Key Takeaways

- Expanding digital platforms, ecosystem integration, and disciplined risk management are boosting cross-selling, revenue growth, and bottom-line stability.

- Earnings diversification, strong capital positions, and regional demand for digital banking support scalable growth and reduced reliance on Chile's economy.

- Economic headwinds, competitive pressures from fintechs, and rising costs may constrain revenue growth, profitability, and flexibility, exposing the bank to sector volatility and earnings risk.

Catalysts

About Banco de Crédito e Inversiones- Provides various banking products and services in Chile, United States, and Peru.

- Ongoing expansion and integration of the EcoRetail ecosystem (Bci, Lider Bci, MACHBANK) and enhanced digital platforms are increasing cross-sell opportunities, driving fee income growth (updated 2025 guidance: 13-15% fee growth), and lowering customer acquisition costs-likely to boost both revenue and net margins.

- City National Bank's (CNB) continued outperformance in deposits and loan growth, alongside the successful execution of its Project WIN strategic plan, is accelerating earnings diversification and NIM expansion (moving toward a 3% medium-term target), decreasing dependence on Chile's economy and supporting consolidated revenue and ROE projections.

- Active portfolio management and risk discipline are resulting in sustained improvement in asset quality (lower NPL ratios, cost of risk trending 0.6–0.7%), enabling capital release and reduced provisioning, which supports higher bottom-line earnings and earnings stability even in a challenging macroeconomic backdrop.

- Robust capital and liquidity positions (CET1 at 11.1%, healthy loan-to-deposit ratios) paired with strategic, long-term technology investments provide the operational flexibility to pursue new growth initiatives and benefit from secular increases in demand for banking, digital payments, and investment services-facilitating scalable earnings growth.

- Rising demand for banking and investment services stemming from middle-class expansion in Chile and Peru, as well as increasing digital adoption and payments volume, underpin Bci's above-system loan growth (notably commercial and SME segments) and strong fee-based income outlook, pointing to sustained revenue growth and improved scale efficiencies.

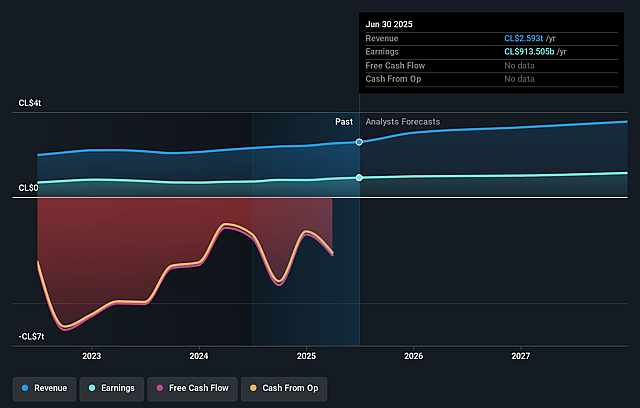

Banco de Crédito e Inversiones Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Banco de Crédito e Inversiones's revenue will grow by 13.6% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 35.2% today to 30.5% in 3 years time.

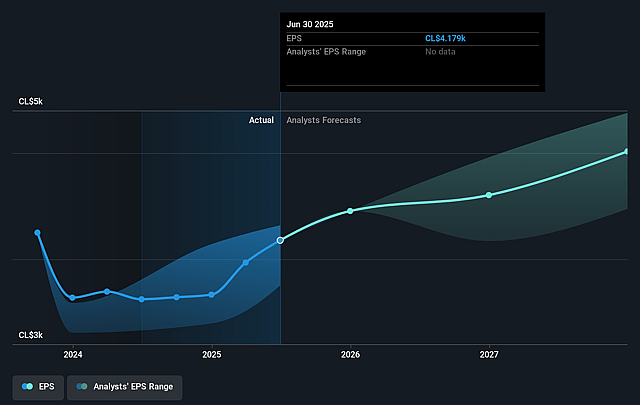

- Analysts expect earnings to reach CLP 1160.1 billion (and earnings per share of CLP 5063.56) by about August 2028, up from CLP 913.5 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.4x on those 2028 earnings, up from 9.3x today. This future PE is greater than the current PE for the CL Banks industry at 9.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.32%, as per the Simply Wall St company report.

Banco de Crédito e Inversiones Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent macroeconomic headwinds in Chile-such as sluggish GDP growth near 2%, high unemployment (8.9%), weak job creation, and elevated inflation (projected at 3.8% for 2025)-may constrain household consumption and moderate credit demand, leading to slower loan and fee income growth and pressuring overall revenues.

- Heavy exposure to the Chilean and regional corporate/SME lending market increases vulnerability to sector-specific economic stresses and trade disruptions (such as new tariffs on Chile's main partners), which could deteriorate loan quality during downturns and drive up non-performing loans and provisioning costs, impacting net margins.

- Intensifying competition from nimble fintechs and alternative digital finance platforms-especially among digitally native, younger clients targeted by MACHBANK-could erode Bci's market share in consumer banking and pressure fee income and net interest margins if digital transformation lags behind more innovative competitors.

- Rising personnel and technology costs, as seen with significant investments in digitalization, ecosystem expansion, and performance incentives, could outpace normalized revenue growth if not carefully managed, potentially compressing operating profitability and efficiency ratios.

- Heightened regulatory complexity and inflation-driven cost increases (such as labor-related laws mandating higher minimum wages and shorter working hours), combined with lingering political uncertainty in Chile, could drive up compliance and operating costs, increase volatility, and limit flexibility in risk management-posing risks to earnings stability and long-term return on equity.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CLP40295.556 for Banco de Crédito e Inversiones based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CLP46000.0, and the most bearish reporting a price target of just CLP29890.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CLP3806.1 billion, earnings will come to CLP1160.1 billion, and it would be trading on a PE ratio of 10.4x, assuming you use a discount rate of 11.3%.

- Given the current share price of CLP38800.0, the analyst price target of CLP40295.56 is 3.7% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.