Last Update01 May 25Fair value Decreased 4.91%

Key Takeaways

- BIC's strategic acquisition and geographic expansion efforts in high-growth markets aim to drive revenue growth and increase scalability.

- Product innovation and supply chain optimization are expected to enhance consumer engagement, boost margins, and improve shareholder value.

- Challenging U.S. market conditions, execution risks in new regions, and sales difficulties in key segments may negatively impact BIC's revenue growth and profitability.

Catalysts

About Société BIC- Manufactures and sells stationery, lighter, shaver, and other products worldwide.

- Société BIC's recent acquisition of Tangle Teezer in the high-growth hair care market is expected to significantly contribute to future revenue and profitability, providing exposure to a new and scalable business with strong potential for value creation.

- The company's focus on geographic expansion, particularly in growth markets like Eastern Europe, the Middle East, Africa, and Latin America, is projected to drive top-line revenue growth through new distribution gains and market penetration.

- BIC's strategic initiatives in product innovation, including new launches and extensions in high-value categories like razors and lighters, aim to enhance consumer engagement and push revenue growth via added value offerings.

- Improved manufacturing efficiencies via supply chain optimization and regionalization of production are set to boost net margins by reducing logistical complexities and enhancing operational resilience.

- Share buyback initiatives and disciplined capital allocation are expected to positively impact earnings per share (EPS), further enhancing shareholder value.

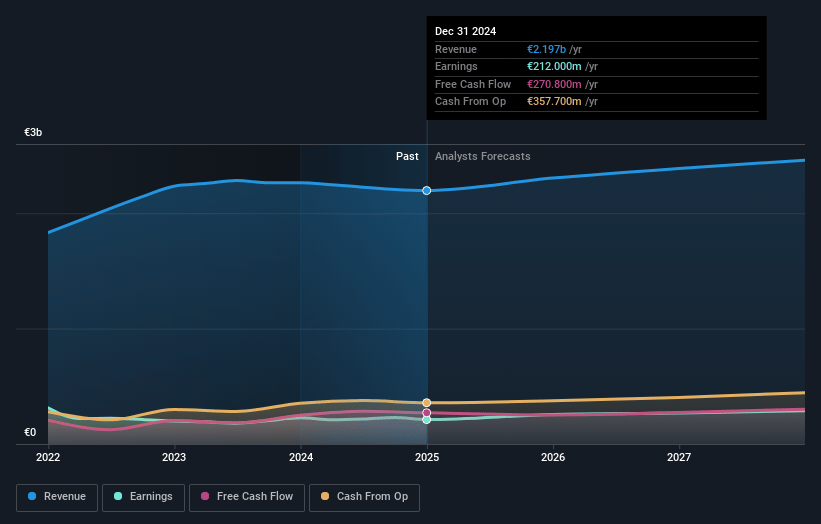

Société BIC Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Société BIC's revenue will grow by 1.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 9.7% today to 11.0% in 3 years time.

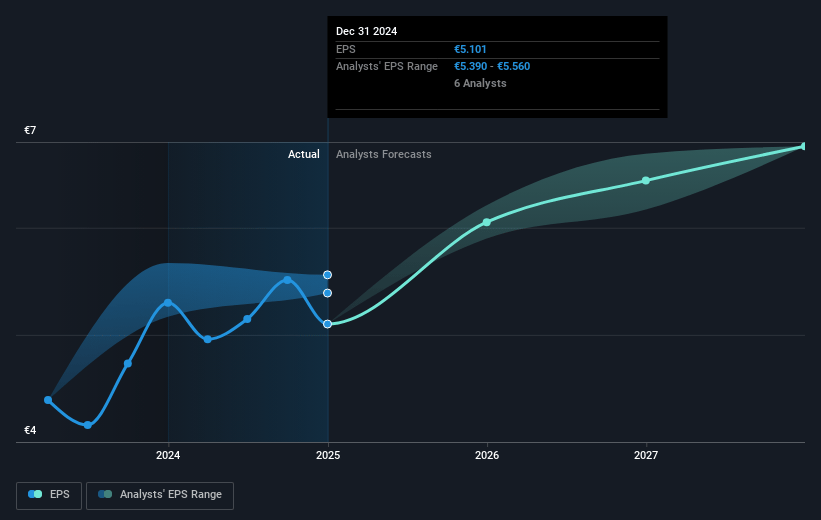

- Analysts expect earnings to reach €254.6 million (and earnings per share of €6.11) by about May 2028, up from €212.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.2x on those 2028 earnings, up from 11.2x today. This future PE is lower than the current PE for the GB Commercial Services industry at 13.5x.

- Analysts expect the number of shares outstanding to decline by 0.98% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.3%, as per the Simply Wall St company report.

Société BIC Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The U.S. market conditions in 2024 were challenging, with higher-than-expected softness in global consumption and declining spending due to inflationary pressures, particularly impacting BIC's U.S. market share. This trend could continue to affect revenues negatively if the economic climate does not improve.

- Growth projections for 2025 rely significantly on new market penetration and expansion, particularly in regions like Eastern Europe and the Middle East and Africa. These strategies carry execution risks and may not deliver expected sales increases if market entry and expansion efforts falter.

- BIC's Flame For Life division faced sales challenges in North America due to downward consumption trends, with the U.S. lighter market declining 5% in value. This decline in a key market segment poses a risk to BIC's revenue growth and margin stability if these trends persist or worsen.

- In the Blade Excellence division, continued competitive pressure in the women's segment could impact market share gains. If BIC fails to sustain its competitive edge, it may negatively impact its revenue and profitability.

- The acquisition of Tangle Teezer is intended to drive growth but involves integration risks. If integration efforts fail to unlock the expected synergies and financial benefits, this could adversely affect BIC's earnings and margin forecasts.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €64.5 for Société BIC based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €70.0, and the most bearish reporting a price target of just €55.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €2.3 billion, earnings will come to €254.6 million, and it would be trading on a PE ratio of 12.2x, assuming you use a discount rate of 6.3%.

- Given the current share price of €57.0, the analyst price target of €64.5 is 11.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.