Last Update 22 Nov 25

Top Risks Assessment

🔥 Critical Risks

- Dilution risk (Highest risks, but their got proven team)

- Debenture share settlement. Repeated financing rounds. Lomero CAPEX will almost certainly require major equity. If Zancudo misses 6 months of planned production →They must raise capital → dilution → weakens ability to finance Lomero → share price collapse.

- Lomero PEA Delay (Non issue until 2030)

- No engineering = no CAPEX/AISC certainty

- This is the single biggest risk to your valuation

- Polymetallic metallurgy: Cu-Pb-Zn-Au-Ag flowsheets are complex

- Regulatory complexity (Low)

- Spain permitting → slow

- Colombia → community & licensing risk

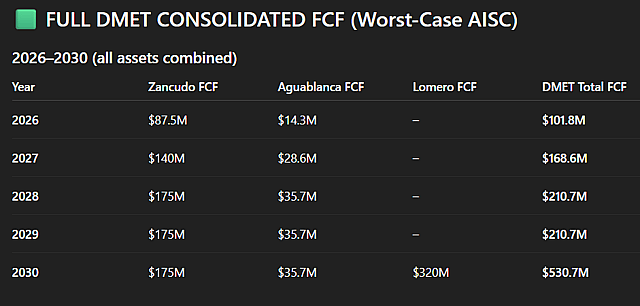

>>> In my view: The main problem is their capex & dilution. But, they will generate around 100M+ FCF by 2027. So, they might not dilute more after this. Just, the CEO said they might dilute some more (if there's possibility) to be use for exploration purpose for LOMERO. As he believe it will eventually reduce gold production price in the ground, but we'll see.

Key Assumptions:

- Resource Totals (2023 Updated Resource):

- Gold: 700,000 oz (Lomero-Poyatos).

- Silver: 7 million oz (Lomero-Poyatos).

- Base Metals (simplified equivalent values):

- Copper: 105M lbs.

- Lead: 96M lbs.

- Zinc: 240M lbs.

- Metal Prices:

- Gold: $4,000/oz.

- Silver: $100/oz.

- Copper: $4/lb.

- Lead: $1/lb.

- Zinc: $1.5/lb.

- Recovery Rate: Assume 80% recovery for all metals.

- Market Cap to Resource Multiple: Assume a conservative 10x FCF multiple.

Step 1: Revenue Estimation (from Lomero-Poyatos)

1. Gold Revenue:

- Recoverable Gold = 700,000 oz × 80% = 560,000 oz.

- Revenue from Gold = 560,000 × $4,000 = $2.24 billion.

2. Silver Revenue:

- Recoverable Silver = 7M oz × 80% = 5.6M oz.

- Revenue from Silver = 5.6M × $100 = $560 million.

3. Copper Revenue:

- Recoverable Copper = 105M lbs × 80% = 84M lbs.

- Revenue from Copper = 84M × $4 = $336 million.

4. Lead Revenue:

- Recoverable Lead = 96M lbs × 80% = 76.8M lbs.

- Revenue from Lead = 76.8M × $1 = $76.8 million.

5. Zinc Revenue:

- Recoverable Zinc = 240M lbs × 80% = 192M lbs.

- Revenue from Zinc = 192M × $1.5 = $288 million.

Total Revenue:

- Total Revenue = $2.24B (gold) + $560M (silver) + $336M (copper) + $76.8M (lead) + $288M (zinc) = $3.5 billion.

Step 2: Free Cash Flow (FCF) Calculation

Assume an AISC of $1,200 for gold equivalent production:

- Recoverable Gold Equivalent Ounces (AGEQ):

- Using gold as the baseline:

- Silver: 5.6M oz ÷ 40 = 140K AGEQ oz.

- Copper: $336M ÷ $4,000 = 84K AGEQ oz.

- Lead: $76.8M ÷ $4,000 = 19.2K AGEQ oz.

- Zinc: $288M ÷ $4,000 = 72K AGEQ oz.

- Total AGEQ = 560K + 140K + 84K + 19.2K + 72K = 875.2K AGEQ oz.

- Using gold as the baseline:

- FCF Calculation:

- Revenue per oz = $4,000 (gold price).

- Costs per oz = $1,200 (AISC).

- Margin per oz = $4,000 - $1,200 = $2,800.

- Total FCF = 875.2K × $2,800 = $2.45 billion.

Step 3: Market Cap Valuation

Using a 10x FCF multiple:

- Market Cap = $2.45 billion × 10 = $24.5 billion.

Step 4: Stock Price Calculation

Assume 100M shares outstanding (adjust based on actual data):

- Stock Price = Market Cap ÷ Shares Outstanding = $24.5 billion ÷ 100M = $245 per share.

Conclusion:

If gold reaches $4,000/oz and silver reaches $100/oz, Denarius Metals could potentially reach a stock price of $245 per share, assuming successful production, consistent costs, and no major obstacles in mining or permitting.

Have other thoughts on Denarius Metals?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

The user RockeTeller has a position in NEOE:DMET. Simply Wall St has no position in any of the companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The author of this narrative is not affiliated with, nor authorised by Simply Wall St as a sub-authorised representative. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimates are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.