Key Takeaways

- Rising regulatory costs, lower ore grades, and labor shortages will likely increase production expenses and compress profitability across operations.

- Shifting investor preferences and integration challenges from acquisitions could undermine long-term demand for gold and hinder expected earnings growth.

- Growth-focused investments, strong gold prices, and improved operational efficiencies position the company for increased production, financial resilience, and enhanced shareholder returns.

Catalysts

About Northern Star Resources- Engages in the exploration, development, mining, and processing of gold deposits.

- With accelerating global efforts toward decarbonization and increased scrutiny on carbon-intensive industries, Northern Star Resources is likely to face rising regulatory and compliance costs over the next decade, which will squeeze net margins and raise the company's long-term cost base.

- The persistent global trend toward digital assets and alternative inflation hedges, such as cryptocurrencies, could steadily undermine gold's traditional role as a financial safe haven, resulting in a potential structural decline in long-term demand and downward pressure on realized revenues for established producers like Northern Star.

- Declining ore grades at key Australian assets, as referenced by management and visible through rising all-in sustaining costs, are likely to drive up future unit production costs and erode profitability, particularly as easily accessed high-grade resources are depleted in coming years.

- The integration of large-scale acquisitions, including De Grey, introduces significant operational complexity and a heightened risk of execution failures or unanticipated capital needs, which may ultimately cause lower than anticipated synergy realization and reduced return on invested capital, adversely affecting long-term earnings growth.

- A tightening global labor market in mining, combined with increasing competition for skilled workers and critical equipment, is forecast to feed persistent cost inflation across the sector; this trend may be exacerbated for Northern Star as it seeks to expand production and develop new projects, potentially resulting in an ongoing compression of operating margins.

