Key Takeaways

- Sustainability concerns and regulatory pressure threaten demand for single-use devices, undermining Ambu's growth and market position in key regions.

- Rising costs, tougher competition, and harsher regulations are squeezing margins and hindering both expansion and earnings potential.

- Benefiting from healthcare trends, infection control focus, operational efficiency, innovation, and sustainability, Ambu is well positioned for durable growth and stronger market competitiveness.

Catalysts

About Ambu- A medical technology company, develops, produces, and sells medical devices to hospitals, clinics, and rescue services worldwide.

- Growing global push for sustainability, stricter environmental regulation, and rising hospital demand for low-waste medical solutions threaten the long-term demand for single-use devices. This structural shift risks eroding Ambu's core volume growth in key Western markets, which is likely to suppress revenue growth and put pressure on the company's competitive positioning.

- Heightened downward pricing pressure due to constrained global healthcare budgets, particularly in developed markets, is set to intensify as procurement shifts more power to group purchasing organizations. This environment will likely reduce Ambu's ability to preserve or expand gross and net margins, significantly limiting future earnings growth.

- Intensifying competition from large multinationals and aggressive low-cost Chinese manufacturers in the single-use endoscopy market is leading to commoditization, protracted sales cycles, and market share risk. As a result, revenue growth is likely to slow, while gross margin may deteriorate as Ambu is forced to discount more aggressively to retain business.

- High and rising R&D and SG&A expenses-combined with uncertain success in expanding into new clinical applications and regions-mean that even minor revenue shortfalls or increased price competition could dramatically reduce net margins and free cash flow over the mid to long term.

- Increasingly complex and lengthening global regulatory pathways (such as EU MDR and FDA requirements) are expected to raise compliance costs and extend time-to-market for new products, reducing operational flexibility and stifling innovation-drivenn ASP (average selling price) expansion, resulting in structurally lower earnings potential.

