Key Takeaways

- Heavy reliance on legacy turbocharging exposes Accelleron to disruptive shifts toward decarbonization, electrification, and stricter emissions regulations.

- Market changes and industry consolidation threaten pricing power, with rising costs and diminished demand putting long-term profitability and margins at risk.

- Strong positioning in clean propulsion, robust recurring revenues from shipyard orders, expanding digital services, and diversified growth shield Accelleron from market volatility and support long-term earnings.

Catalysts

About Accelleron Industries- Designs, manufactures, sells, and services turbochargers, fuel injection equipment, and digital solutions for heavy-duty applications worldwide.

- Despite recent margin expansion, Accelleron remains highly exposed to accelerating global decarbonization and energy transition efforts, which threaten to erode revenue growth and undermine the long-term earnings base as fossil-fuel-related marine and energy markets shrink.

- The company's heavy dependence on legacy turbocharging products for marine and power applications leaves it vulnerable to rapid technology disruption from electrification, fuel-cell advances, and shifting customer demand, posing a risk of declining top-line growth and severe margin compression over the coming decade.

- Intensifying regulatory scrutiny and much tougher international emissions standards, such as those from the IMO and EU, are likely to force heavy and sustained investment in research and development while threatening to render substantial portions of Accelleron's existing installed base and product portfolio obsolete, thereby squeezing net margins and depressing future profitability.

- Rising global interest rates and persistent high cost of capital may significantly constrain capital spending by shipping and power customers, leading to project cancellations, lower capital expenditures, and subdued demand for both new installations and services-pressuring both revenue growth and high-margin aftermarket earnings.

- Industry consolidation among OEMs and shipbuilders, as well as the migration of manufacturing to lower-cost regions, could reduce Accelleron's pricing power and turn turbocharger products into increasingly commoditized offerings, seriously limiting long-term revenue and endangering high EBITDA margins the company currently enjoys.

