Key Takeaways

- Heavy reliance on European markets and outdoor advertising leaves the company exposed to regional economic cycles and tightening regulatory environments.

- Digital platform investments boost margins, but global shifts toward rival ad formats and lack of international reach may limit sustainable long-term growth.

- Weakening advertiser confidence, margin pressure, and lack of progress on non-core asset divestments heighten earnings volatility and limit near-term shareholder value creation.

Catalysts

About Ströer SE KGaA- Provides out-of-home (OOH) media and digital out-of-home advertising services in Germany and internationally.

- Although Ströer SE KGaA is demonstrating robust growth in digital out-of-home and programmatic advertising, benefiting from ongoing urbanization and digital transformation in European media, its high dependence on the German and broader European advertising market leaves it vulnerable to local economic downturns and regulatory changes, which could pressure revenue and margins in the medium-to-long term.

- While the company's early investments in digital infrastructure and proprietary data platforms have allowed for higher yields and premium pricing, the rapid acceleration of global digital ad spending toward search, social, and CTV-dominated by well-capitalized competitors-risks capping Ströer's long-term addressable market and thus limiting sustainable revenue growth.

- Ströer's recurring revenue profile, underpinned by customer retention rates well above 100% and churn below one percent among its top clients, suggests stability; nevertheless, increasing restrictions on outdoor public advertising and heightened environmental regulation in urban centers could progressively curtail the amount of inventory available to monetize, constraining both revenue growth and margin expansion over time.

- Despite recent margin improvements from operational leverage and the expanding mix of higher-margin digital products, profitability remains reliant on ongoing capex for digital transformation, and should audience mobility patterns shift away from high-density travel corridors-either due to remote work trends or unforeseen urban disruptions-the company may see downward pressure on yields and net margins.

- Even as Ströer seeks to unlock value through selective asset divestments and remains exposed to consolidation opportunities in the European OOH sector, its limited international diversification and exposure to regional economic oscillations may result in revenue stagnation and earnings headwinds if structural shifts in global advertising or stricter privacy regimes erode the core business's competitive advantages.

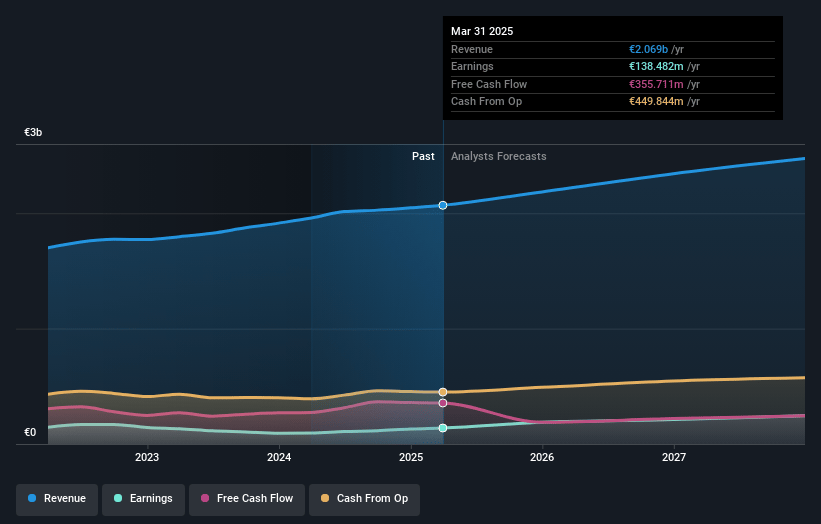

Ströer SE KGaA Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Ströer SE KGaA compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Ströer SE KGaA's revenue will grow by 5.5% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 6.7% today to 10.0% in 3 years time.

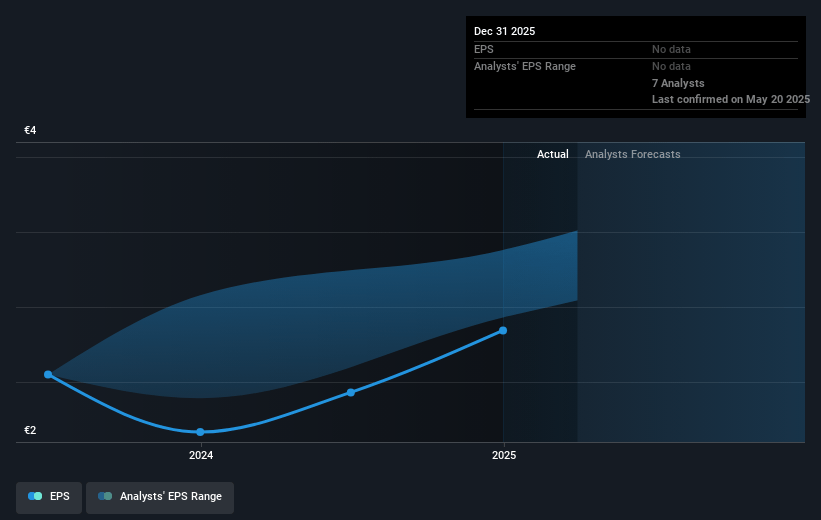

- The bearish analysts expect earnings to reach €243.2 million (and earnings per share of €nan) by about July 2028, up from €138.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 14.4x on those 2028 earnings, down from 19.1x today. This future PE is lower than the current PE for the GB Media industry at 27.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.74%, as per the Simply Wall St company report.

Ströer SE KGaA Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Continued macroeconomic uncertainty in core markets, particularly Germany and the US, is making advertisers more conservative in their budgets, which could slow growth in Ströer's Statista segment and potentially drag down group revenue growth if cautious sentiment persists.

- Both the Digital and Dialog Media segments are experiencing margin pressure due to weak performance in door-to-door activities and a need for restructuring and offshoring investments, which could negatively impact group net margins in the medium term.

- The Asam e-commerce segment has suffered from declining international sales, especially regarding China, and remains exposed to a challenging consumer environment in the DACH region, raising the risk of stagnant or declining revenues from non-core businesses.

- Only 30% to 35% of out-of-home bookings are locked in at midyear, leaving much of the annual run rate exposed to shifts in advertiser sentiment or volatile macro conditions, thereby increasing quarterly revenue unpredictability and risk to earnings stability.

- The group continues to lack a clear path and timeline for divesting non-core assets (Statista, Asam, Dialog), and capital market/M&A uncertainty could mean that any value unlocking and share price appreciation from such disposals is postponed, limiting the realization of potential gains for shareholders in the near term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Ströer SE KGaA is €54.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Ströer SE KGaA's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €100.0, and the most bearish reporting a price target of just €54.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be €2.4 billion, earnings will come to €243.2 million, and it would be trading on a PE ratio of 14.4x, assuming you use a discount rate of 5.7%.

- Given the current share price of €47.25, the bearish analyst price target of €54.0 is 12.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.