Last Update 01 Nov 25

Fair value Decreased 7.14%Analysts have lowered their price target for Empresa Distribuidora y Comercializadora Norte Sociedad Anónima from $2,800 to $2,600. This adjustment is due to ongoing regulatory uncertainties and a less compelling valuation outlook.

Analyst Commentary

Recent commentary on Empresa Distribuidora y Comercializadora Norte Sociedad Anónima reflects a careful stance among analysts as regulatory and economic factors continue to evolve. The perspectives highlight both optimism and concerns that shape the company's outlook.

Bullish Takeaways

- Some analysts note that company-specific catalysts remain, which could support valuation recovery if there is greater regulatory transparency.

- Argentina's economic environment is fluid, and any favorable macroeconomic shifts could provide upside for the company's shares.

- The company’s continued operational execution may position it to benefit from eventual clarity in regulation and market conditions.

Bearish Takeaways

- Uncompelling valuation metrics drive cautious sentiment, with the stock appearing less attractive compared to peers in the sector.

- Lingering regulatory headwinds and recent adverse developments create uncertainty over near-term financial results and investor confidence.

- The timeline for potential company-specific catalysts remains unclear, leading analysts to remain on the sidelines until there is higher visibility.

- Ongoing regulatory challenges are now perceived as worse than previously expected, which may further delay meaningful upside.

What's in the News

- The Ministry of Economy of the Nation has filed legal action against the Company and Edesur in the federal administrative litigation court. The lawsuit follows issues related to Resolution 590/2021. Notification to the Company was received recently (Key Developments).

- The Board of Directors has scheduled a meeting on August 8, 2025, to approve and review the Company's condensed interim financial statements. This meeting will include the review of key financial reports and summaries for the period ended June 30, 2025 (Key Developments).

Valuation Changes

- Consensus Analyst Price Target: Lowered from ARS 2,800 to ARS 2,600, reflecting a more cautious outlook.

- Discount Rate: Remains unchanged at 23.97%, indicating no shift in perceived risk levels.

- Revenue Growth: Edged down from 19.89% to 19.25% year-over-year, suggesting slightly slower projected expansion.

- Net Profit Margin: Fell significantly from 1.66% to 0.12%, indicating notable pressure on profitability expectations.

- Future P/E: Increased sharply from 71.85x to 930.87x, signaling a considerably less attractive valuation based on earnings forecasts.

Key Takeaways

- Structural tariff reforms and reduced financial uncertainty are set to strengthen margins and enable greater investment capacity.

- Grid modernization and rising electrification support sustained volume growth and improved operational efficiency.

- Regulatory dependence, economic instability, capital demands, technological disruption, and persistent energy losses threaten revenue growth, profitability, and financial resilience.

Catalysts

About Empresa Distribuidora y Comercializadora Norte Sociedad Anónima- Engages in the distribution and sale of electricity in Argentina.

- The recent sharp tariff increases (including a 319% hike, ongoing 4% monthly adjustments, and a 5-year tariff review granting increases over inflation) signal a structural shift toward cost-reflective pricing, likely to stabilize and significantly boost future revenues and improve EBITDA margins.

- Ongoing rapid urbanization and a growing customer base in Buenos Aires (customer count up 2% YoY) directly expand Edenor's addressable market, supporting sustained volume growth and resilient top-line revenues.

- Substantial capital investment in grid modernization-including remote control/telemetry, smart meters, and automation-will drive operational efficiencies, reduce energy losses, and contain opex, providing scope for margin expansion.

- The growing electrification of Argentina's transportation and industry, combined with Edenor's active role in supporting the energy transition (as evidenced by new investments in lithium and copper), positions the company to capture rising medium/long-term electricity demand, supporting volume and revenue growth.

- Resolution and regularization of historic debt with CAMMESA, along with improved credit ratings, reduce financial uncertainty and interest expenses, paving the way for improved net margins and future investment capacity.

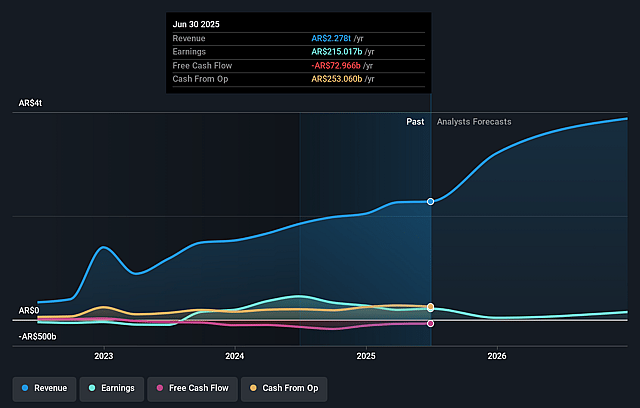

Empresa Distribuidora y Comercializadora Norte Sociedad Anónima Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Empresa Distribuidora y Comercializadora Norte Sociedad Anónima's revenue will grow by 19.9% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 9.4% today to 1.7% in 3 years time.

- Analysts expect earnings to reach ARS 65.0 billion (and earnings per share of ARS 1.76) by about September 2028, down from ARS 215.0 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 71.8x on those 2028 earnings, up from 5.8x today. This future PE is greater than the current PE for the US Electric Utilities industry at 6.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 23.97%, as per the Simply Wall St company report.

Empresa Distribuidora y Comercializadora Norte Sociedad Anónima Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's recent improvements in operating results are highly dependent on regulated tariff increases, but these adjustments remain subject to ongoing government intervention and gradual implementation, creating the risk of future policy reversals or new tariff freezes that could structurally cap revenues and compress earnings.

- Argentina's persistent high inflation and currency volatility continue to threaten Edenor's real revenue growth and increase input costs, pressuring net profit margins and potentially eroding the benefits of current tariff normalization.

- The need for sizable ongoing capital expenditures to modernize the grid, reduce losses, and transition to a smart network could constrain free cash flow, increase financial leverage, and limit returns to shareholders, especially if regulatory returns or financing conditions deteriorate.

- The sector's exposure to distributed renewable energy adoption and increasing energy efficiency could reduce electricity demand growth within Edenor's service area, pressuring top-line revenues over the long term as more customers shift to self-generation.

- While energy losses and irregular connections remain a challenge (at 15.55%, with only 9.58% recognized by the regulator for tariff purposes), failure to materially improve these metrics could result in unrecoverable costs, ongoing inefficiencies, and negative impacts on profitability and distribution margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ARS2800.0 for Empresa Distribuidora y Comercializadora Norte Sociedad Anónima based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ARS3925.3 billion, earnings will come to ARS65.0 billion, and it would be trading on a PE ratio of 71.8x, assuming you use a discount rate of 24.0%.

- Given the current share price of ARS1415.0, the analyst price target of ARS2800.0 is 49.5% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.