Last Update 06 Dec 25

Fair value Decreased 2.29%PRL: Tighter Underwriting Will Support Asset Quality And Future Share Price Upside

Analysts have trimmed their price target on Propel Holdings by C$1 to C$36.39, citing slightly softer growth, modestly lower profitability expectations, and a marginally higher discount rate, even as they remain constructive on the company’s long term outlook.

Analyst Commentary

Analyst updates following the latest results reflect a recalibration of expectations rather than a shift in the underlying positive thesis on Propel Holdings.

Bullish Takeaways

- Bullish analysts continue to maintain positive ratings despite lower price targets, which signals confidence in the company’s long term growth prospects and execution capability.

- Some see recent share price weakness as a potential entry point. This suggests the risk reward profile remains attractive relative to revised valuation levels.

- The tightening of underwriting standards is viewed as a prudent response to heightened delinquencies. This could support asset quality and earnings durability over time.

- Price targets, though reduced, still sit materially above current levels. This implies upside potential if management delivers on growth and margin improvement initiatives.

Bearish Takeaways

- Bearish analysts highlight that softer Q3 performance and elevated credit costs have reduced near term earnings visibility. This is viewed as warranting lower valuation multiples.

- Successive cuts to price targets suggest growing caution around the pace of growth, particularly if tighter underwriting constrains origination volumes.

- Heightened delinquencies introduce greater execution risk, as management must balance risk control with maintaining scale and profitability.

- The narrowing spread between previous and current target prices reflects concerns that the company may face a more challenging macro and credit environment than previously anticipated.

What's in the News

- Received regulatory approval from Puerto Rico's Office of the Commissioner of Financial Institutions to establish Propel International Bank Inc., an International Financial Entity that will expand its consumer lending platform and enable potential product and market diversification (Key Developments).

- Announced a new partnership with Column N.A. to launch Freshline, an unsecured personal loan product under the CreditFresh brand and ForwardFlow business, targeting underserved U.S. consumers in new geographies from Q1 2026 (Key Developments).

- Board authorized a new share buyback plan on November 12, 2025, together with a normal course issuer bid allowing repurchase of up to 2,703,439 shares, or 6.86% of issued share capital, through November 13, 2026, with all repurchased shares to be cancelled (Key Developments).

- Continued executing on its prior buyback program, repurchasing 15,000 shares for CAD 0.32 million between October 1 and November 10, 2025, completing the tranche under the November 7, 2024 authorization (Key Developments).

- Reiterated 2025 earnings guidance, expecting results to remain in line with previously communicated revenue and net income margin targets, and declared a quarterly dividend of CAD 0.2100 per share payable December 4, 2025 (Key Developments).

Valuation Changes

- Fair Value: Trimmed slightly from CA$37.24 to CA$36.39, reflecting modestly softer growth and profitability assumptions.

- Discount Rate: Increased marginally from 7.94% to 7.97%, indicating a slightly higher perceived risk profile or required return.

- Revenue Growth: Lowered slightly from 25.92% to 25.39%, pointing to a small downgrade in expectations for top line expansion.

- Net Profit Margin: Reduced modestly from 14.51% to 14.04%, signaling a minor recalibration of long-term profitability.

- Future P/E: Edged up from 8.15x to 8.50x, implying a slightly higher valuation multiple on revised forward earnings estimates.

Key Takeaways

- AI-powered risk assessment and digital adoption are boosting operational efficiencies, supporting strong credit performance and sustained revenue growth.

- Geographic expansion, product diversification, and scaling of Lending-as-a-Service are reducing risk exposure and driving more stable, diversified earnings.

- Intensifying competition, regulatory uncertainties, credit risk exposure, and rising operational costs threaten profitability and market position if growth initiatives fail to offset these pressures.

Catalysts

About Propel Holdings- Operates as a financial technology company.

- The ongoing tightening of traditional bank credit and increased rejection rates among mainstream lenders is pushing more high-quality consumers toward alternative credit sources like Propel, expanding their addressable market and directly supporting robust originations and revenue growth.

- Propel's continued investment and advancements in AI-powered risk assessment and automation are delivering both improved credit performance and increasing operational efficiencies, which are expected to drive future margin expansion and higher net income as the company scales.

- Acceleration of digital adoption, expanded smartphone usage, and persistent changes in employment patterns-such as growth in the gig economy-are sustaining and increasing demand for Propel's online and app-based credit products, likely supporting long-term top line growth.

- Expansion into new geographies (notably the U.K.) and diversified product offerings, along with a growing pipeline of business development initiatives and fintech partnerships, are set to widen revenue streams, reduce exposure to single-market risk, and smooth earnings volatility.

- Scaling of the Lending-as-a-Service business is expected to materially increase revenue and margin contribution, with the company signaling that this line will more than double into 2026, further supported by high partner satisfaction, strong capital availability, and improved operating leverage.

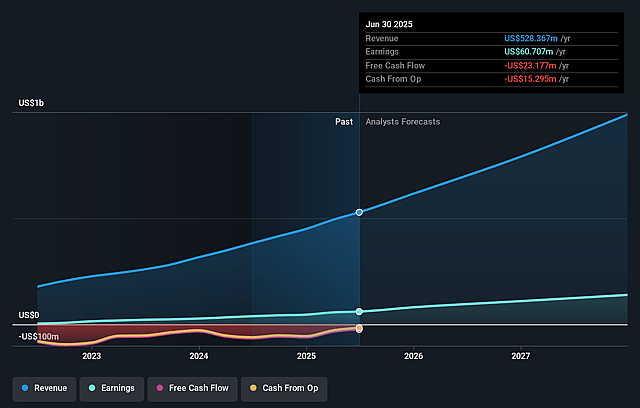

Propel Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Propel Holdings's revenue will grow by 28.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 11.5% today to 14.8% in 3 years time.

- Analysts expect earnings to reach $163.9 million (and earnings per share of $3.32) by about September 2028, up from $60.7 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.6x on those 2028 earnings, down from 15.0x today. This future PE is lower than the current PE for the CA Consumer Finance industry at 15.2x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.08%, as per the Simply Wall St company report.

Propel Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Rising acquisition and data costs, especially as competition for lead generation and organic marketing intensifies, could continue to pressure net margins if customer acquisition costs increase faster than revenue growth.

- Regulatory risks remain elevated as Propel expands into new geographies; fragmented or tightening lending regulations, rate caps, or outright restrictions on high-interest loans could directly limit revenue potential and increase compliance and operating costs in key markets.

- Over-reliance on nonprime and subprime consumer segments, even as Propel seeks to move up the credit spectrum, leaves the company exposed to higher structural default risk and the possibility of worsening credit performance, which could negatively impact both net income and provisioning needs.

- Larger, well-capitalized financial institutions adopting advanced AI and open banking could leverage their scale and real-time data advantages to undercut Propel on pricing or credit terms, threatening Propel's market share and putting long-term pressure on revenues and operating leverage.

- Sustained operational investments (e.g., AI, new product launches, business development initiatives), while necessary for growth, could dampen net margin expansion if top-line growth slows or if these investments do not deliver commensurate improvements in productivity and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$44.157 for Propel Holdings based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.1 billion, earnings will come to $163.9 million, and it would be trading on a PE ratio of 11.6x, assuming you use a discount rate of 8.1%.

- Given the current share price of CA$32.13, the analyst price target of CA$44.16 is 27.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.