Last Update 01 May 25

Key Takeaways

- Strategic asset sales enhance cash flow for investments or share buybacks, positively impacting future earnings.

- Strong occupancy rates and expansion plans are set to boost revenue and optimize net margins.

- The company's shift from debt to net cash may limit leverage and growth, with macroeconomic uncertainties, unclear goals, and high vacancies posing risks to revenue and stability.

Catalysts

About Syn Prop & Tech- We are SYN, and we have a deep understanding of the Brazilian commercial real estate market.

- The completion of multiple capital reductions and sales, such as the Brasilio Machado building, frees up cash flow which could potentially be used for more strategic investments or share buybacks, impacting future earnings positively.

- The phased leasing strategy related to the CLD lease and the large share of Class A buildings being fully occupied suggest a strong occupancy rate going forward, which will likely enhance revenue and improve net margins.

- Syn Prop & Tech has a strategy of growing market share in key areas like ITM, where they have increased their participation significantly. This could drive revenue growth through economies of scale and optimize net margins.

- There is potential for significant expansion in areas such as the Cidade Sao Paulo Shopping Mall, with a projected increase in gross leasable area, which can contribute positively to future revenues.

- The company's articulated goal to maintain debt under 2x while preserving significant liquidity for strategic investments suggests a financial strategy targeting sustainable growth and potentially higher earnings through a balanced capital structure.

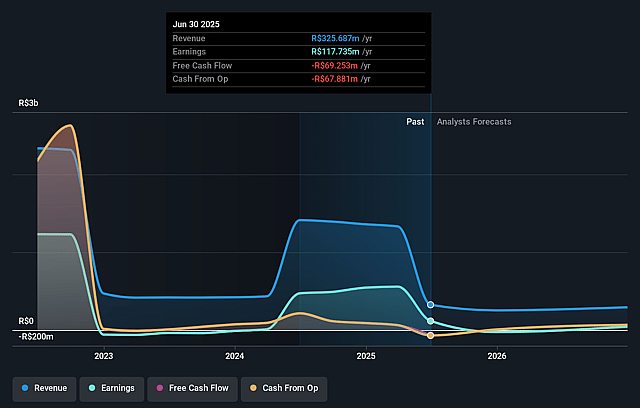

Syn Prop & Tech Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Syn Prop & Tech's revenue will decrease by 67.3% annually over the next 3 years.

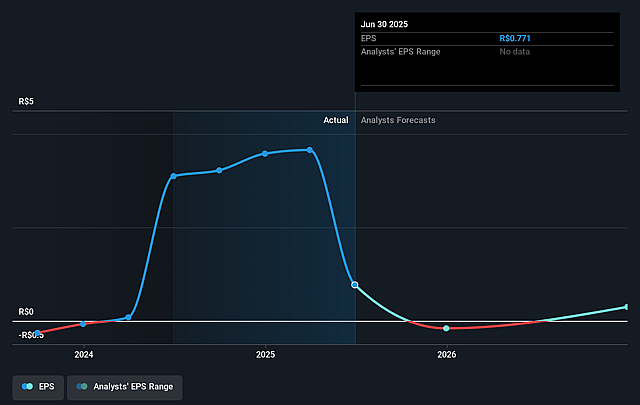

- Analysts are not forecasting that Syn Prop & Tech will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Syn Prop & Tech's profit margin will increase from 40.2% to the average BR Real Estate industry of 18.5% in 3 years.

- If Syn Prop & Tech's profit margin were to converge on the industry average, you could expect earnings to reach R$8.8 million (and earnings per share of R$0.06) by about May 2028, down from R$546.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 232.3x on those 2028 earnings, up from 1.6x today. This future PE is greater than the current PE for the BR Real Estate industry at 7.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 23.93%, as per the Simply Wall St company report.

Syn Prop & Tech Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's shift from a debt position to a net cash position might limit leverage capacity and restrict growth opportunities unless favorable investment conditions emerge, potentially impacting revenue growth prospects.

- Uncertainty about macroeconomic conditions in Brazil and globally could affect the company's performance, influencing future earnings and net margins negatively if economic conditions worsen.

- Potential yield and leverage goals remain unclear, possibly causing investor uncertainty and influencing perceptions of the company's long-term financial health and net earnings.

- The high vacancy rates in some properties, like in Rio de Janeiro and specific warehouses, could lead to reduced rental income and negatively affect net margins.

- The dependence on future store expansions and asset growth in competitive property sectors, with uncertain returns, poses risks that could impact the company's revenue growth and overall financial stability if market conditions do not improve as expected.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of R$7.05 for Syn Prop & Tech based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of R$9.1, and the most bearish reporting a price target of just R$5.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be R$47.5 million, earnings will come to R$8.8 million, and it would be trading on a PE ratio of 232.3x, assuming you use a discount rate of 23.9%.

- Given the current share price of R$5.86, the analyst price target of R$7.05 is 16.9% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Syn Prop & Tech?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.