Key Takeaways

- Technology and AI investments are reducing costs and driving operational efficiencies, supporting stronger margins and long-term earnings growth above peers.

- Strong digital platforms and proprietary customer relationships enable superior deposit growth, lending volumes, and expansion of non-interest income streams.

- Leadership in digital banking, stable low-cost funding, prudent risk management, and strong capital position underpin resilience and sustained earnings despite industry disruption and margin pressures.

Catalysts

About Commonwealth Bank of Australia- Provides retail and commercial banking services in Australia, New Zealand, and internationally.

- Analyst consensus views sustained technology and AI investment as a cost headwind, but CBA's accelerated in-house tech build and AI deployment are already yielding tangible operational efficiencies, compressing future cost growth and positioning cost-to-income ratios for structural long-term improvement, supporting superior net margin expansion.

- While analyst consensus is concerned by deposit competition limiting net interest margin upside, CBA's deep proprietary distribution, record main bank relationships, and technology-enhanced deposit pricing strategies are set to drive outperformance in deposit growth and retention, enabling disciplined margin resilience and stronger-than-expected net interest income growth.

- Australia's population growth and ongoing urbanisation, coupled with CBA's #1 position in mortgages and business lending, will amplify lending volumes well ahead of system, underpinning multi-year revenue and earnings growth above peers as new household formation and SME creation accelerate.

- Rapid adoption of digital banking and payments, combined with CommBank's best-in-market digital platforms and AI-powered customer engagement, are leading to outsized transaction growth and fee-based income gains, expanding revenue streams independently of interest rate cycles.

- Ageing demographics and the rise in household wealth are driving sustained demand for superannuation and personal financial management, areas where CBA's technology leadership and scale will capture disproportionate share, securing long-term growth in high-margin fee and commission income.

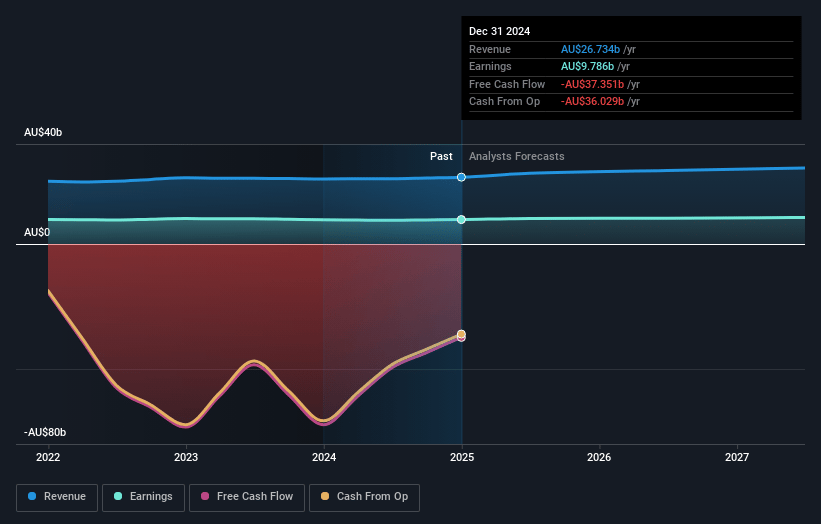

Commonwealth Bank of Australia Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Commonwealth Bank of Australia compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Commonwealth Bank of Australia's revenue will grow by 7.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 36.6% today to 36.7% in 3 years time.

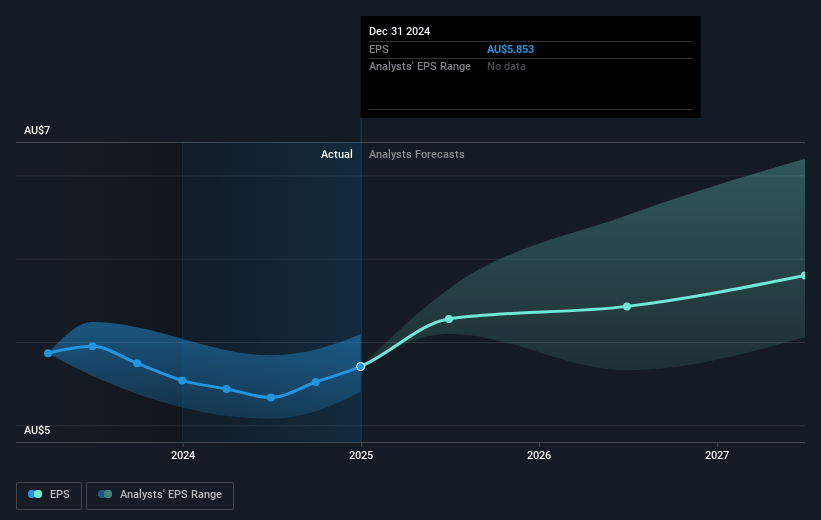

- The bullish analysts expect earnings to reach A$12.2 billion (and earnings per share of A$7.29) by about July 2028, up from A$9.8 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 24.5x on those 2028 earnings, down from 30.7x today. This future PE is greater than the current PE for the AU Banks industry at 15.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.62%, as per the Simply Wall St company report.

Commonwealth Bank of Australia Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Commonwealth Bank of Australia's continued investment in technology and digital capabilities, such as record-high investment in AI, leading customer engagement tools, and the #1-ranked CommBank app, positions it well to counter disruption from fintech and digital entrants, which could help protect both revenue growth and customer retention over the long term.

- The company's strong deposit franchise, with 77% customer deposit funding and market-leading positions in both retail and business banking, provides a stable, low-cost funding base that could partially offset margin compression even as industry competition increases, thereby supporting net interest margins and earnings.

- Disciplined capital management and strong capital ratios-such as a Common Equity Tier 1 ratio well above regulatory minimums-give CBA notable flexibility to absorb shocks or invest for growth, reducing the risk of dividend cuts or dilutive capital raisings and thereby benefiting shareholder returns and net tangible assets.

- CBA's ability to consistently grow volume in both home and business lending above system, while maintaining tight risk controls and strong credit quality with low impairments and arrears, suggests resilience to macroeconomic downturns and limits the potential impact from overexposure to the housing market on its top-line revenue and loan loss provisions.

- Continued robust operational performance, high return on equity, strong organic capital generation, and leading customer satisfaction metrics across key market segments indicate sustained franchise health, supporting stable or increasing dividends and positive earnings momentum despite industry-wide regulatory, technological, and margin pressures.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Commonwealth Bank of Australia is A$143.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Commonwealth Bank of Australia's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of A$143.0, and the most bearish reporting a price target of just A$97.49.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be A$33.1 billion, earnings will come to A$12.2 billion, and it would be trading on a PE ratio of 24.5x, assuming you use a discount rate of 7.6%.

- Given the current share price of A$179.42, the bullish analyst price target of A$143.0 is 25.5% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.