Key Takeaways

- Expanded silver output, operational improvements, and index inclusion support revenue growth, margin gains, and increased investor visibility amid strengthening demand for silver.

- Enhanced balance sheet flexibility and sustained cost optimization position the company to capitalize on higher silver prices and market volatility.

- Persistent cost pressures, operational risks, and geographic concentration threaten profitability and future growth, while reliance on high-grade discoveries could drive share price volatility and possible dilution.

Catalysts

About Americas Gold and Silver- Engages in the exploration, development, and production of mineral properties in the Americas.

- A major ramp-up in silver production is expected in the coming quarters as the EC120 project at Cosalá reaches full commercial output and new high-grade zones at Galena (such as the 034 vein and core mine area) are developed, positioning the company to benefit from rising global demand driven by the accelerating transition to renewable energy and electrification, which should boost revenue growth.

- Recent operational investments-modernized mining fleet, expanded underground access, and focused drilling-are expected to unlock higher-grade production and increase operational efficiency, improving operating leverage and potentially reducing all-in sustaining costs, positively impacting net margins.

- Streamlined balance sheet management through significant liability reduction, debt refinancing, and convertible debenture conversion increases financial flexibility and resilience, allowing the company to better withstand market volatility and paving the way for enhanced long-term earnings and free cash flow.

- Inclusion in major silver and gold mining indices (such as SIL and the potential future inclusion in GDXJ) is increasing institutional investor visibility and ownership, which may facilitate access to more attractively priced capital and support share price appreciation as the company delivers on its growth initiatives, ultimately impacting equity valuation.

- Ongoing focus on operational optimization and cost reductions alongside tightening global silver supply (due to underinvestment in new projects) positions Americas Gold and Silver to capitalize on higher commodity prices that result from sustained deficits, boosting both top-line revenues and net profitability as underlying secular trends in industrial and emerging market demand play out.

