Last Update 11 Nov 25

Fair value Decreased 1.61%SHL: Full-Year Revenue Outlook And Dividend Raise Will Support Upside

Narrative Update on Siemens Healthineers

The analyst price target for Siemens Healthineers was reduced by EUR 1 to EUR 61. Analysts cite shifts in market expectations and adjustments to forecast assumptions for this change.

Analyst Commentary

Bullish Takeaways

- Bullish analysts continue to maintain a positive long-term outlook on Siemens Healthineers and reaffirm a Buy rating, despite the slight reduction in the price target.

- The company's fundamentals and business model remain robust, which provides confidence in its ability to execute its growth strategy.

- Valuation remains attractive, even with minor downward adjustments. This suggests the shares offer upside potential from current levels.

- Recent operational performance and the innovation pipeline are seen as drivers of sustainable earnings growth.

Bearish Takeaways

- Bearish analysts express caution due to shifting market expectations, which has led to a reduction in the price target.

- Persistent macroeconomic uncertainties could weigh on execution and short-term growth prospects.

- Forecast assumptions have been adjusted to reflect potential headwinds and this has impacted near-term valuation.

- Slower than expected recovery or delays in business segments may pose risks to the company meeting its targets.

What's in the News

- Siemens Healthineers AG has provided earnings guidance for the first quarter of 2026, anticipating revenue growth below the outlook range of 5% to 6%. The company expects full-year comparable revenue growth to remain within the 5% to 6% range. Ongoing macroeconomic challenges, particularly a strong euro and tariffs, are projected to offset earnings growth. (Key Developments)

- The company is raising its proposed dividend for 2025 by EUR 0.05 per share, bringing the total to EUR 1 per share. (Key Developments)

- Aiforia Technologies and Siemens Healthineers have announced new and expanded partnerships, including a local agreement in Finland and a strategic collaboration to accelerate the adoption of AI-powered diagnostic solutions across Europe. (Key Developments)

- Siemens Healthineers launched the Atellica DT 250 Analyzer, a new benchtop instrument that provides quality drug testing and enhanced workflow efficiency. The analyzer is capable of processing up to 225 test results per hour. (Key Developments)

- Carna Health and Siemens Healthineers entered a strategic agreement to accelerate adoption of AI-enabled chronic kidney disease screening platforms and point-of-care testing systems. The partnership aims to expand access to care in underserved regions. (Key Developments)

Valuation Changes

- Fair Value Estimate has decreased slightly, moving from €58.81 to €57.86.

- The discount rate has risen from 5.88% to 6.18%, indicating an increased risk factor in the valuation model.

- Revenue growth expectations have edged up modestly, changing from 5.41% to 5.48% per year.

- Net profit margin has improved, increasing from 11.58% to 11.76%.

- Future P/E ratio has fallen from 25.27x to 23.18x, reflecting adjusted growth and valuation forecasts.

Key Takeaways

- Innovation in imaging and AI diagnostics, plus digital adoption, is driving order growth, margin improvement, and recurring, higher-quality revenues worldwide.

- Rising chronic diseases, aging populations, and emerging market investments will sustain long-term market expansion, supporting continued revenue and margin gains.

- Tariff pressures, China market challenges, unfavorable currency shifts, operational restructuring, and industry competition all threaten margins, pricing power, and long-term growth.

Catalysts

About Siemens Healthineers- Through its subsidiaries, develops, manufactures, and sells a range of diagnostic and therapeutic products and services to healthcare providers worldwide.

- Strong, ongoing innovation in advanced imaging (e.g., Photon Counting CT, molecular imaging) and AI-driven diagnostic solutions is fueling robust order growth across all global markets, supporting both revenue expansion and higher net margins as adoption increases.

- A rapidly aging population and rising chronic disease incidence are consistently boosting demand for high-precision diagnostics and individualized therapies-core competencies for Siemens Healthineers-indicating a durable multi-year uplift in addressable market size and likely top-line growth.

- Expansion of long-term Value Partnerships with hospitals and healthcare systems is shifting the business mix toward higher recurring revenue streams, which help stabilize earnings, improve revenue visibility, and support sustained operating margin expansion.

- Accelerating digital and AI adoption in healthcare-alongside a growing installed base of automated, integrated diagnostic platforms-positions Siemens Healthineers to capture higher-margin software and solutions revenues, enhancing overall earnings quality.

- Emerging market healthcare infrastructure investments, alongside potential recovery in China, offer significant room for market share gains and volume growth in advanced medical equipment, providing upside potential to both revenue and net margin as global demand resumes.

Siemens Healthineers Future Earnings and Revenue Growth

Assumptions

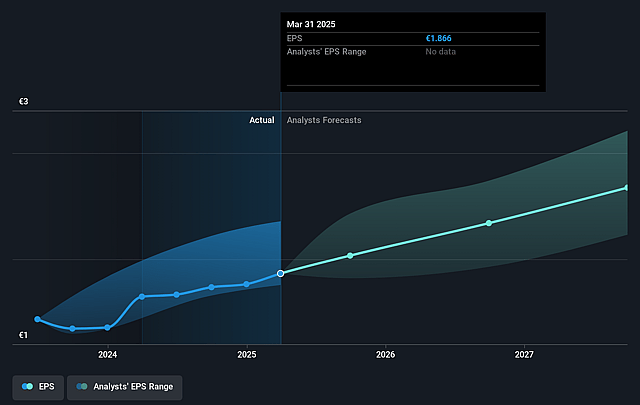

How have these above catalysts been quantified?- Analysts are assuming Siemens Healthineers's revenue will grow by 5.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 9.3% today to 11.7% in 3 years time.

- Analysts expect earnings to reach €3.2 billion (and earnings per share of €2.86) by about September 2028, up from €2.2 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as €2.6 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 25.2x on those 2028 earnings, up from 23.9x today. This future PE is greater than the current PE for the DE Medical Equipment industry at 17.0x.

- Analysts expect the number of shares outstanding to grow by 0.65% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.93%, as per the Simply Wall St company report.

Siemens Healthineers Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Exposure to significant and increasing tariff headwinds, particularly in the Imaging and Advanced Therapies segments, poses a risk to profitability as mid-term mitigation strategies like value-add relocation and pricing adjustments may take time to fully materialize, likely pressuring net margins and EPS.

- Prolonged weakness and structural challenges in the China market-especially the ongoing impact of China's volume-based procurement (VBP) in Diagnostics-are resulting in a reset of pricing and distribution models, suppressing revenue growth and compressing margins for a key region that has yet to show sustained recovery.

- Unfavorable foreign exchange movements, especially from the depreciation of the U.S. dollar against the euro, create translational headwinds that impact group revenues and margins, with current hedges only delaying the negative effects that are set to increase in coming quarters.

- Ongoing restructuring and portfolio simplification in Diagnostics, including site closures and product line discontinuations, signal underlying operational weaknesses; without a clear timeline for margin recovery, near

- and mid-term earnings could remain under pressure.

- Intense industry competition, particularly in digital diagnostics and imaging, as well as growing price sensitivity from healthcare providers under value-based care models, increase the risk of commoditization and market share loss-threatening Siemens Healthineers' pricing power and sustainable revenue growth over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €60.183 for Siemens Healthineers based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €65.0, and the most bearish reporting a price target of just €50.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €27.4 billion, earnings will come to €3.2 billion, and it would be trading on a PE ratio of 25.2x, assuming you use a discount rate of 5.9%.

- Given the current share price of €46.66, the analyst price target of €60.18 is 22.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.