Last Update 17 Apr 25

Key Takeaways

- Operational enhancements and strategic investments in new technologies are set to boost efficiency, reduce costs, and increase earnings.

- Strategic initiatives, including new market opportunities and tariff management, are expected to enhance market resilience and drive sustainable revenue growth.

- Potential tariffs and duties, market reliance, economic volatility, asset sales, and operational risks pose significant challenges to Western Forest Products' revenue and profitability.

Catalysts

About Western Forest Products- Operates as an integrated softwoods forest products company in Canada, the United States, Japan, China, Europe, and internationally.

- The successful commissioning of new equipment, such as the first continuous dry kiln and automated grading equipment supported by AI, is expected to enhance operational efficiency, leading to a significant reduction in production costs and an increase in gross margins and earnings.

- The company anticipates improvements in the demand and pricing for North American cedar products and industrial lumber products, suggesting a positive trend for revenue growth throughout 2025.

- Western Forest Products is exploring opportunities in thermally modified hemlock, which could create new revenue streams and add significant value to their timber assets, thereby enhancing earnings over time.

- Strategic partnerships and asset sales have strengthened the balance sheet, reducing debt and improving liquidity, which can support future capital investments to drive long-term growth in earnings.

- The development of plans to manage and potentially capitalize on U.S. tariff changes demonstrates a proactive approach to maintaining net margins and stabilizing pricing, creating resilience in earnings projections.

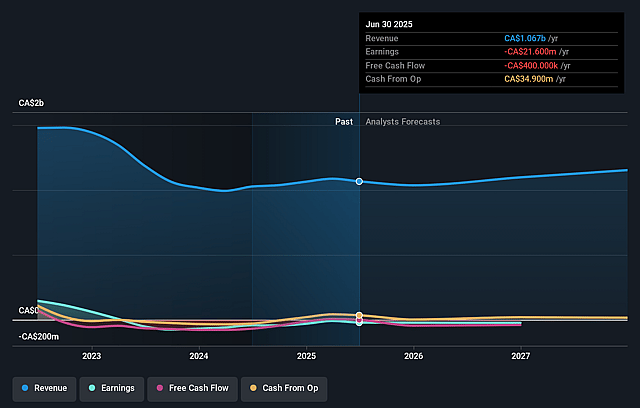

Western Forest Products Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Western Forest Products's revenue will grow by 6.3% annually over the next 3 years.

- Analysts are not forecasting that Western Forest Products will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Western Forest Products's profit margin will increase from -2.9% to the average CA Forestry industry of 12.8% in 3 years.

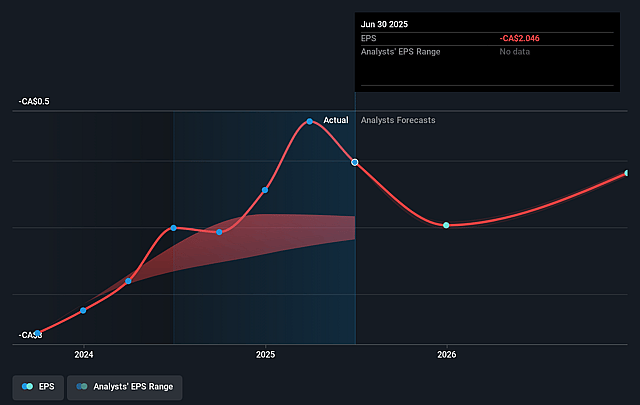

- If Western Forest Products's profit margin were to converge on the industry average, you could expect earnings to reach CA$164.1 million (and earnings per share of CA$0.52) by about April 2028, up from CA$-30.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 1.5x on those 2028 earnings, up from -4.0x today. This future PE is lower than the current PE for the CA Forestry industry at 13.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.42%, as per the Simply Wall St company report.

Western Forest Products Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The potential implementation of a new 25% tariff on Canadian goods exported to the U.S., in addition to the existing 14.4% softwood lumber duties, could significantly impact Western Forest Products' revenue and profitability by possibly reducing export volumes or forcing the company to absorb additional costs if they cannot fully pass these costs onto consumers.

- The company's reliance on the North American market, particularly through the softwood lumber dispute, poses a risk to revenue stability, especially if demand elasticity prevents the full pass-through of tariffs and duties to their customers.

- There's uncertainty and potential volatility in the company's key markets, including Japan and China. Economic factors such as currency fluctuations and slowed construction activity could impact sales and net margins in these regions.

- The company's strategy of selling noncore assets, while currently beneficial for reducing debt, may result in reduced future revenue streams from these assets or limit the company’s ability to generate cash flow from diversified sources.

- Operational risks related to weather and external supply factors (such as log supply interruptions during winter) could affect timber harvesting and manufacturing operations, thereby impacting overall revenue and possibly leading to increased operational costs.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$0.588 for Western Forest Products based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$0.7, and the most bearish reporting a price target of just CA$0.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CA$1.3 billion, earnings will come to CA$164.1 million, and it would be trading on a PE ratio of 1.5x, assuming you use a discount rate of 10.4%.

- Given the current share price of CA$0.38, the analyst price target of CA$0.59 is 35.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Western Forest Products?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.