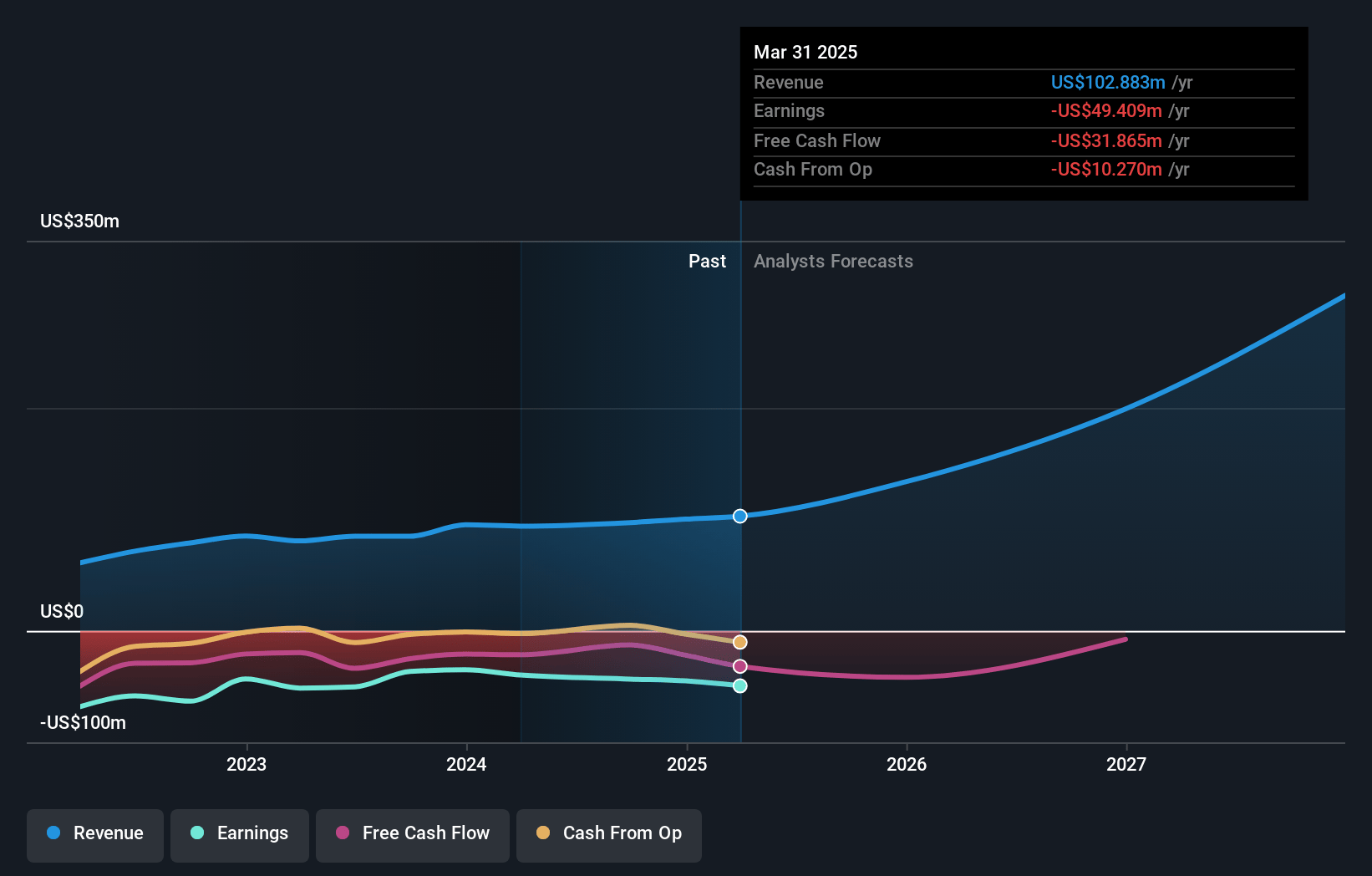

Americas Gold and Silver Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Americas Gold and Silver's revenue will grow by 45.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from -48.0% today to 27.0% in 3 years time.

