Key Takeaways

- Structural shifts toward alternative proteins and mounting competition challenge BRF's sales volumes, growth prospects, and pricing power in core markets.

- Regulatory, environmental, and macroeconomic pressures threaten profitability, increase operating expenses, and heighten earnings volatility for the foreseeable future.

- Strategic global expansion, product mix shifts, efficiency gains, robust financial health, and strong ESG practices position BRF for resilient growth and improved profitability.

Catalysts

About BRF- BRF S.A. raises, produces, and slaughters poultry and pork for processing, production, and sale of fresh meat, processed products, pasta, margarine, pet food, and other products.

- Shifting global consumer preferences are accelerating away from traditional animal proteins, with sustained growth in plant-based and alternative protein consumption. This long-term change threatens to erode BRF's core revenue streams over time, especially as younger consumers in both developed and developing markets increasingly adopt flexitarian or vegetarian diets, which would weigh on sales volumes and limit top-line growth.

- The company remains highly exposed to regulatory and environmental risk, as increasing global pressure to curb greenhouse gas emissions and promote sustainable resource use in food production is raising compliance costs for animal protein producers. As more countries and large buyers impose stricter ESG standards, BRF will likely face rising operating expenses and potential supply chain disruptions, further compressing net margins and profitability over the next decade.

- Despite recent efficiency gains and margin improvements, BRF's long-term organic and inorganic growth strategies depend heavily on continued expansion in international markets that are increasingly subject to volatile regulatory barriers, animal health risks such as avian influenza, and unpredictable export bans. These ongoing threats could periodically disrupt exports, cause inventory losses, and create revenue volatility that undermines stable earnings growth.

- With industry competition intensifying (both from global majors and low-cost regional players in key emerging markets), pricing power will remain under pressure, and BRF's attempts to protect or enhance market share could trigger price wars or higher promotional spending. This ongoing margin compression would likely lead to lower mid-cycle earnings and challenge sustainability of current profitability levels.

- Persistent macroeconomic instability-including inflation and currency volatility, particularly in BRF's domestic market of Brazil as well as other key emerging markets-poses a sustained threat to the company's cost structure and consumer demand. This long-term exposure reduces financial predictability and increases the risk of earnings disappointments, putting further strain on cash flow and investment capacity.

