Last Update 15 Dec 25

NGD: Revenue Will Rise As $4,500 Gold Supports Continued Outperformance

Analysts have modestly raised their price target on New Gold, reflecting slightly higher long term valuation multiples and updated precious metal price forecasts that support a fair value of approximately C$15.12 per share.

Analyst Commentary

Recent research notes highlight a constructive backdrop for New Gold, with multiple price target increases reflecting stronger long term commodity assumptions and improved company specific execution.

Bullish Takeaways

- Bullish analysts have raised their price targets, signaling increased confidence that New Gold can sustain higher earnings power and justify a premium to prior valuation multiples.

- Upward revisions to long term gold and silver price forecasts support a more favorable revenue and cash flow outlook and bolster the case for multiple expansion over the next several years.

- Maintained positive stock ratings alongside higher targets suggest that recent operational performance is viewed as aligned with, or modestly ahead of, prior expectations for growth and execution.

- Higher projected metal prices into 2026 and 2027 provide a longer runway for balance sheet strengthening and potential reinvestment in growth projects, which underpins a higher fair value range.

Bearish Takeaways

- Bearish analysts caution that part of the recent target hikes represent a catch up to year to date share price strength, which implies more limited upside from current levels.

- There is sensitivity to commodity price assumptions, with valuation still heavily dependent on achieving elevated gold and silver prices through 2026 and beyond.

- Execution risks, including potential cost inflation and project delivery timelines, could pressure margins and limit the extent to which higher metal prices translate into incremental free cash flow.

- After a strong run in both gold prices and the stock, any disappointment in macro conditions or company specific performance could prompt a reassessment of the more optimistic target levels.

What's in the News

- Coeur Mining agreed to acquire New Gold in an all stock transaction valuing New Gold at approximately $6.8 billion. The deal implies $8.51 per share and would leave New Gold shareholders with about 38% of the combined company, with closing targeted for the first half of 2026 (M&A Transaction Announcements).

- New Gold reaffirmed its 2025 production guidance, expecting total gold output of 325,000 to 365,000 ounces. The company anticipates New Afton at the midpoint and Rainy River above the midpoint of their respective ranges, and copper production at the midpoint of 50 to 60 million pounds (Corporate Guidance).

- The company reported third quarter 2025 production of 115,213 ounces of gold and 12.0 million pounds of copper, with year to date gold output rising to 245,994 ounces compared with 217,865 ounces a year earlier (Announcement of Operating Results).

- Management indicated New Gold is actively evaluating acquisitions while prioritizing a strong balance sheet, organic growth, and disciplined capital allocation focused on per share value creation (Seeking Acquisitions/Investments).

Valuation Changes

- Fair Value: Unchanged at approximately CA$15.12 per share, indicating no material shift in the underlying intrinsic value estimate.

- Discount Rate: Risen slightly from about 7.21% to 7.27%, reflecting a modest increase in perceived risk or required return.

- Revenue Growth: Effectively unchanged at around 14.07% annually, suggesting a stable outlook for top line expansion.

- Net Profit Margin: Essentially flat at approximately 39.30%, indicating no meaningful revision to long term profitability expectations.

- Future P/E: Risen modestly from about 14.57x to 14.81x, implying a slightly higher valuation multiple applied to forward earnings.

Key Takeaways

- Increased production efficiency, resource expansion, and copper exposure are driving higher margins, revenue diversification, and long-term growth potential.

- Ongoing cost reductions and disciplined capital management are strengthening financial flexibility and positioning the company for improved shareholder returns.

- Heavy dependence on maturing assets, high costs, significant capital demands, and execution risks threaten long-term production stability, earnings sustainability, and financial flexibility.

Catalysts

About New Gold- An intermediate gold mining company, engages in the development and operation of mineral properties in Canada.

- Ramp-up of higher-grade ore production at both Rainy River (open pit and underground) and New Afton (C-Zone block cave), supported by strong operational execution and milestones achieved, is expected to drive increased gold and copper output at lower unit costs, directly improving revenue and net margins over the next 2–3 years.

