Key Takeaways

- Persistent dominance in LNG dual-fuel systems and an expanding service network strengthen Accelleron's competitive position and boost recurring revenue from aftermarket and margin-rich segments.

- Strategic capacity expansion near key trade hubs and surging demand in data center power turbochargers drive long-term growth, especially in rapidly modernizing emerging markets.

- Structural headwinds from decarbonization, rapid technology shifts, and rising competition threaten Accelleron's core markets, earnings stability, and long-term profitability.

Catalysts

About Accelleron Industries- Designs, manufactures, sells, and services turbochargers, fuel injection equipment, and digital solutions for heavy-duty applications worldwide.

- Whereas analyst consensus emphasizes growth from the OMC2 and True North Marine acquisitions, it appears to understate the substantial capacity ramp: management targets tripling OMT/OMC2 revenues to $150 million by 2029, and is already exploring further expansions beyond this, implying a potentially much larger, sustained uplift to group top-line growth and earnings than currently anticipated.

- Analyst consensus highlights LNG dual-fuel systems as a transitional driver, but may also be underestimating the persistence and magnitude of this trend: industry structural constraints and slow ramp-up of alternative fuels mean LNG will likely remain the dominant transition fuel well into the 2030s, providing Accelleron with a more durable market share, recurring revenue, and elevated net margins in its highest-profitable segments.

- Accelleron's unique global service network and ability to provide multi-brand servicing-even for competitor products, due to its local inventory and relationships-creates an untapped opportunity to capture aftermarket share beyond its own installed base, increasing service revenues and supporting industry-leading margin resilience.

- Building critical capacity near major growth hubs, including Asia-Pacific and the US, positions Accelleron to capitalize directly on the pronounced long-term rebound and modernization cycle in global maritime trade, particularly as fleet renewal accelerates in emerging markets, fueling both equipment and long-tail service revenue for years to come.

- Explosive growth in AI-driven data center demand could rapidly transform Accelleron's high-speed turbocharger segment, as management expects to again double data center revenues in 2025 and sees robust momentum in decentralized power generation-trends that could lead to outsized revenue acceleration and margin expansion from the currently smaller but fastest-growing business lines.

