Last Update 22 Aug 25

Fair value Increased 5.63%The upward revision in APA Group’s price target reflects a significant improvement in net profit margin, outweighing a reduced revenue growth outlook, with the consensus fair value increasing to A$8.67.

What's in the News

- APA Infrastructure Trust and APA Investment Trust proposed amendments to their constitutions to insert a new clause 12 in the schedule.

- APA Group announced an ordinary dividend of AUD 0.30 per share for the six months ending June 30, 2025.

Valuation Changes

Summary of Valuation Changes for APA Group

- The Consensus Analyst Price Target has risen from A$8.25 to A$8.67.

- The Net Profit Margin for APA Group has significantly risen from 8.31% to 10.35%.

- The Consensus Revenue Growth forecasts for APA Group has significantly fallen from 5.3% per annum to 4.0% per annum.

Key Takeaways

- Persistent energy demand and infrastructure resilience support long-term asset utilization, stable margins, and sustained revenue growth.

- Diversification into renewables and disciplined cost controls underpin future high-growth revenue streams and margin resilience.

- Rising renewable adoption and stricter climate policies threaten gas pipeline demand, revenue stability, and capital access, increasing operational, financial, and regulatory risks.

Catalysts

About APA Group- Engages in the energy infrastructure business in Australia.

- Persistent and growing baseline demand for natural gas in Australia, driven by population growth, increased urbanization, and electrification-led peak reliability needs (especially as coal retires), underpins long-duration asset utilization and supports future revenue growth and improved operating leverage.

- The ongoing global emphasis on energy security and infrastructure resilience is creating tailwinds for APA's core pipelines and storage assets, ensuring robust, long-term contracted volumes and pricing power, which bolsters earnings visibility and margin stability.

- APA's active expansion of its organic growth pipeline (from $1.8bn to $2.1bn) in projects supporting LNG exports, domestic supply, and midstream gas-fired power generation positions the company to capture continued industry and regulatory support for modernized, reliable gas infrastructure; this should drive multi-year EBITDA and margin growth.

- Strategic diversification into renewable and hybrid (gas + renewables) energy infrastructure for remote grids and mining customers, while leveraging proven relationships and delivery capabilities, is laying the foundation for new, higher-growth revenue streams and supporting risk-adjusted net margins.

- The company's disciplined cost-out initiatives, strong inflation-linked contract portfolio, and funding strength (improved credit metrics, absence of near-term refinancing risk, ability to self-fund growth) are expanding margin resilience and supporting steady growth in distributions and free cash flow per security.

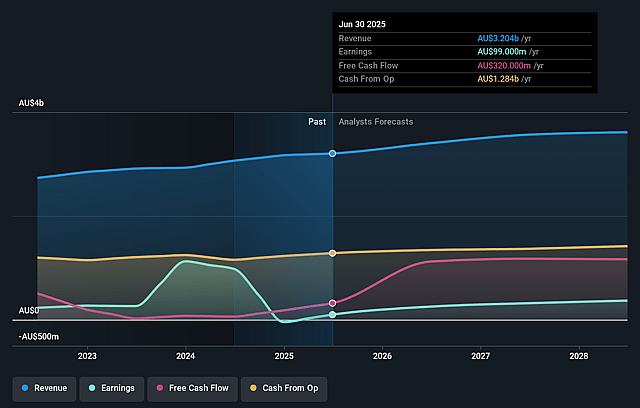

APA Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming APA Group's revenue will grow by 4.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.1% today to 10.5% in 3 years time.

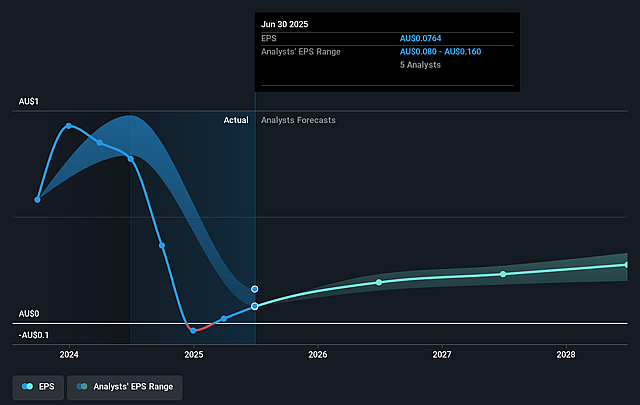

- Analysts expect earnings to reach A$385.1 million (and earnings per share of A$0.29) by about September 2028, up from A$99.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting A$469.0 million in earnings, and the most bearish expecting A$256 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 36.9x on those 2028 earnings, down from 115.3x today. This future PE is lower than the current PE for the AU Gas Utilities industry at 115.3x.

- Analysts expect the number of shares outstanding to grow by 0.74% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.91%, as per the Simply Wall St company report.

APA Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerating global energy transition toward renewables and away from fossil fuels poses a risk to long-term demand for APA Group's core gas infrastructure assets; as electrification and renewable energy penetration rise, pipeline throughput volumes and revenue growth could structurally decline.

- Potential tightening of climate change regulation, such as more stringent emissions standards or carbon pricing, could increase operational and compliance costs for gas pipelines, negatively impacting net margins and earnings.

- Long-term contracts that underpin APA Group's revenue might be exposed to renegotiation or lower renewal rates as industrial and commercial customers transition to lower-carbon alternatives, introducing revenue uncertainty and risk of underutilized assets.

- The company's ongoing need for substantial capital expenditure-both for expansion and asset maintenance-could pressure free cash flow and increase debt, particularly if growth projects underperform or face delays due to regulatory or market changes, thereby affecting net margins and earnings stability.

- Increased investor and societal focus on ESG factors may result in higher financing costs and declining investor appetite for gas infrastructure, potentially lowering APA Group's valuation and increasing its cost of capital, which could reduce net returns on future growth investments.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$8.718 for APA Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$9.3, and the most bearish reporting a price target of just A$7.7.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$3.7 billion, earnings will come to A$385.1 million, and it would be trading on a PE ratio of 36.9x, assuming you use a discount rate of 6.9%.

- Given the current share price of A$8.75, the analyst price target of A$8.72 is 0.4% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on APA Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.