Key Takeaways

- EMEA region headwinds and budget suspensions could stagnate near-term revenue growth and challenge sustaining high growth rates.

- Focus on dividends over share buyback and high expansion expenses may pressure margins and signal limited reinvestment in growth.

- Strong financial performance, strategic transformation, and investment in technology and client relationships position Bravura Solutions for continued revenue and earnings growth.

Catalysts

About Bravura Solutions- Develops, licenses, and maintains administration and management software applications for the wealth management and funds administration sectors in Australia, the United Kingdom, New Zealand, and internationally.

- The company is experiencing certain headwinds in the EMEA region such as tighter FY '25 budgets of clients and the impact of the Fidelity International transaction, which could imply a potential stagnation or decline in revenue growth in the near term due to the loss of annual run rate revenue.

- Despite the current improvements, the company anticipates that demand could drop off in the second half due to customers suspending budgets, which points to potential softening of future revenues and challenges in sustaining the current high growth rate.

- Bravura has suspended its on-market share buyback while focusing on returning excess capital through dividends, which suggests a conservative approach in capital allocation. This could strain future earnings growth if it indicates limited reinvestment in growth initiatives.

- The company is investing in expanding technology and people, particularly in APAC Digital Advice, which increases operational expenses and may pressurize net margins unless this translates into substantial revenue growth in the long term.

- There is a risk associated with Bravura being heavily reliant on current macroeconomic conditions and FX tailwinds to support revenue upgrades. If these economic conditions fluctuate unfavorably, revenue and earnings projections might not be met, impacting net margins and overall financial performance.

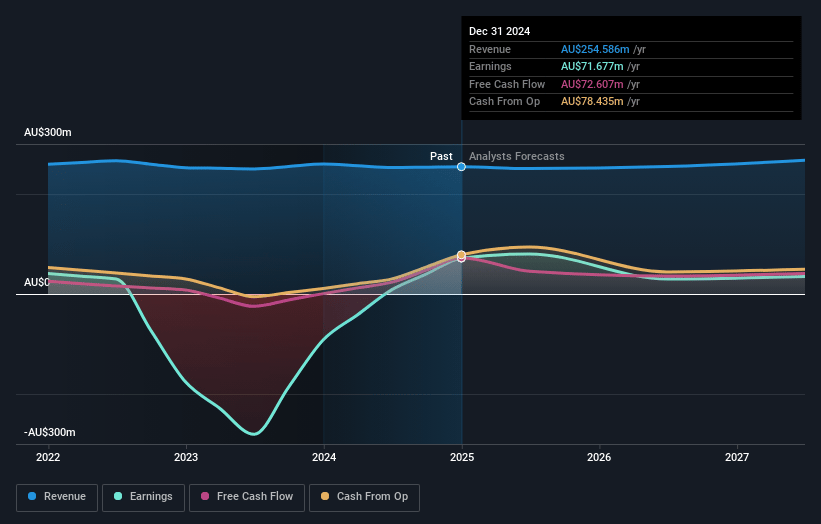

Bravura Solutions Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Bravura Solutions's revenue will grow by 2.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 28.2% today to 14.3% in 3 years time.

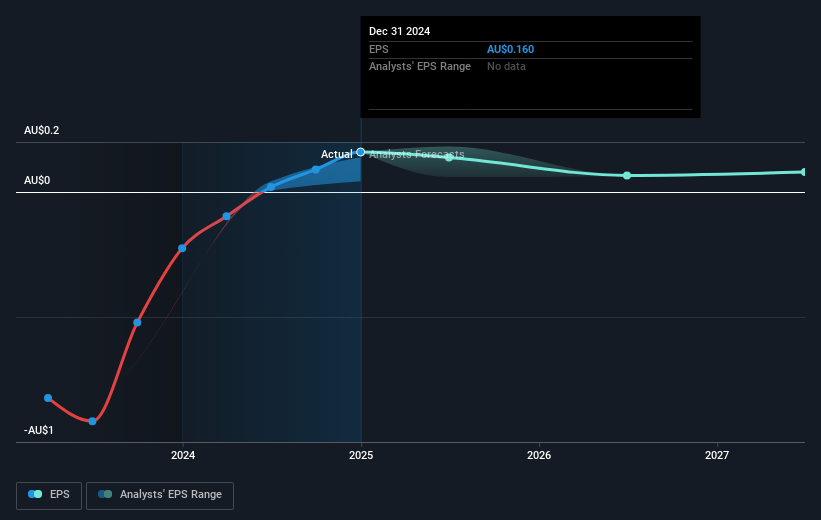

- Analysts expect earnings to reach A$39.2 million (and earnings per share of A$0.09) by about February 2028, down from A$71.7 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 36.9x on those 2028 earnings, up from 17.0x today. This future PE is lower than the current PE for the AU Software industry at 66.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.39%, as per the Simply Wall St company report.

Bravura Solutions Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company has announced an improved financial performance, with revenue growth, EBITDA upgrades, and strong cash EBITDA, which could indicate sustainable revenue and earnings growth.

- Bravura Solutions has a robust balance sheet with a substantial cash position and is returning significant capital to shareholders, reflecting strong cash flow management and potential positive impacts on net margins.

- The business is executing a transformation strategy that is delivering improved profitability and expanding margins, suggesting that net margins and earnings could continue to improve.

- Ongoing investment in technology and people, along with market traction, particularly in the APAC region with digital advice solutions, may bolster future revenues.

- Strengthening client relationships and trust, particularly in EMEA and APAC markets, are positioning the company for revenue growth and improved earnings through upgraded guidance and strategic alignment with clients.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$2.609 for Bravura Solutions based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$3.17, and the most bearish reporting a price target of just A$1.66.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$274.4 million, earnings will come to A$39.2 million, and it would be trading on a PE ratio of 36.9x, assuming you use a discount rate of 7.4%.

- Given the current share price of A$2.72, the analyst price target of A$2.61 is 4.2% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.