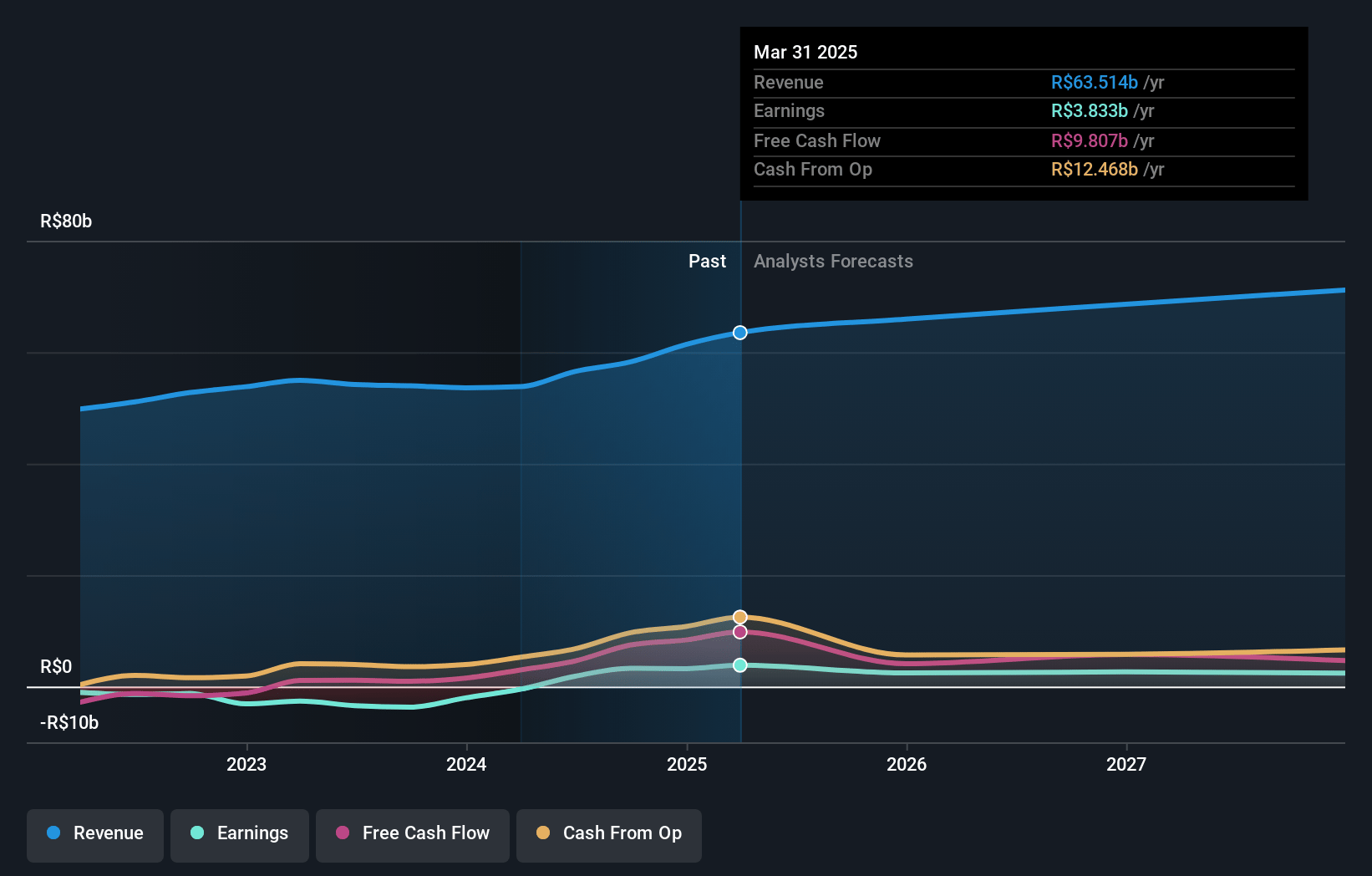

BRF Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on BRF compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming BRF's revenue will grow by 4.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 6.0% today to 3.0% in 3 years time.

