Last Update01 May 25Fair value Increased 0.082%

Key Takeaways

- Competitive market conditions and regulatory challenges in Latin America may hinder AGT's revenue growth if not strategically managed.

- Investment in R&D and product development may compress margins if sales fail to increase, while halted dividends might impact investor sentiment.

- Product innovation and easing regulatory constraints can drive revenue growth, while a strong balance sheet positions the company for sustained earnings and flexibility.

Catalysts

About Ainsworth Game Technology- Designs, develops, manufactures, sells, distributes, and services electronic gaming machines, and other related equipment and services in Australia, North America, Latin America, Europe, New Zealand, South Africa, Asia, and internationally.

- AGT is facing competitive market conditions and regulatory restrictions in Latin America, which may hinder revenue growth if not addressed, affecting overall revenue prospects.

- Continued investment in R&D and product development expenses, which increased by 8% compared to the previous period, may compress net margins if the expected product improvements do not yield a corresponding increase in sales.

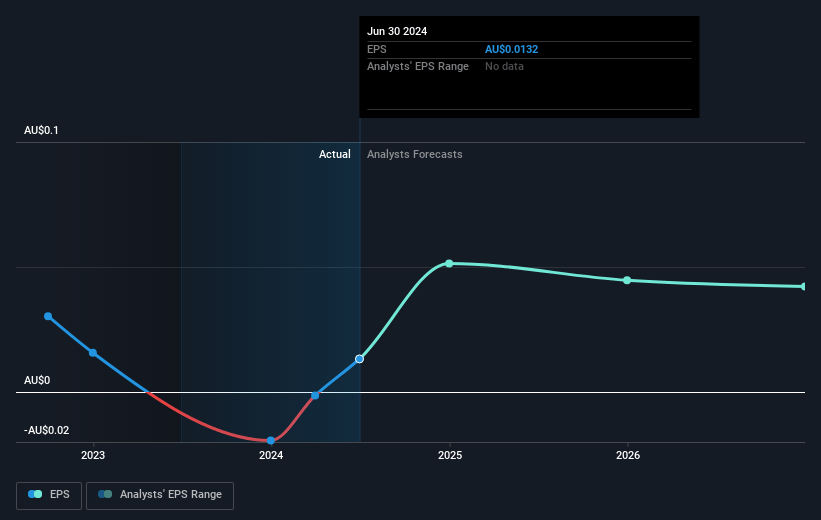

- The suspension of dividends to shareholders to prioritize product commercialization indicates that earnings are being reinvested rather than returned to shareholders, potentially affecting investor sentiment and future EPS.

- The termination of the GAN exclusivity contract led to reduced contributions from the digital segment, which impacted EBITDA. If AGT fails to successfully explore new opportunities with global operators, earnings may continue to be negatively affected.

- Challenges in Latin American sales due to import restrictions and political instability, particularly in Mexico and Argentina, could persist, putting pressure on revenue growth if these market conditions do not stabilize.

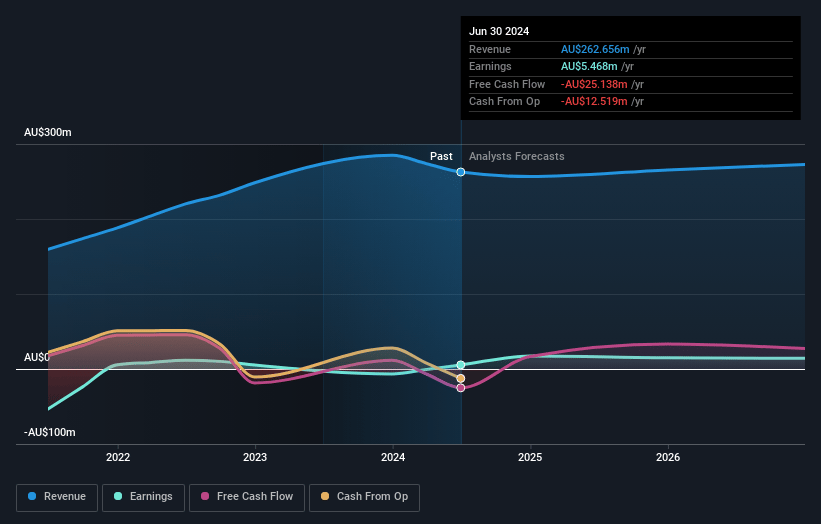

Ainsworth Game Technology Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Ainsworth Game Technology's revenue will grow by 4.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 11.5% today to 5.9% in 3 years time.

- Analysts expect earnings to reach A$17.7 million (and earnings per share of A$0.05) by about May 2028, down from A$30.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.2x on those 2028 earnings, up from 10.7x today. This future PE is lower than the current PE for the AU Hospitality industry at 20.7x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.7%, as per the Simply Wall St company report.

Ainsworth Game Technology Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Strong performance in North America and positive feedback for new products such as the A-Star Raptor cabinet and new game titles contribute to a 5% increase in segment profit, indicating potential revenue growth through continued product innovation.

- Regulatory constraints in Latin America are expected to ease, potentially returning the region to historical revenue levels and increasing overall revenue resilience.

- Commitment to R&D investment ensures competitive product offerings, which can enhance future earnings growth by maintaining a competitive edge.

- Increased international revenue and consistent high gross margins, especially with strong sales in North America, indicate potential for stable earnings and healthy net margins.

- Strong balance sheet with a net cash position and undrawn credit facilities provides financial stability and flexibility to invest in growth opportunities, potentially sustaining or improving profit margins and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of A$0.851 for Ainsworth Game Technology based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be A$301.0 million, earnings will come to A$17.7 million, and it would be trading on a PE ratio of 20.2x, assuming you use a discount rate of 7.7%.

- Given the current share price of A$0.96, the analyst price target of A$0.85 is 12.8% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.