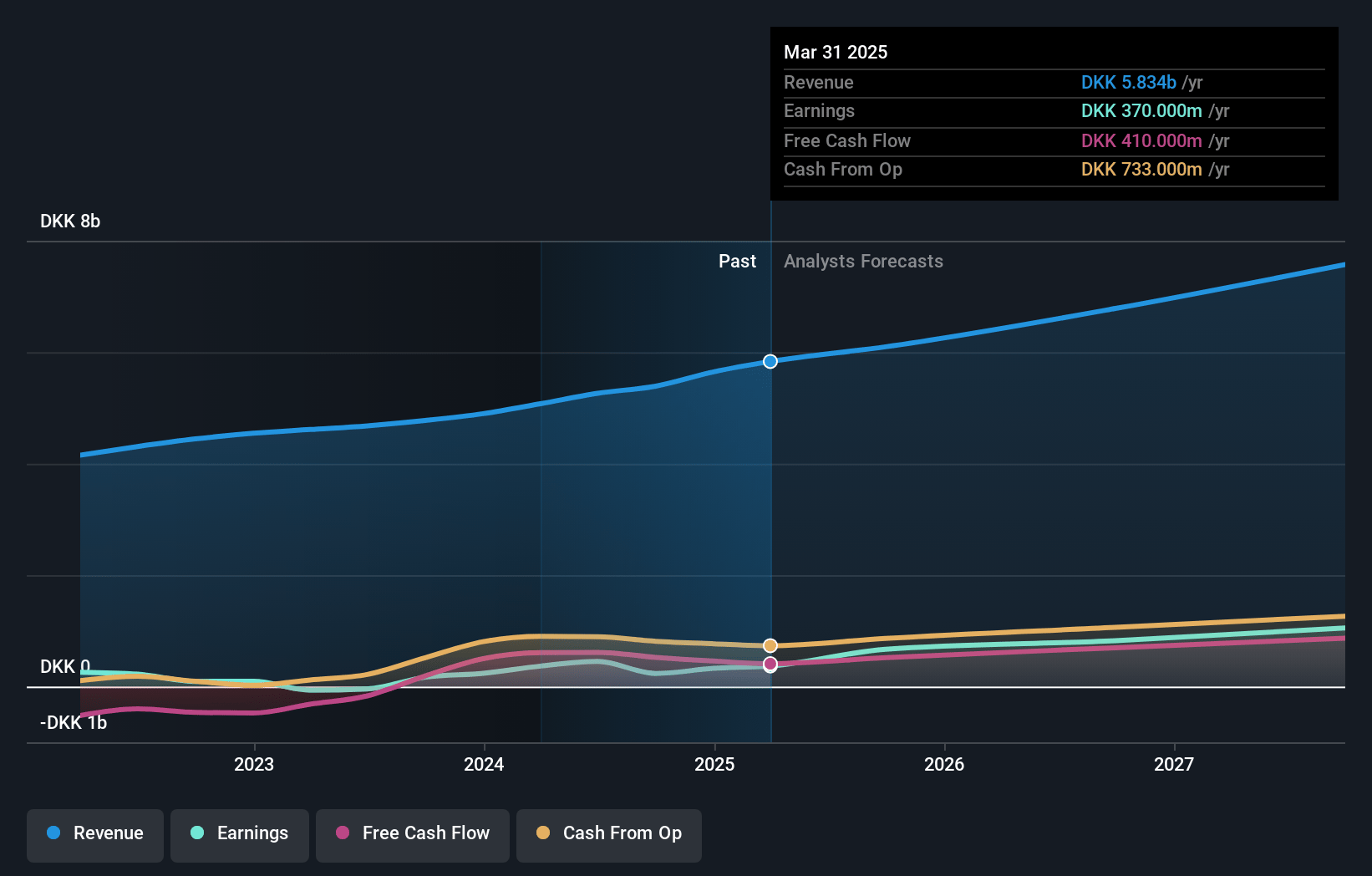

Ambu Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Ambu compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Ambu's revenue will grow by 10.7% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 6.3% today to 14.6% in 3 years time.

