Last Update 10 Dec 25

ISA: Future Returns Will Be Shaped By Earnings Multiples And Profitability Stability

Analysts have modestly reduced their price target for Interconexión Eléctrica E.S.P. to COP 26,250.00, reflecting a slightly lower discount rate and marginally softer expectations for future valuation multiples, while keeping long term revenue growth and profitability assumptions broadly unchanged.

What's in the News

- Interconexión Eléctrica E.S.P. plans to invest between COP 6.2 and 6.8 trillion in 2026, representing about 26% of the Ecopetrol Group's annual budget, with roughly 80% earmarked for its electric transmission business (company disclosure)

Valuation Changes

- Fair Value Estimate: Unchanged at COP 26,250.00, indicating no revision to the central valuation outcome.

- Discount Rate: Decreased slightly from 17.10% to approximately 16.90%, modestly increasing the present value of future cash flows.

- Revenue Growth: Effectively unchanged at around 1.88% per year, suggesting stable expectations for top line expansion.

- Net Profit Margin: Essentially flat at about 14.79%, reflecting no material change in long term profitability assumptions.

- Future P/E: Eased slightly from 19.22x to about 19.12x, implying a marginally lower expected valuation multiple on future earnings.

Key Takeaways

- Strategic focus on renewable energy projects and significant infrastructure expansion positions ISA for long-term growth in revenue and market presence in Latin America.

- Investment plans and technological innovations aim to enhance operational efficiency, support profitability, and reinforce shareholder value through disciplined financial management.

- Operational vulnerabilities, regulatory changes, and high debt levels threaten ISA's revenue, liquidity, and growth potential.

Catalysts

About Interconexión Eléctrica E.S.P- Engages in the electric power, roads, and ICT and telecommunications business activities.

- ISA's new projects, particularly in renewable energy connections, such as Porton del Sol and Atlantic photovoltaic, indicate a strategic move towards enabling the energy transition and decarbonizing the energy matrix. This focus is expected to drive increased revenue streams as renewable projects are commissioned and become operational.

- The company achieved a significant milestone of operating almost 50,000 kilometers of transmission lines, consolidating its position as a major player in Latin America. This expansion, along with the entry into new markets like Panama, suggests a potential increase in long-term revenue and earnings.

- With a backlog of COP 26.1 trillion in investments planned from 2025 to 2030, ISA is strategically positioned to capitalize on substantial growth opportunities in energy and infrastructure development, which is likely to enhance future revenue and profitability.

- The implementation of technologies such as smart valves and the first corporate venture, Indigo, aims to optimize network capacity and foster innovation. These developments are expected to improve operational efficiency and potentially expand net margins.

- The financial strategy, including maintaining a debt-to-EBITDA ratio in line with investment-grade ratings and a proposed increase in dividends, highlights ISA's commitment to shareholder value. This fiscal discipline may bolster investor confidence and eventually reflect positively in the company's earnings and stock valuation.

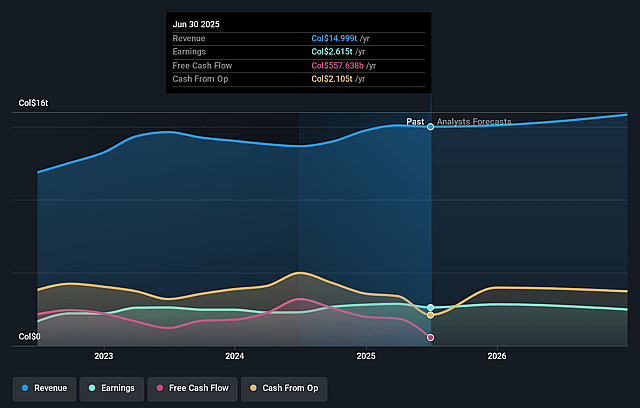

Interconexión Eléctrica E.S.P Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Interconexión Eléctrica E.S.P's revenue will grow by 3.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 17.4% today to 14.4% in 3 years time.

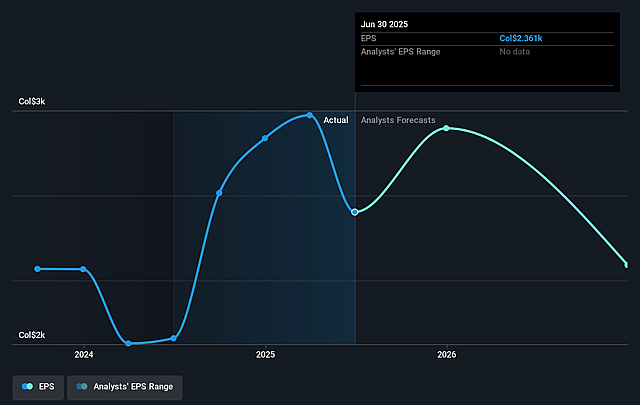

- Analysts expect earnings to reach COP 2403.9 billion (and earnings per share of COP 2170.25) by about September 2028, down from COP 2615.5 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.8x on those 2028 earnings, up from 9.4x today. This future PE is greater than the current PE for the CO Electric Utilities industry at 12.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 16.52%, as per the Simply Wall St company report.

Interconexión Eléctrica E.S.P Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The technical problem in Chile and subsequent power shutdown reveal potential operational vulnerabilities and risk of system disruptions, which can impact ISA's revenue and reputation.

- The company's reliance on awarded projects rather than anticipated plans or bids may limit its growth potential. Failure to win future contracts would affect future revenue streams.

- Regulatory changes, particularly in Colombia, could impact tariff reviews and therefore affect ISA's net margins and revenue stability.

- The high level of debt, despite being aligned with the growth strategy, could strain financials if not managed carefully, especially if revenues do not meet expectations.

- The accounts receivable issue with [indiscernible] and the uncertainties tied to recovering said debts can impact ISA's liquidity and overall financial health.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of COP25750.0 for Interconexión Eléctrica E.S.P based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be COP16641.2 billion, earnings will come to COP2403.9 billion, and it would be trading on a PE ratio of 18.8x, assuming you use a discount rate of 16.5%.

- Given the current share price of COP22180.0, the analyst price target of COP25750.0 is 13.9% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Interconexión Eléctrica E.S.P?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.