Key Takeaways

- Accelerated revenue and margin growth is likely from post-boycott sales recovery, digital transformation, and synergistic acquisitions in underpenetrated markets.

- Strong demographic trends and operational efficiency position Americana for sustainable, above-peer expansion with enhanced customer retention and scalability.

- Heavy reliance on core fast-food brands and MENAT markets, combined with slow adaptation to health and digital trends, threatens margin stability and long-term growth.

Catalysts

About Americana Restaurants International- Operates a chain of restaurant in the United Arab Emirates, Saudi Arabia, Kuwait, Egypt, Qatar, Kazakhstan, Bahrain, Jordan, Oman, Lebanon, Morocco, North Africa, and Iraq.

- While analysts broadly agree Americana's disciplined new store openings in core MENA geographies will support revenue growth, they may underestimate the speed of recovery and upside from post-boycott sales normalization, especially as transaction volumes in recently acquired or previously affected markets like Oman and Egypt have significant headroom for growth, offering potential for outsized revenue acceleration compared to consensus expectations.

- The analyst consensus recognizes ongoing digital adoption, but the true earnings potential of Americana's digital transformation-kiosk rollout, loyalty programs, and the new customer data platform-could be far greater, as early data shows a 200 percent surge in kiosk-driven transactions and rapid omnichannel growth, pointing to step-change improvements in customer retention, upsell opportunities, and sustainable margin expansion well ahead of peer averages.

- With the MENA region experiencing robust demographic and socioeconomic tailwinds such as surging middle-class populations, rapid urbanization, and rising demand for branded dining, Americana stands to benefit disproportionately due to its proven multi-brand platform and established infrastructure-setting up the business for double-digit organic revenue growth for multiple years.

- The company's demonstrated ability to achieve positive operating leverage-even with sharply rising delivery channel mix-combined with a scalable supply chain and hub-and-spoke shared services model, suggests Americana can both preserve and gradually enhance net margins as it expands, contrary to concerns of margin dilution from higher delivery and distribution costs.

- Recent M&A (like Pizza Hut Oman) and clear appetite for further bolt-on acquisitions in underpenetrated markets, along with its track record of swift operational turnarounds, give Americana a unique pathway to accelerate network expansion, realize rapid post-acquisition revenue and margin uplift, and drive earnings above consensus through strategic inorganic growth.

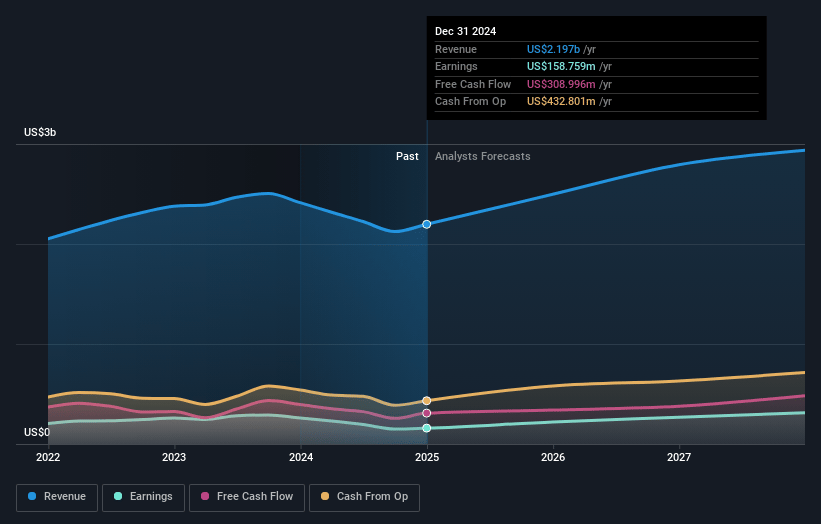

Americana Restaurants International Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Americana Restaurants International compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Americana Restaurants International's revenue will grow by 15.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 7.2% today to 10.1% in 3 years time.

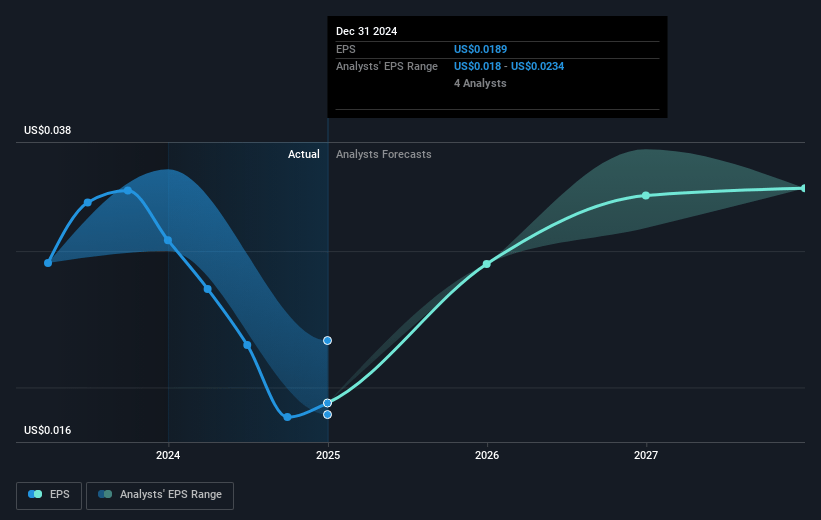

- The bullish analysts expect earnings to reach $350.8 million (and earnings per share of $0.04) by about July 2028, up from $163.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 39.8x on those 2028 earnings, up from 31.1x today. This future PE is greater than the current PE for the AE Hospitality industry at 18.8x.

- Analysts expect the number of shares outstanding to decline by 0.3% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 20.88%, as per the Simply Wall St company report.

Americana Restaurants International Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent shift in consumer preferences toward healthier, plant-based, and sustainable food could continue to erode demand for Americana's core fast-food offerings, putting long-term pressure on top line revenue growth and comp sales.

- The company remains highly reliant on a few master franchise agreements with brands like KFC and Pizza Hut, which raises vulnerability to renegotiation terms, loss of franchise rights, or operational constraints, potentially leading to volatile revenue streams.

- Geographic concentration in MENAT markets exposes Americana to ongoing foreign exchange volatility, political/regulatory disruptions, and supply chain instability, which could lead to inconsistent earnings and margin pressure over time.

- The accelerating shift to digital ordering and food delivery platforms is intensifying competition, lowering barriers to entry, and weakening brand loyalty, all of which may suppress same-store sales growth and increase marketing and technology costs, resulting in margin compression.

- Slow adaptation to evolving consumer expectations-including demand for localized menus, experiential dining formats, and digital personalization-could lead to declining customer frequency and loss of market share, ultimately impacting long-term revenue and net profit trajectory.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Americana Restaurants International is AED3.49, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Americana Restaurants International's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of AED3.49, and the most bearish reporting a price target of just AED2.25.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $3.5 billion, earnings will come to $350.8 million, and it would be trading on a PE ratio of 39.8x, assuming you use a discount rate of 20.9%.

- Given the current share price of AED2.22, the bullish analyst price target of AED3.49 is 36.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.