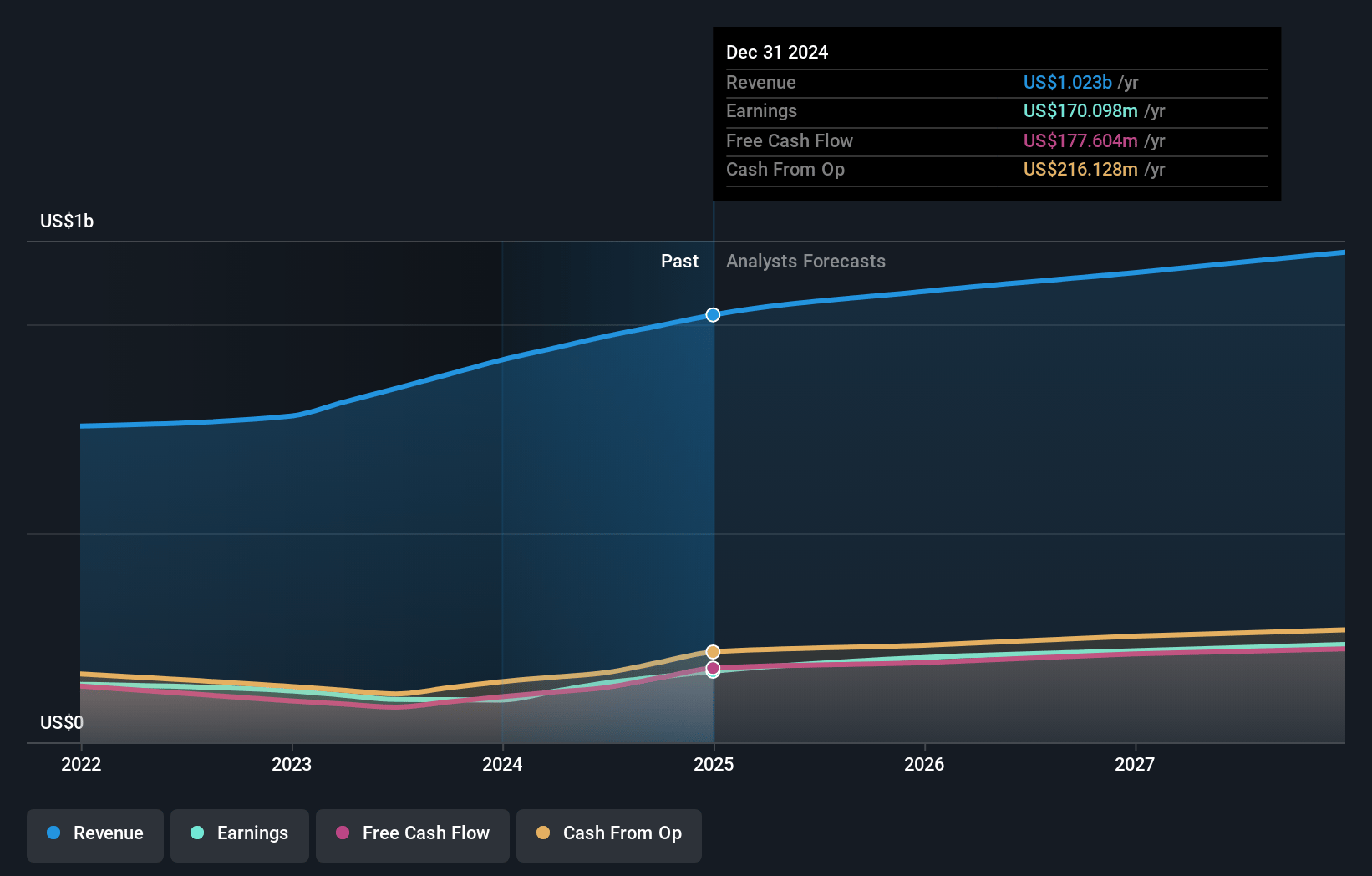

Accelleron Industries Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Accelleron Industries compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Accelleron Industries's revenue will grow by 4.3% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 16.6% today to 20.8% in 3 years time.

- The bearish analysts expect earnings to reach $240.9 million (and earnings per share of $2.58) by about July 2028, up from $170.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 21.1x on those 2028 earnings, down from 48.2x today. This future PE is lower than the current PE for the CH Electrical industry at 28.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.67%, as per the Simply Wall St company report.

Accelleron Industries Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerating global trend toward decarbonization and stricter emissions standards is driving persistent demand for energy-efficient turbocharging and low-emission technologies, and Accelleron's sustained investments in R&D have positioned the company as a leader in clean propulsion, which supports continued revenue and market share growth.

- Full shipyard order books until 2029–2030, particularly for dual-fuel and LNG-capable vessels-where Accelleron has achieved market shares of 65% in low speed, 80% in medium speed, and over 90% with LNG carriers-creates a multi-year installed base that will drive long-term aftermarket service revenues and contribute to stable net margin expansion.

- The rapid growth of global data centers, with data center energy demand in the U.S. expected to reach up to 12% of national electricity consumption, underpins increasing demand for high-speed turbochargers for backup and decentralized power, providing a robust new growth opportunity that will bolster revenues and earnings.

- Accelleron's transformation from a transactional service provider to a recurring Availability-as-a-Service model, coupled with expansion in digital solutions and predictive maintenance offerings, is set to increase high-margin recurring revenue streams and strengthen long-term EBITDA and cash flow generation.

- Geographic and product diversification, supported by organic and bolt-on acquisitions in emerging markets and adjacent technologies (e.g., fuel injection, digital), shields the company from regional downturns and cyclical volatility while enabling continued top-line and free cash flow growth over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Accelleron Industries is CHF37.17, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Accelleron Industries's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CHF74.9, and the most bearish reporting a price target of just CHF37.17.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $1.2 billion, earnings will come to $240.9 million, and it would be trading on a PE ratio of 21.1x, assuming you use a discount rate of 5.7%.

- Given the current share price of CHF70.0, the bearish analyst price target of CHF37.17 is 88.3% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.