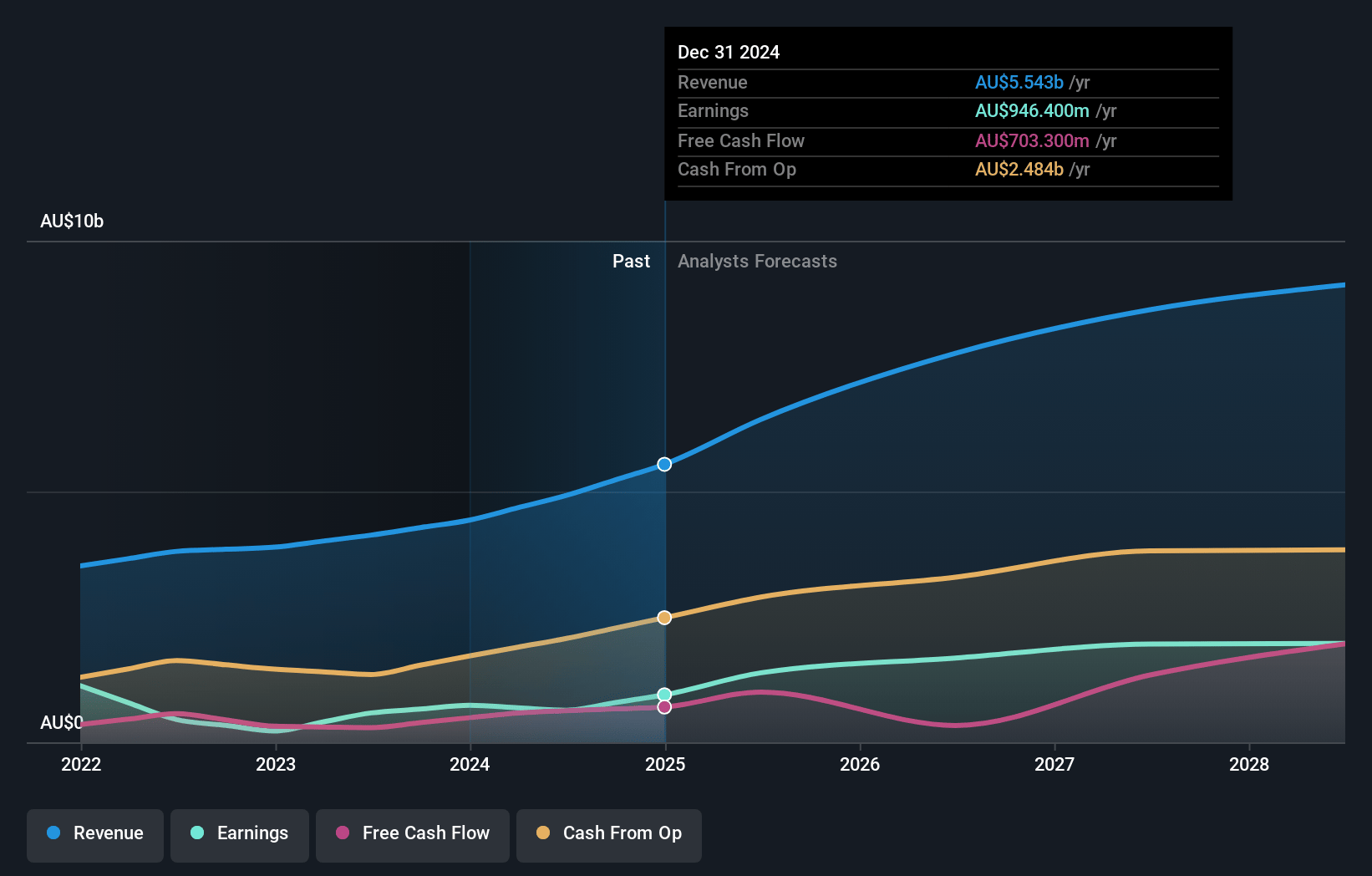

Northern Star Resources Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Northern Star Resources compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Northern Star Resources's revenue will grow by 10.9% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 17.1% today to 13.3% in 3 years time.

