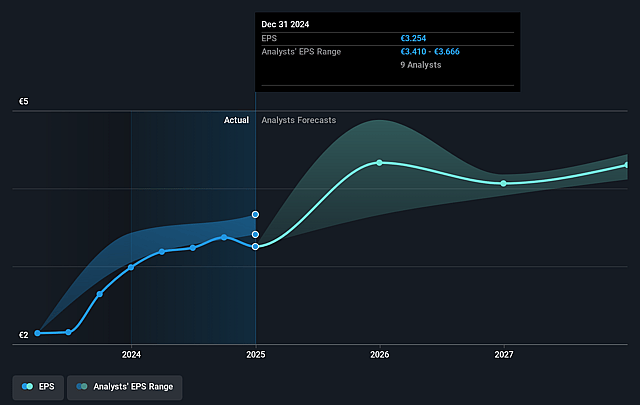

- Analysts expect earnings to reach €8.9 billion (and earnings per share of €4.43) by about September 2028, up from €7.1 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.1x on those 2028 earnings, up from 11.5x today. This future PE is greater than the current PE for the GB Insurance industry at 10.5x.

- Analysts expect the number of shares outstanding to decline by 1.81% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.77%, as per the Simply Wall St company report.

AXA Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistently unfavorable foreign exchange (FX) movements, notably the weaker US dollar and currency volatility in key Asian markets, have already led to a reduction in net income and book value, and continued FX headwinds could further erode reported earnings and shareholder value over the long term.

- The intensifying soft market conditions in reinsurance and select commercial lines (e.g., US property rates turning negative, slowing pricing momentum at AXA XL) may put pressure on underwriting margins, increasing the risk that earnings and combined ratio improvements fall short of current targets.

- Overexposure to mature European markets, especially in core life and health insurance, creates structural limitations for revenue growth as these markets face stagnation and slow premium expansion compared to higher-growth emerging geographies.

- Reliance on ambitious operational efficiency gains, particularly from investments in technology, digitalization, and AI, creates execution risk-as the projected margin improvements and cost reductions are not yet fully realized, and failure to deliver these could constrain future net margins and earnings growth.

- Ongoing climate change and increased frequency of natural catastrophes pose a risk of higher claims volatility and potential underwriting losses, threatening future profitability and putting additional pressure on reinsurance costs and AXA's net results.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €44.577 for AXA based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €47.8, and the most bearish reporting a price target of just €40.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €123.9 billion, earnings will come to €8.9 billion, and it would be trading on a PE ratio of 12.1x, assuming you use a discount rate of 6.8%.

- Given the current share price of €39.33, the analyst price target of €44.58 is 11.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on AXA?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.