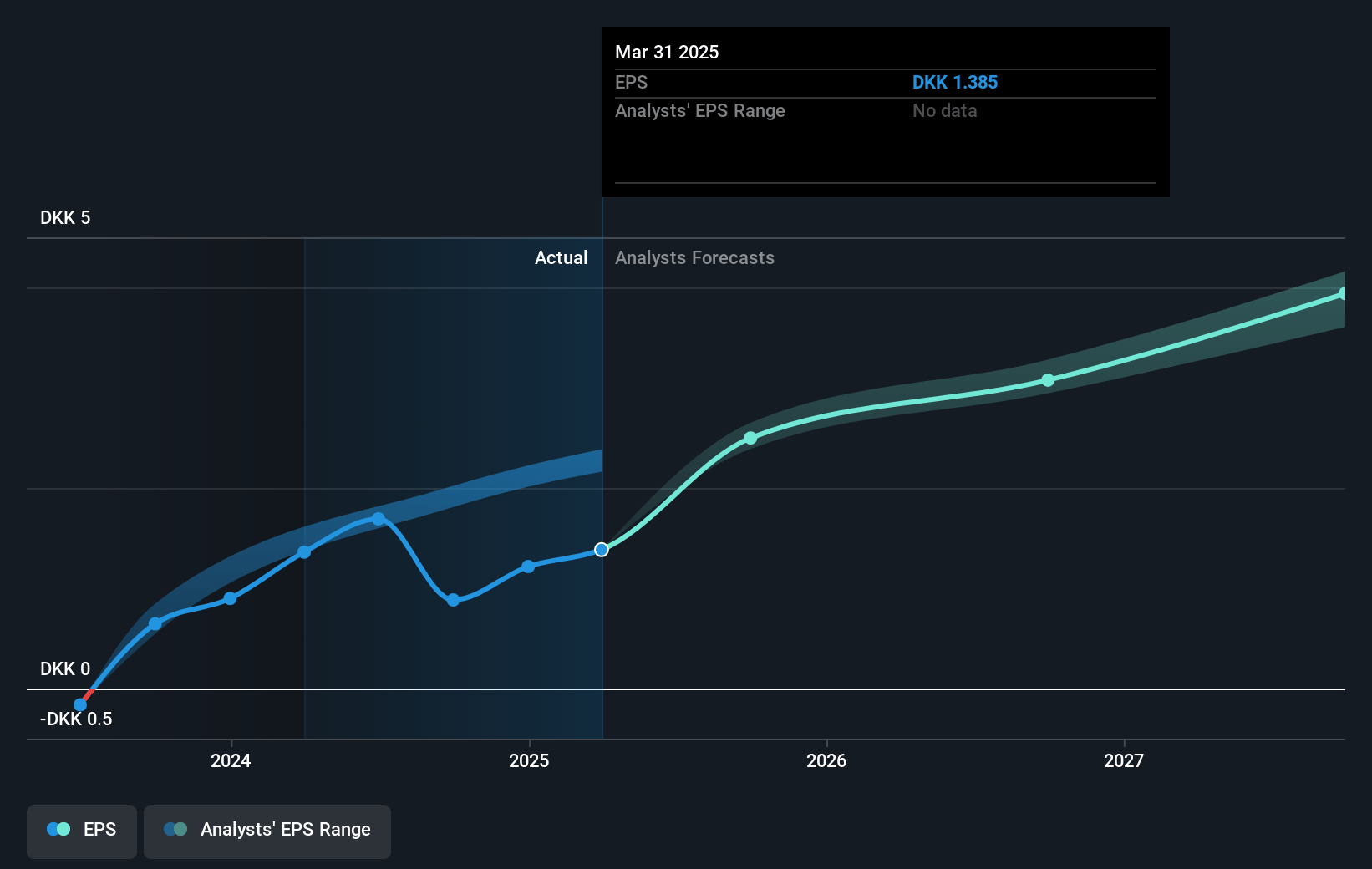

- The bearish analysts expect earnings to reach DKK 1.2 billion (and earnings per share of DKK 4.29) by about July 2028, up from DKK 370.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 25.2x on those 2028 earnings, down from 72.3x today. This future PE is lower than the current PE for the GB Medical Equipment industry at 30.5x.

- Analysts expect the number of shares outstanding to decline by 0.6% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.63%, as per the Simply Wall St company report.

Ambu Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Demographic trends such as the aging global population and rising healthcare demand could drive sustained growth for Ambu, expanding its addressable market and supporting long-term revenue increases.

- Heightened focus on infection control and hospital-acquired infection prevention is accelerating the shift to single-use endoscopes, structurally favoring Ambu and positioning it for continued market share gains and higher sales.

- Operational improvements, ongoing manufacturing expansion (particularly high efficiency and spare capacity in the Mexico facility), and a flexible global supply chain suggest increasing gross margins and operational leverage, enhancing long-term profitability.

- Ambu's continued innovation and successful launches in endoscopy (e.g., SureSight Connect, aScope 5 Cysto HD, ureteroscope) point to the potential for gradual but significant incremental revenue streams as new products gain traction.

- Expansion into new indications, digital integration, and the Recircle sustainability program provide differentiation and defend Ambu's competitive position, increasing customer stickiness and ultimately supporting resilient earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Ambu is DKK94.54, which represents two standard deviations below the consensus price target of DKK130.7. This valuation is based on what can be assumed as the expectations of Ambu's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of DKK147.0, and the most bearish reporting a price target of just DKK90.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be DKK7.9 billion, earnings will come to DKK1.2 billion, and it would be trading on a PE ratio of 25.2x, assuming you use a discount rate of 5.6%.

- Given the current share price of DKK100.4, the bearish analyst price target of DKK94.54 is 6.2% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.