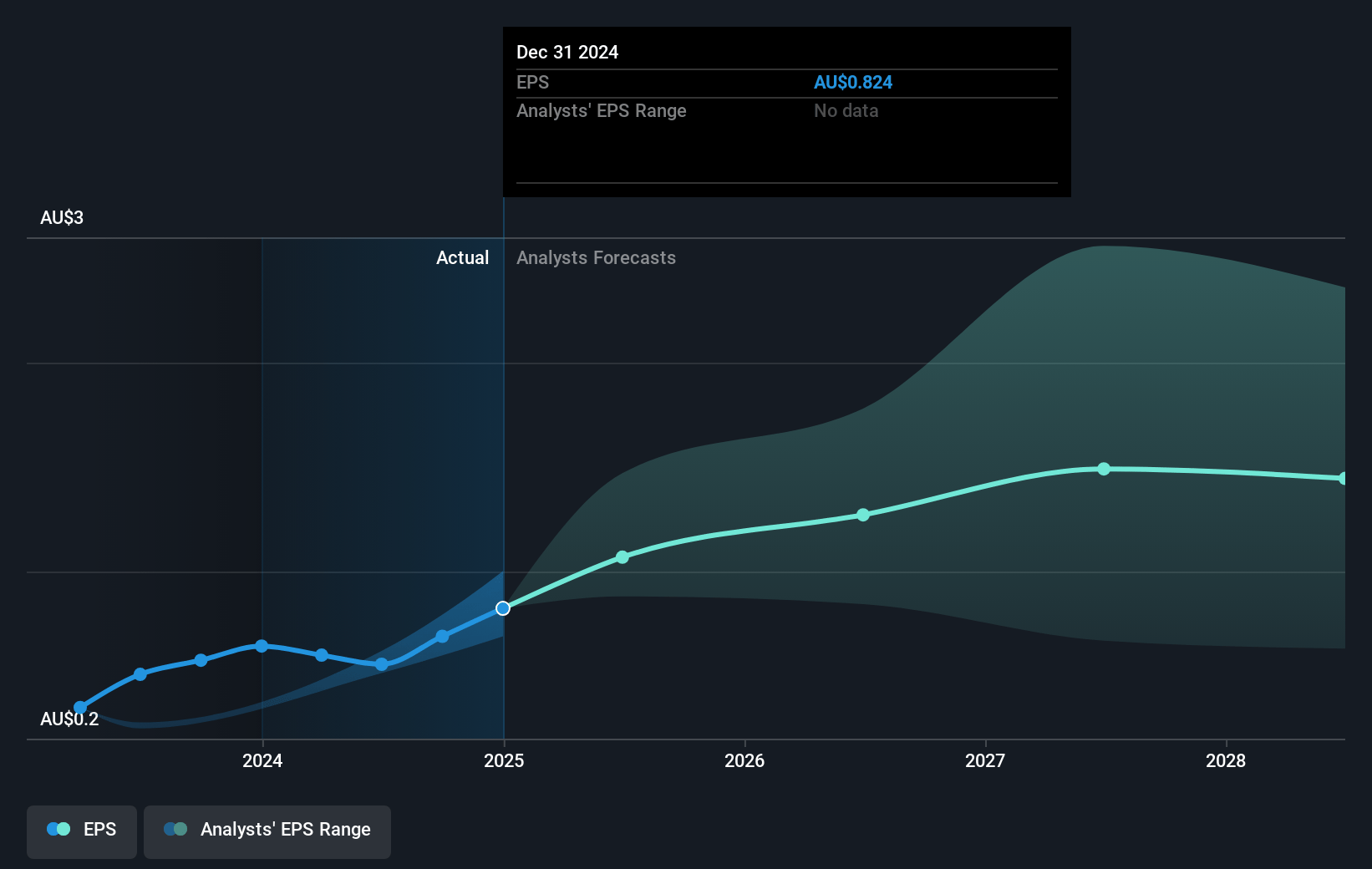

- The bearish analysts expect earnings to reach A$1.0 billion (and earnings per share of A$0.7) by about July 2028, up from A$946.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 24.7x on those 2028 earnings, down from 24.8x today. This future PE is greater than the current PE for the AU Metals and Mining industry at 13.5x.

- Analysts expect the number of shares outstanding to decline by 0.41% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.14%, as per the Simply Wall St company report.

Northern Star Resources Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The successful integration and development of the De Grey (Hemi) asset is poised to drive significant production growth and unlock accelerated tax benefits, which could increase both Northern Star's revenues and free cash flow over the medium and long term.

- Robust gold prices above A$5,000 per ounce, coupled with continued strength in gold demand as a safe-haven and strategic investment, may sustain elevated realised prices and support strong revenues and margins for Northern Star Resources in the coming years.

- The company's ongoing heavy investment in mill expansions, underground development, and exploration across key assets such as KCGM, Yandal, and Pogo positions the business to grow output, improve mining efficiency, and reduce unit costs, which can lift operating margins and net earnings.

- Management emphasized that recent operational challenges at KCGM represent a timing delay rather than a permanent reduction in future production potential, as mining access and efficiency in key areas are now improving and production run-rates are expected to rise, supporting future revenue and overall cash generation.

- The strong balance sheet, demonstrated operating cash flow generation, disciplined capital allocation, and commitment to advancing high-return projects provide financial flexibility and resilience, underlining the company's ability to fund growth and deliver improved shareholder returns over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Northern Star Resources is A$14.27, which represents two standard deviations below the consensus price target of A$20.87. This valuation is based on what can be assumed as the expectations of Northern Star Resources's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$27.0, and the most bearish reporting a price target of just A$13.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be A$7.6 billion, earnings will come to A$1.0 billion, and it would be trading on a PE ratio of 24.7x, assuming you use a discount rate of 7.1%.

- Given the current share price of A$16.42, the bearish analyst price target of A$14.27 is 15.1% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.