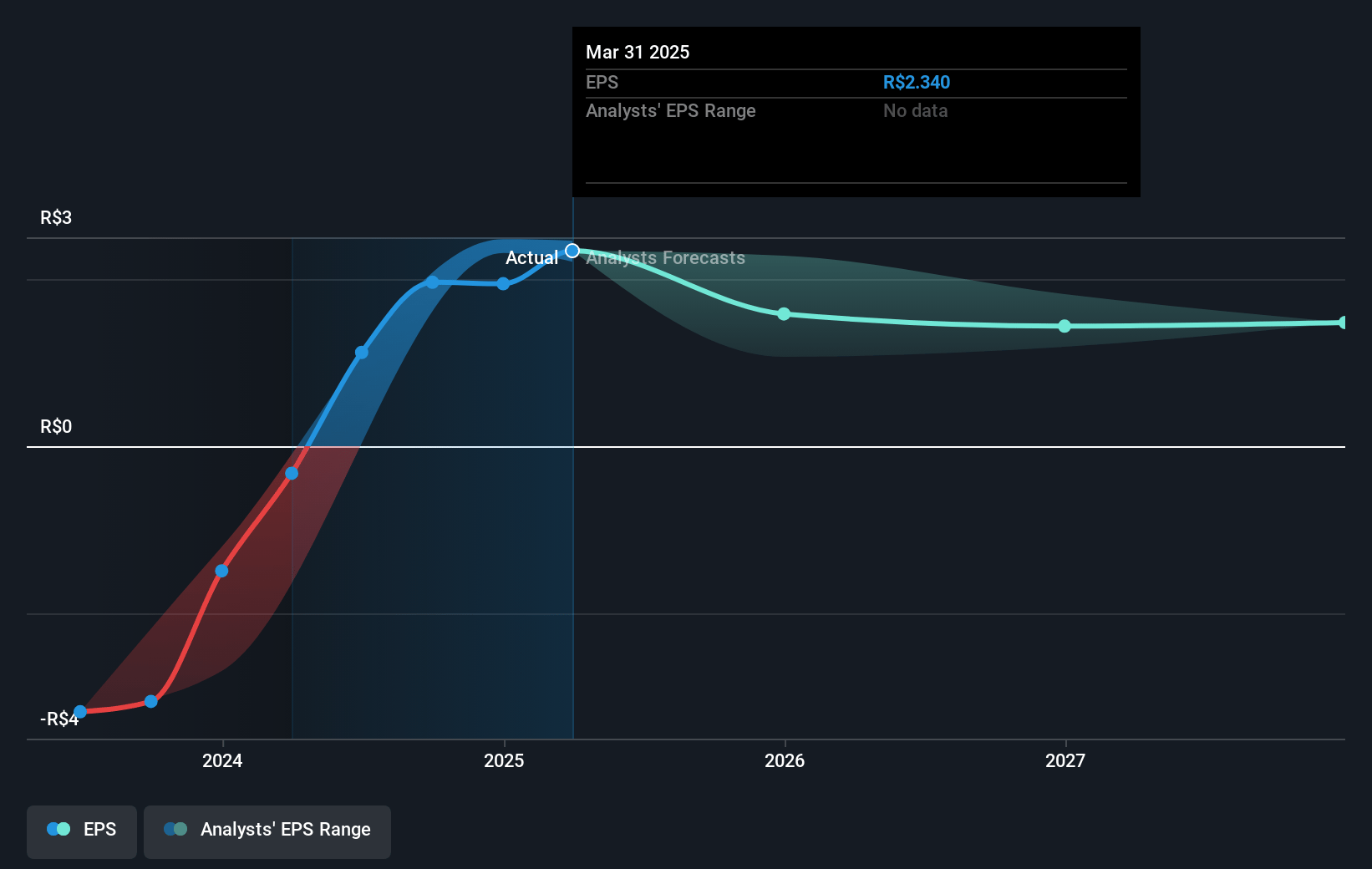

- The bearish analysts expect earnings to reach R$2.1 billion (and earnings per share of R$1.31) by about July 2028, down from R$3.8 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 18.7x on those 2028 earnings, up from 8.8x today. This future PE is greater than the current PE for the US Food industry at 10.6x.

- Analysts expect the number of shares outstanding to decline by 3.54% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 17.32%, as per the Simply Wall St company report.

BRF Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sustained global demand for protein and BRF's strategic international expansion, including significant investments in new plants in Saudi Arabia and China, position the company to benefit from higher sales volumes and diversified export markets, supporting long-term revenue growth and resilience.

- BRF's ongoing shift toward higher-margin processed and value-added products, coupled with strong brand leadership in Brazil and key international markets, is likely to drive margin expansion and improved overall profitability in the coming years.

- Operational efficiency initiatives, notably the BRF+ program, have delivered substantial cost savings, increased asset utilization, and improved plant productivity, which could continue lowering production costs and increasing earnings and free cash flow over the long term.

- A solid capital structure, highlighted by the lowest leverage in BRF's history and a comfortable liquidity position, provides the financial flexibility to invest in growth opportunities and withstand potential industry shocks, reducing financial risk and supporting sustainable net earnings.

- Strong progress in ESG practices, global animal welfare rankings, and supply chain traceability enhance BRF's competitiveness, potentially opening up premium market segments and long-term contracts that could stabilize and grow future revenues and profit margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for BRF is R$17.3, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of BRF's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of R$34.0, and the most bearish reporting a price target of just R$17.3.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be R$71.8 billion, earnings will come to R$2.1 billion, and it would be trading on a PE ratio of 18.7x, assuming you use a discount rate of 17.3%.

- Given the current share price of R$21.0, the bearish analyst price target of R$17.3 is 21.4% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.