- Ongoing advancement and investment in exploration and resource expansion at both sites (especially the K-Zone at New Afton and Northwest trend at Rainy River) position the company for resource conversion and future reserve replacement, supporting sustained long-term production growth and earnings.

- Successful consolidation of 100% interest in New Afton, combined with higher copper exposure and the broader global push towards electrification, increases participation in a commodity with structurally rising demand, enhancing revenue diversification and supporting higher cash flows.

- Consistent progress on cost-reduction and operational efficiency initiatives, evidenced by declining all-in sustaining costs and record free cash flow, are boosting overall operational margins and positioning the company to benefit disproportionately from persistent high gold prices due to heightened geopolitical tensions and inflationary pressures.

- Execution of a disciplined capital allocation strategy-including significant debt reduction, careful management of expansion capital, and a shift towards potential shareholder returns as free cash flow inflects-will increase financial flexibility, reduce interest expense, and improve both earnings and the company's valuation multiples.

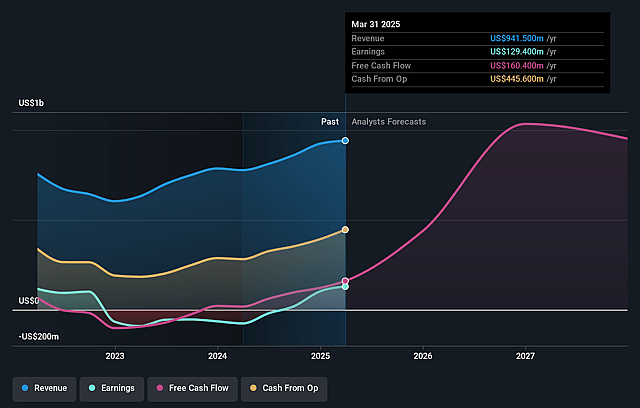

New Gold Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming New Gold's revenue will grow by 33.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 14.0% today to 45.1% in 3 years time.

- Analysts expect earnings to reach $1.1 billion (and earnings per share of $0.84) by about September 2028, up from $144.9 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 5.5x on those 2028 earnings, down from 33.6x today. This future PE is lower than the current PE for the US Metals and Mining industry at 18.0x.

- Analysts expect the number of shares outstanding to grow by 0.1% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.67%, as per the Simply Wall St company report.

New Gold Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing reliance on Rainy River and New Afton as core assets-with Rainy River expected not to fully replace all mined reserves and New Afton's C-Zone starting with lower-than-average grades-raises long-term risks of declining production volumes and resource depletion if exploration does not yield significant new discoveries, potentially impacting future revenue and earnings.

- Sustained high all-in sustaining costs at Rainy River ($1,696/oz in Q2 2025) and overall costs that, while improving, remain vulnerable to even modest gold price declines or inflationary pressures, may erode net margins if commodity prices weaken or operational efficiency initiatives stall, impacting net income and financial flexibility.

- Significant capital expenditures for growth (e.g., C-Zone development, ongoing underground expansion at Rainy River, and $30 million in exploration spend for 2025) combined with a need to pay down drawn credit facilities and gold prepayment obligations may constrain free cash flow and limit the company's ability to return capital to shareholders or invest in new opportunities, negatively affecting net earnings and liquidity.

- Execution risk remains elevated around the ramp-up of New Afton's C-Zone and the underground expansion at Rainy River, where any project delays, cost overruns, or technical challenges in mine development could disrupt planned production increases and delay cash flow inflection points, thus impacting revenue and earnings reliability.

- Despite strong exploration activity, any failure to materially expand reserves (especially at Rainy River, where full reserve replacement in 2025 is not expected) would heighten long-term exposure to industry-wide challenges of reserve depletion, higher exploration costs, and declining ore grades-ultimately pressuring future revenues and the sustainability of earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$8.782 for New Gold based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.5 billion, earnings will come to $1.1 billion, and it would be trading on a PE ratio of 5.5x, assuming you use a discount rate of 6.7%.

- Given the current share price of CA$8.49, the analyst price target of CA$8.78 is 3.3% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on New Gold?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.