Key Takeaways

- Over-optimism about revenue and profit growth overlooks the company's reliance on temporary factors, slow renewables transition, and threats from cost inflation and competition.

- International expansions and renewables investments may not yield significant short-term gains, while legacy fossil fuel exposure increases earnings volatility and margin pressure.

- Stable core utilities, global renewable diversification, infrastructure investment, technological demand, and a strong balance sheet support sustained growth, high margins, and reliable shareholder returns.

Catalysts

About Abu Dhabi National Energy Company PJSC- Operates as an integrated utility company in the United Arab Emirates, North America, Europe, Africa, and internationally.

- The market may be overestimating TAQA's future revenue growth by assuming that accelerated global investments in MENA energy infrastructure and the UAE's AI-driven power needs will immediately and sustainably drive earnings, despite the company's acknowledgment that recent revenue growth (notably in Transmission & Distribution) was linked to specific pass-through costs and may normalize, suggesting limited visibility for ongoing above-trend top-line expansion.

- Investors could be overvaluing TAQA on the belief that the shift towards renewables and global decarbonization will provide strong earnings tailwinds, despite the company's slower pace of portfolio transition relative to global peers, ongoing dependence on fossil fuel generation, and the sharp decline in Oil & Gas revenues and EBITDA-raising the risk of margin compression and stranded legacy asset exposure.

- Persistent reliance on stable, regulated revenues combined with heavy CapEx in core domestic utilities may be fueling the perception of defensive, predictable earnings; however, cost base inflation (from post-merger integration, G&A reallocation, and remediation work), plus rising grid modernization and cybersecurity expenses, threaten to erode future net margins as competition and regulatory burdens accrue.

- Recent international expansion (e.g., Transmission Investments U.K. acquisition) and past M&A activities, particularly in renewables via Masdar, may be viewed as catalysts for substantial long-term growth, but post-acquisition integration, lower immediate scale impact, and reduced incremental investment planned for the near term could limit near-future earnings uplift and capital efficiency, risking inflated valuation multiples.

- The systematic decline in Oil & Gas earnings due to ongoing asset decommissioning and weaker commodity prices exposes TAQA to further earnings volatility, particularly if the energy transition accelerates and regulatory or ESG pressures increase, potentially resulting in lower return on capital and pressured free cash flow relative to current market expectations.

Abu Dhabi National Energy Company PJSC Future Earnings and Revenue Growth

Assumptions

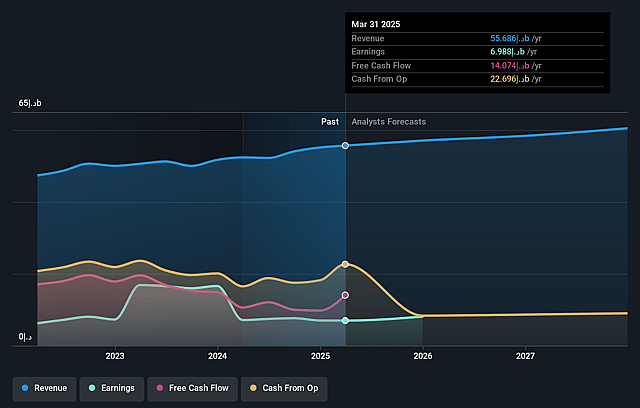

How have these above catalysts been quantified?- Analysts are assuming Abu Dhabi National Energy Company PJSC's revenue will grow by 3.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 12.5% today to 15.0% in 3 years time.

- Analysts expect earnings to reach AED 9.2 billion (and earnings per share of AED 0.08) by about July 2028, up from AED 7.0 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 49.2x on those 2028 earnings, down from 52.8x today. This future PE is greater than the current PE for the AE Integrated Utilities industry at 38.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 18.81%, as per the Simply Wall St company report.

Abu Dhabi National Energy Company PJSC Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's core utilities businesses (Transmission & Distribution and Water Solutions) continue to show resilience, with regulated and contracted revenues accounting for 90% of the top line, providing reliable and predictable cash flows that support long-term revenue and earnings stability.

- Strategic expansion and investment into international renewable energy and transmission assets (e.g., Masdar's global acquisitions, the Transmission Investments deal in the U.K.) position TAQA to benefit from global decarbonization trends, diversifying its earnings base and supporting future revenue growth.

- Ongoing and increasing capital investment in regulated networks and utility infrastructure, coupled with strong government and shareholder backing, strengthens long-term asset value and facilitates high-margin projects, which can bolster future net margins.

- The UAE's ambitious AI strategy through 2031, with significant new data center and energy infrastructure demand, directly benefits TAQA's growth pipeline, likely driving sustainable increases in energy demand, revenues, and asset utilization in the company's home market.

- Improved liquidity, ample cash generation, and a strong balance sheet-reflected in the ability to repay major bond maturities from internal resources-reduce financial risk, ensure favorable financing conditions, and support continued dividend stability and growth, positively impacting long-term earnings and shareholder returns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of AED2.395 for Abu Dhabi National Energy Company PJSC based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of AED3.14, and the most bearish reporting a price target of just AED1.65.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be AED61.1 billion, earnings will come to AED9.2 billion, and it would be trading on a PE ratio of 49.2x, assuming you use a discount rate of 18.8%.

- Given the current share price of AED3.28, the analyst price target of AED2.4 is 37.0% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.