Last Update 19 Mar 25

Fair value Decreased 0.60%Key Takeaways

- Increased sales force and new software management tools are set to propel revenue growth and customer base expansion in the U.S.

- Strategic focus on cloud, security, and AI offerings enhances revenue prospects alongside deeper vendor partnerships to boost profit margins.

- Slower demand, higher operational expenses, and potential policy changes could pressure Softchoice's margins, revenue stability, and growth, especially in hardware and Microsoft partnerships.

Catalysts

About Softchoice- Designs, procures, implements, and manages information technology (IT) solutions in Canada and the United States.

- Softchoice's significant investment in expanding its sales force by 43% over the past three years, including an 18% increase in the past year alone, is expected to drive revenue growth by acquiring new customers and expanding the customer base in the United States.

- The launch of the proprietary SAM+ Hub, a self-serve centralized subscription software management tool, positions Softchoice to capture a larger share of customer spend and drive additional software revenue. This innovation could lead to increased revenue streams as it encourages consolidation of more software titles through Softchoice.

- Strong partnerships and incentives from major vendors, particularly Microsoft, continue to enhance Softchoice's gross profit margins. The transition toward Microsoft's CSP licensing model is anticipated to provide more stable and resilient recurring revenue, which could support earnings growth.

- Continued growth in high-margin services offerings, driven by investments in technical capabilities and advanced consulting services in areas like AI, could boost Softchoice's net margins. Increasing service engagement across the customer base suggests opportunities for higher profitability.

- Strategic focus on expanding offerings in high-growth areas such as cloud, security, and AI, positions Softchoice for significant future revenue growth and improved earnings driven by demand for automation and cybersecurity solutions amidst rising AI threats.

Softchoice Future Earnings and Revenue Growth

Assumptions

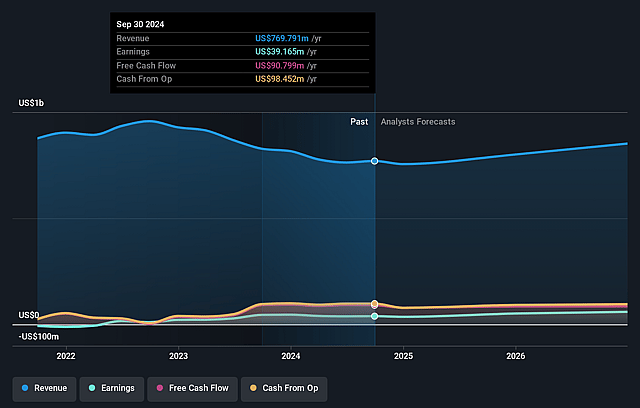

How have these above catalysts been quantified?- Analysts are assuming Softchoice's revenue will grow by 4.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.1% today to 8.0% in 3 years time.

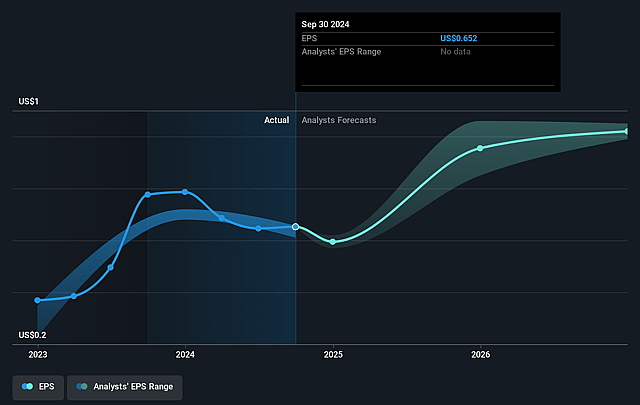

- Analysts expect earnings to reach $70.3 million (and earnings per share of $1.25) by about March 2028, up from $39.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.3x on those 2028 earnings, down from 26.1x today. This future PE is lower than the current PE for the CA Electronic industry at 21.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.48%, as per the Simply Wall St company report.

Softchoice Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Softchoice's adjusted EBITDA growth was only 2% for the quarter, which was impacted by higher variable compensation and growth investments. This might indicate pressure on net margins due to increased operational expenses.

- The company noted a slower demand environment in certain markets, potentially affecting revenue growth and overall earnings if these conditions persist.

- Hardware component, which still comprises a part of their business, may face headwinds, as reflected in the caution around forecasting Q4 seasonality and the emphasis on hardware's reduced contribution, impacting revenue stability.

- Uncertainty surrounding external factors like potential changes in tariffs, mentioned in the context of White House policy changes, could affect the cost structure and thus impact net margins and profitability.

- The current headwinds faced by peers in Microsoft incentive revenues could pose a risk to Softchoice if similar conditions impact their extensive partnership, potentially affecting their revenue streams and growth potential with Microsoft products.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$24.915 for Softchoice based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $881.0 million, earnings will come to $70.3 million, and it would be trading on a PE ratio of 18.3x, assuming you use a discount rate of 7.5%.

- Given the current share price of CA$24.48, the analyst price target of CA$24.92 is 1.7% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Softchoice?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.