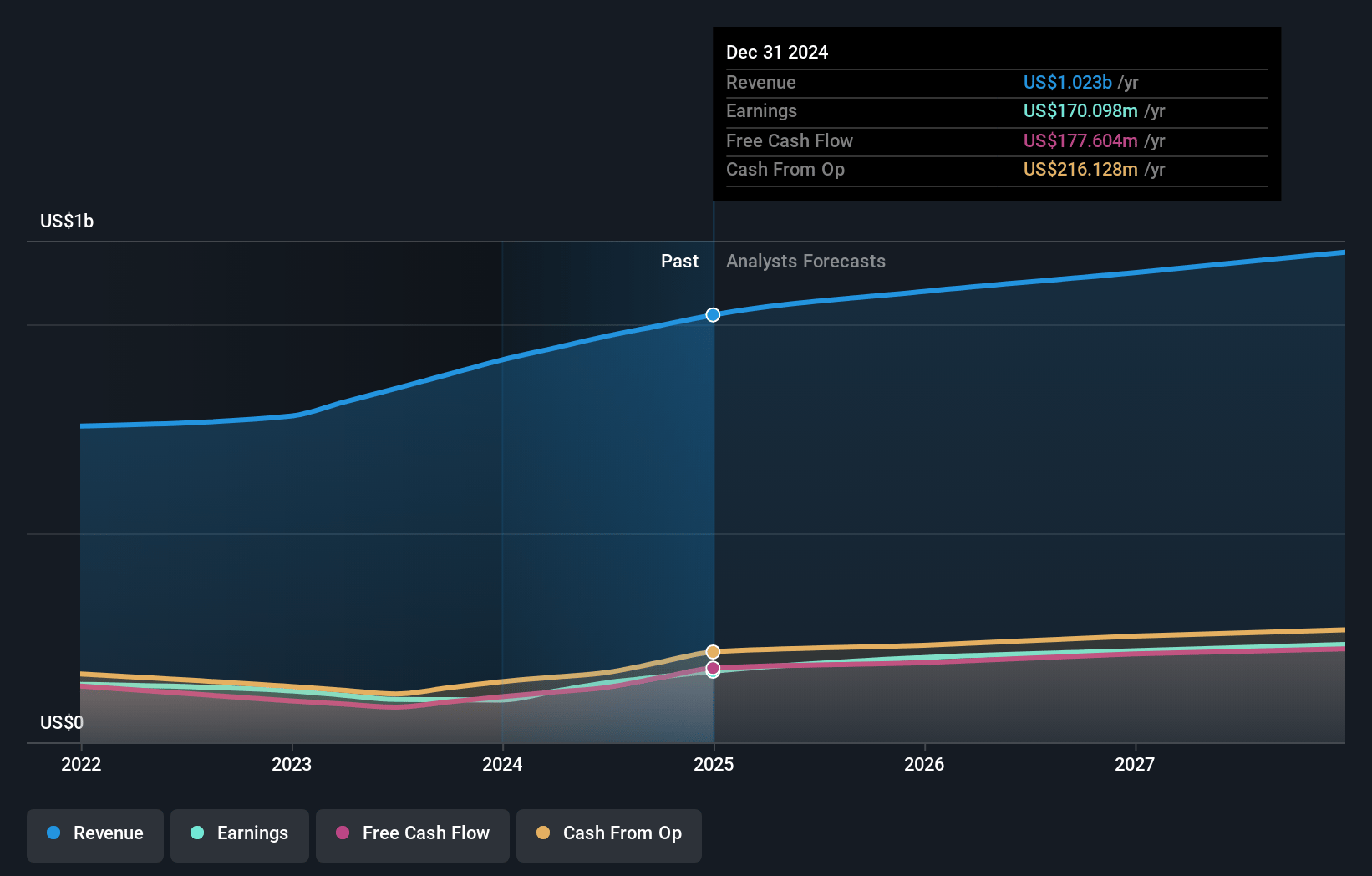

Accelleron Industries Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Accelleron Industries compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Accelleron Industries's revenue will grow by 15.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 16.6% today to 21.7% in 3 years time.

- The bullish analysts expect earnings to reach $345.6 million (and earnings per share of $4.21) by about July 2028, up from $170.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 29.7x on those 2028 earnings, down from 48.2x today. This future PE is greater than the current PE for the CH Electrical industry at 28.6x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.68%, as per the Simply Wall St company report.

Accelleron Industries Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Global decarbonization and stricter international emission regulations are likely to reduce demand for legacy marine propulsion and fossil-fuel-based systems, potentially leading to a structural decline in Accelleron's core market and long-term future revenues.

- The company's business remains highly concentrated in marine and industrial turbocharging, so rapid electrification, adoption of fuel-cell technologies, or significant progress in new zero-carbon fuels could sharply erode Accelleron's addressable market, resulting in revenue contraction and increased earnings volatility.

- Accelleron's heavy reliance on aftermarket service and retrofits-currently accounting for about 75% of revenue-may come under pressure if alternative propulsion technologies require less maintenance or if operational efficiency reduces service intensity, negatively impacting net margins and free cash flow.

- Sustained high capital expenditures and ongoing investment in R&D to remain competitive during the sector's transition may lead to rising costs and put downward pressure on bottom-line earnings if innovation does not deliver sufficient new growth areas.

- The company faces increasing price competition from Asian manufacturers and potential industry consolidation, which could compress margins, erode market share, and undermine both revenue growth and long-term profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Accelleron Industries is CHF74.9, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Accelleron Industries's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CHF74.9, and the most bearish reporting a price target of just CHF37.17.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $1.6 billion, earnings will come to $345.6 million, and it would be trading on a PE ratio of 29.7x, assuming you use a discount rate of 5.7%.

- Given the current share price of CHF70.0, the bullish analyst price target of CHF74.9 is 6.5% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.