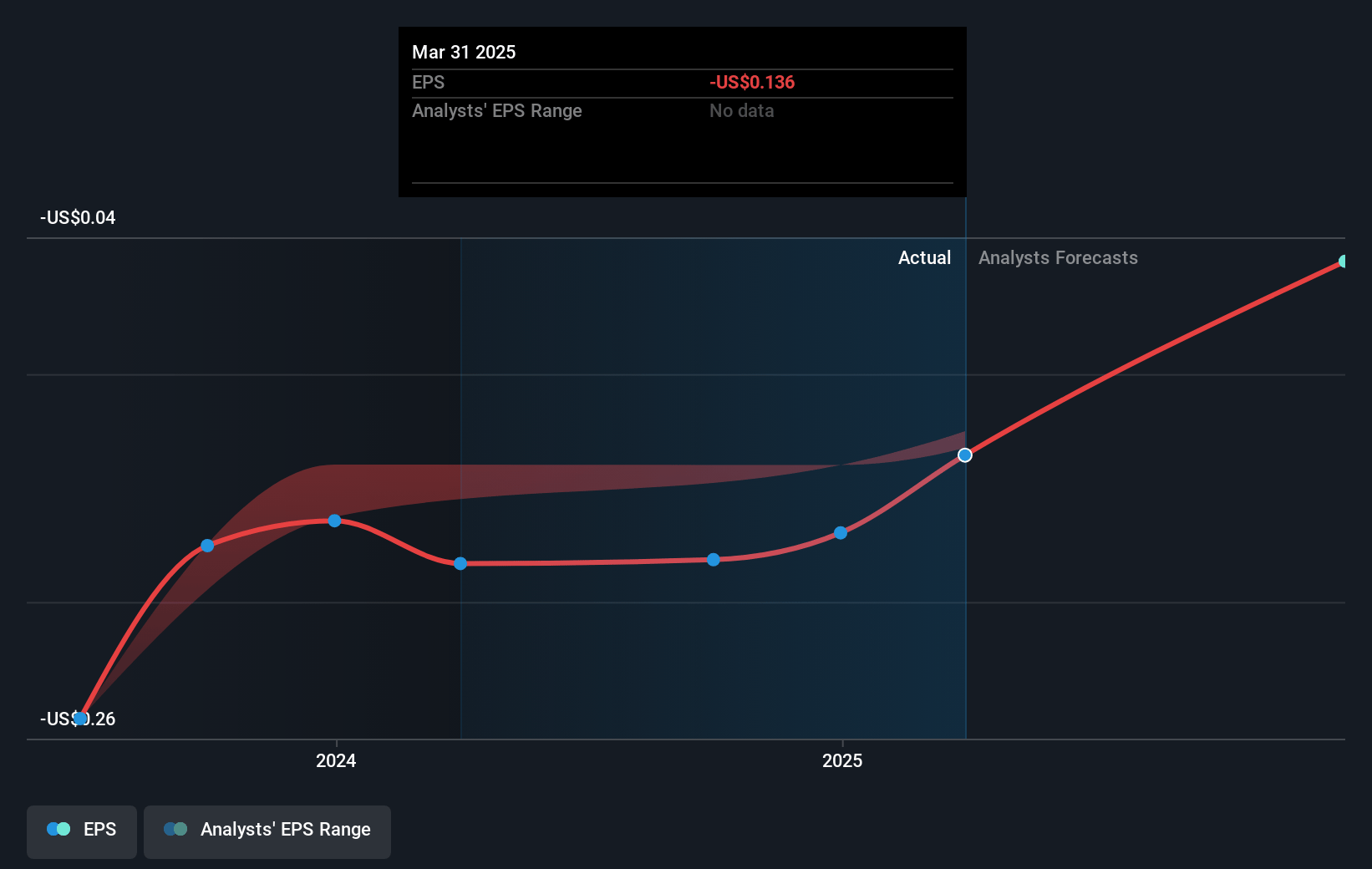

- Analysts expect earnings to reach $86.3 million (and earnings per share of $0.13) by about June 2028, up from $-49.4 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.3x on those 2028 earnings, up from -11.0x today. This future PE is lower than the current PE for the CA Metals and Mining industry at 15.5x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.5%, as per the Simply Wall St company report.

Americas Gold and Silver Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Despite higher realized metal prices driving a 12% revenue increase, Americas Gold and Silver continues to report significant net losses ($19 million in Q1 2025 vs. $16 million prior year), highlighting ongoing profitability challenges that could pressure net margins and long-term earnings.

- The company's all-in sustaining costs ($35.67 per silver ounce) remain above current realized silver prices ($32 per ounce), signaling persistent cost pressures that could undermine margin improvement and place downward pressure on future earnings if silver prices weaken.

- A significant component of near-term growth is dependent on successful ramp-up and optimization of new production areas (e.g. EC120 at Cosalá and the 034 vein at Galena), which are subject to typical operational risks, development delays, or grade variability-posing threats to meeting production targets and projected revenue growth.

- The company's operations are geographically concentrated in regions (Mexico, Galena in the US) that are subject to potential geopolitical risks, regulatory changes, and cost inflation pressures (e.g., labor and energy), which could erode operating profitability or expose the company to sudden increases in costs, negatively impacting net margins and sustainable cash flow.

- While recent financing and index inclusions have improved balance sheet flexibility and investor visibility, the heavy reliance on high-grade discoveries, tightly held shares, and institutional support could expose the share price to volatility should operational setbacks occur or if sustained losses persist-potentially necessitating further dilution or debt and adversely affecting shareholder value and future equity pricing.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$1.75 for Americas Gold and Silver based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$2.0, and the most bearish reporting a price target of just CA$1.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $319.5 million, earnings will come to $86.3 million, and it would be trading on a PE ratio of 14.3x, assuming you use a discount rate of 6.5%.

- Given the current share price of CA$1.14, the analyst price target of CA$1.75 is 34.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.